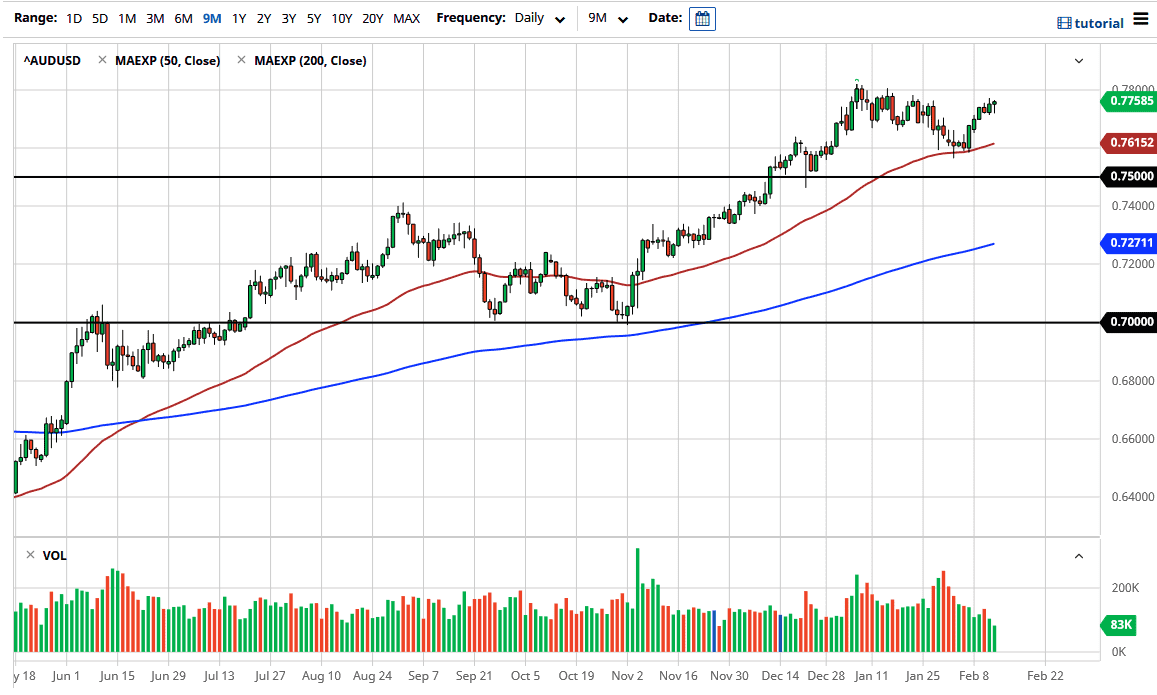

The Australian dollar initially pulled back during the trading session on Friday but turned around to show signs of bullish pressure yet again. The market is forming a bit of a hammer at this juncture just below the 0.78 handle. The 0.78 level is a large, round, psychologically significant figure, and if we can break above there, then it is likely that we will continue going higher to reach towards the 0.80 level. The 0.80 level is also a major round number that people will pay close attention to. This is because not only is it a psychologically important figure, but it is also a major level on the monthly chart. If we can break above there, things will change drastically.

On the breakout above the 0.0 level, it is likely that the market will go much higher, as it becomes more of a “buy-and-hold” type of scenario. This is a level that has been important more than one time, and therefore I think it will catch a lot of attention. In that situation, we would probably see the US dollar get absolutely hammered against most currencies as well.

Looking at this chart, we could get a bit of a pullback from here, but I think the 50-day EMA would be massive support near the 0.76 level. The 0.76 level has been supportive previously, and the 50-day EMA is starting to slope higher, so I think it all ties in quite nicely. The Aussie dollar is highly correlated to the idea of the reflation trade, as we are starting to see a ton of stimulus coming out of the United States. That should in theory drive down the value of the US dollar anyway, but it also should drive up the demand for hard assets such as the copper markets, aluminum markets, and the like. Australia is a major exporter of metals to China, which also should be demanding more if the global market is going to pick up again. I like buying dips in this market, and it certainly looks as if we are making a strong argument for going higher given enough time. I recognize that we have a lot of resistance above, but the tenacity of this market should not be overlooked.