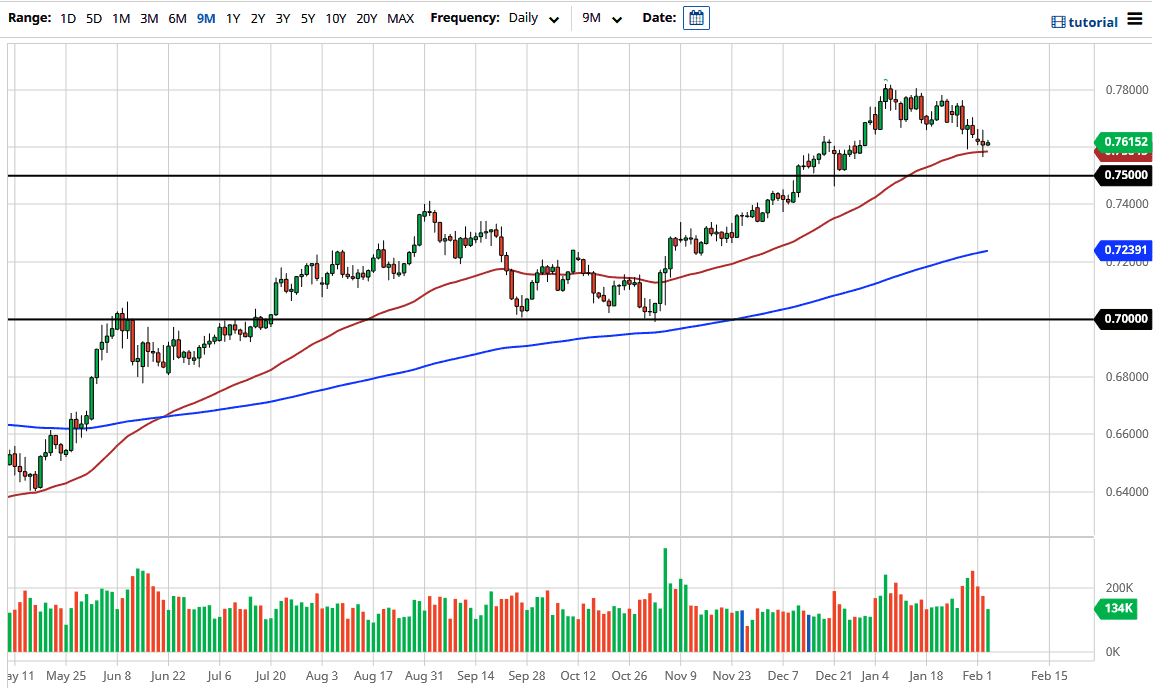

The Australian dollar did very little during the trading session on Wednesday as we continue to hang around the 0.76 level. At this point, the market is probably going to continue to see the area between the 0.76 level and the 0.75 level as a scenario in which buyers may come back to pick up “cheap Aussie dollars.”

This pullback should offer a bit of value, assuming that we are going to continue to see massive amounts of stimulus and the Federal Reserve stepping in to try to kill the US dollar. However, if we continue to see a lot of concern around the world when it comes to reopening economies, that could cause a problem for the Aussie, as it is so highly levered to commodities and the idea of the “reflation trade” that people have been banking on. In other words, they are looking for the global economy to take off to the upside as we continue to see the vaccine get rolled out.

The market is likely to continue to move on the latest political noise out there, as the United States continues to debate the whole idea of stimulus. It does look like the Democrats are going to use “reconciliation” in order to cram a huge package through, but it is going to be a bit difficult if they use any other pathway than that, as the Republicans seem unlikely to approve that big of a budget. That, then, would cripple the Democrats from being able to push things through like that for the rest of the year, because reconciliation is something that can only be done once a year.

To the upside, if we do reach towards the 0.78 level, then we will start to look at the 0.80 level. The 0.80 level is an area that continues to be paid close attention to as it is a large, round, psychologically significant number and it is worth noting that it was historically important a couple of times in the past. Because of this, I think that the market will be very attracted to that figure overall. Whether we can break above the 0.80 level is a different story, but if we do, then the Australian dollar will take off to the upside much higher than most people expect.