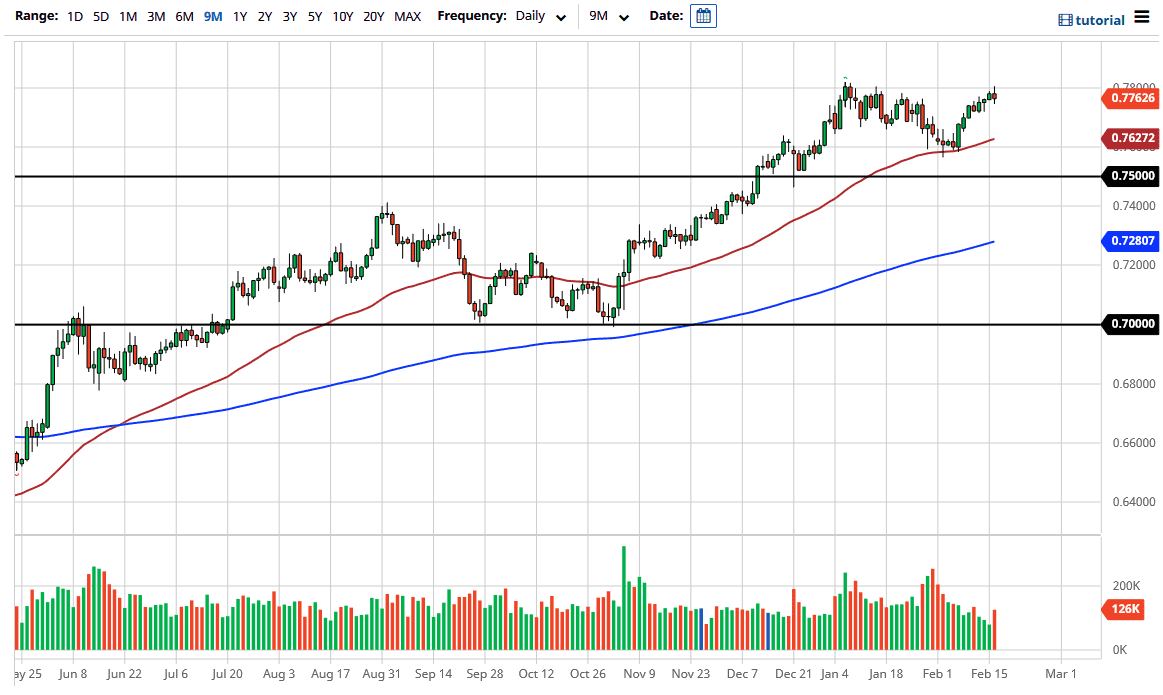

The Australian dollar fluctuated during the trading session on Tuesday as it tries to break above the 0.78 handle. However, the 0.78 level has been significant resistance in the past, which it proved itself to be again during the day on Tuesday. The 0.78 level could possibly be broken to the upside in order to kick off a move towards the 0.80 level. That level is the next major resistance barrier, from both a psychological standpoint as well as a structural one. In fact, when you look at the 0.80 level, the market has respected that as a major pivot point on the monthly chart. If we were to break above there, it is likely that we could be in more of a “buy-and-hold” type of scenario.

In the short term, I believe that the market probably could go looking towards the 50-day EMA underneath, which is currently at the 0.7627 level. It is sloping higher, which suggests that we are going to go higher over the longer term, but we may just be a little bit overextended. Pullbacks will be thought of as value, and most certainly people will be willing to take advantage of them.

One of the biggest things working against the Aussie dollar right now is the fact that the 10-year yield is starting to rise, and that makes the US dollar attractive. However, the Australian dollar has seen quite a bit of bullish pressure due to the fact that there is supposed to be massive stimulus coming out the United States, and that should work against the US dollar. However, we are still kicking around the idea and have not gotten anywhere near passing anything due to the second impeachment circus that just concluded in Washington DC. With a clearly dysfunctional government in the United States, that may cause some issues when it comes to passing legislation. It is not that it will not happen, it is just that we do not exactly know when or even if it is going to be the same size as previously thought. Regardless, this is a market that looks as if it is running out of steam, but that makes sense, as we had such a hard shot higher in such a short amount of time.