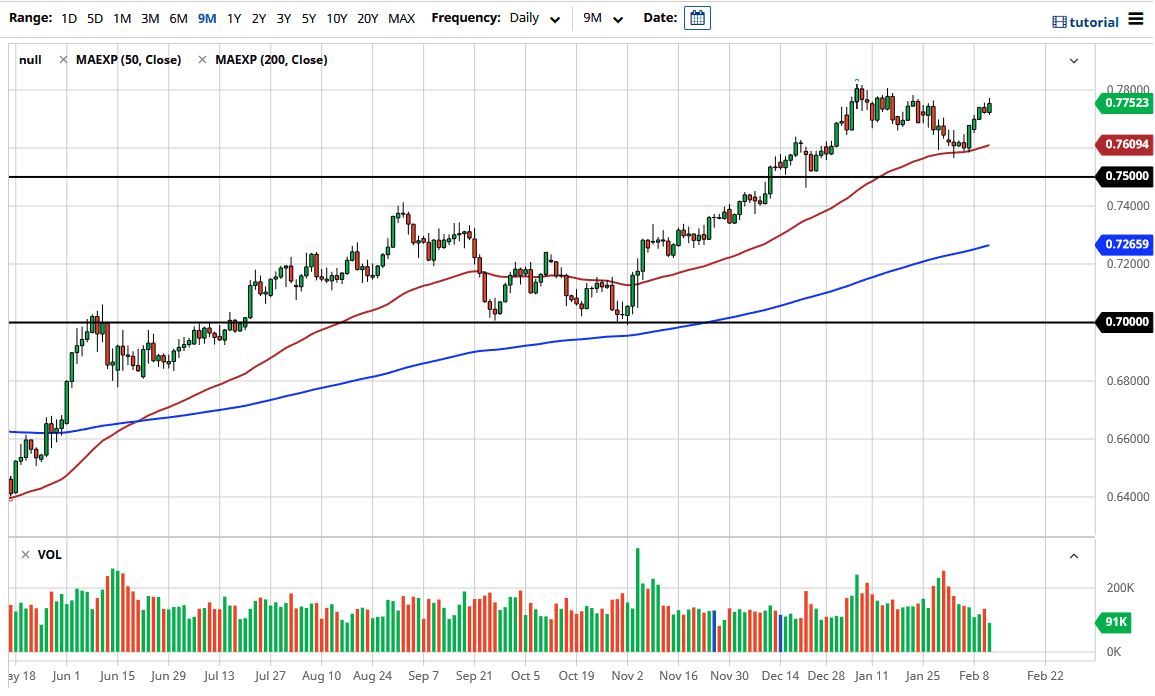

The Aussie dollar rallied a bit during the trading session on Thursday, to break above the top of the shooting star from the previous session. That of course is a sign that the market is going to continue to break higher given enough time. The 0.78 level above is an area where you would see a bit of resistance, based upon the previous action that we had seen. The 0.78 level is important, but I think even more importantly is going to be the 0.80 level above there. I do think that is where we are going, but it may take time to get there.

In the meantime, I think pullbacks will continue to be bought into, especially after last three or four days. At this point, the market is likely to look at the 50 day EMA underneath as potential support, and you could even make a bit of an argument for a bullish flag be informed. If that is the case, then you could even say that we have already broken above the top of that flag to kick off the bullish move. I am not quite ready to say that though, because the 0.78 level has been so massive as far as resistance is concerned.

At this point, I do not really have a scenario in which I am willing to sell the Australian dollar unless of course we break down below the 0.75 handle, something that does not look likely to happen in the short term. More likely is that we eventually do break above the 0.78 handle, which could open up a move towards the 0.80 level. Pay attention to the US Dollar Index because it will also give you an idea as to how the greenback is going to behave against most currencies, let alone the Australian dollar. That being said, the Australian dollar is highly correlated to the commodities markets, and of course the “reflation trade”, which is based upon the idea of stimulus and people buying things like copper and aluminum. Iron is also a big market in Australia, so all these things should continue to drive this market higher given enough time, unless of course there is a sudden “risk off trade” coming back into the market. Right now, it seems like everybody is thinking more about when the vaccine finally opens up the economy again.