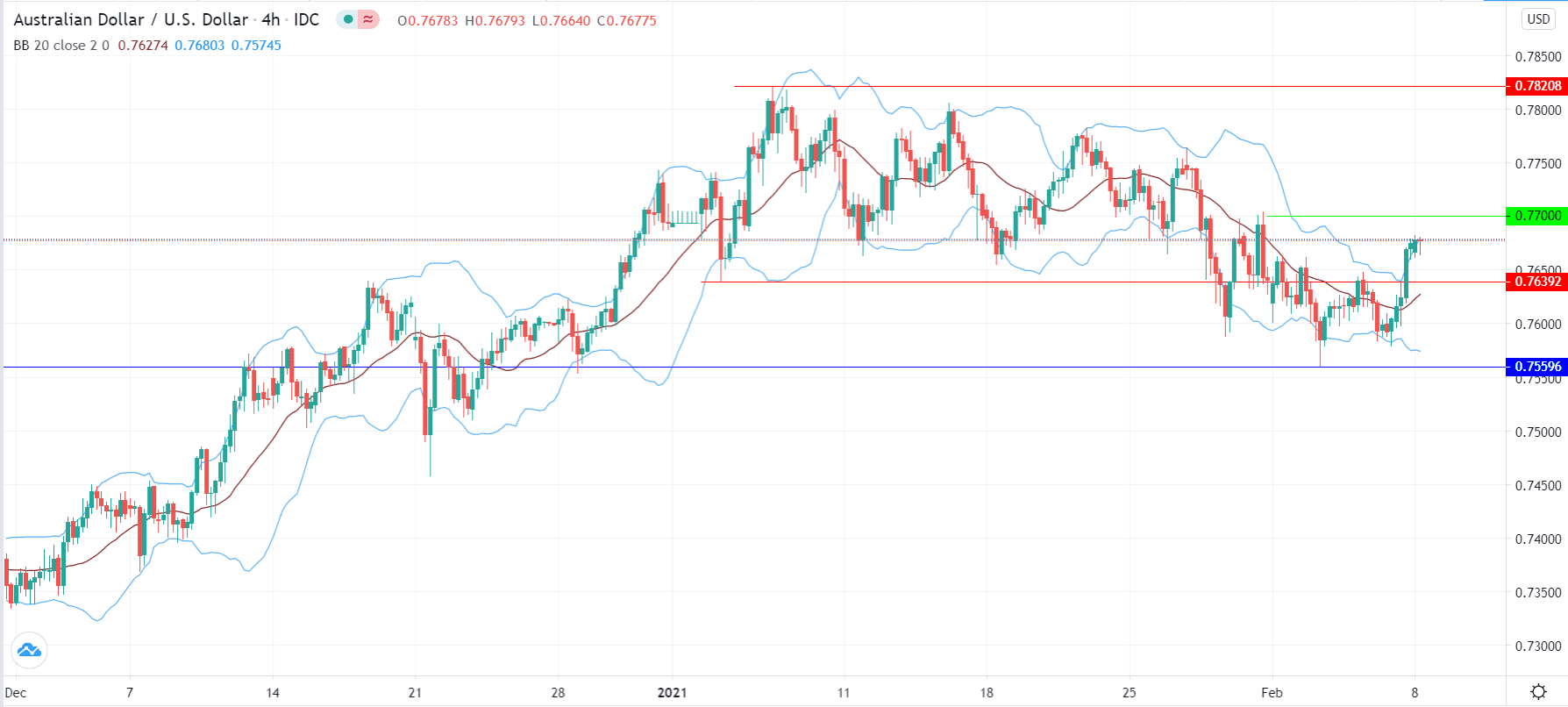

The Australian dollar rallied on Friday after what was a very quiet week for the market. We are sitting at the 50-day EMA, and the fact that we have bounced from there suggests that there is more upward momentum to be had. The Australian dollar is probably acting favorably to the talk of forcing a $1.9 trillion stimulus through Congress in a process called reconciliation. This essentially makes it all but a formality to get passed, but it is a process that takes several weeks. Dragging that out could hurt the global growth situation, but traders tend to focus more on stimulus than the real economy.

The idea is that the more stimulus we get, the stronger the Australian dollar will be mainly due to the fact that Aussie economy is so heavily anchored in the hard commodity sector. Demand for things like iron, copper and aluminum will be increased if there will be more spending; at least that is the theory. It should not be a huge surprise that we continue to see a little bit of upward pressure. Furthermore, the 50-day EMA has a certain amount of psychological importance to it from a technical analysis standpoint. Beyond that, the 0.76 level is the beginning of potential support that extends down to the 0.75 level. With all that combining at the same time, it should not be a huge surprise that we have rallied.

Another thing that has exacerbated the idea of stimulus going forward is the fact that the jobs number for the month of January was so anemic. The addition of 49,000 jobs in the United States is not the kind of rebound they were hoping to get from December, so at this point Wall Street is celebrating the idea of more stimulus coming, which in turn has them buying commodities and shorting the US dollar. Remember, liquidity is a major driver of what happens next, and the idea is that the US dollar is going to continue to struggle. If commodities continue to rally the way they have, that should make the Australian dollar the biggest beneficiary of that trade. To the upside, we could go looking towards the 0.80 level. If we can break above there, then the market may very well go looking towards the 0.80 level above.