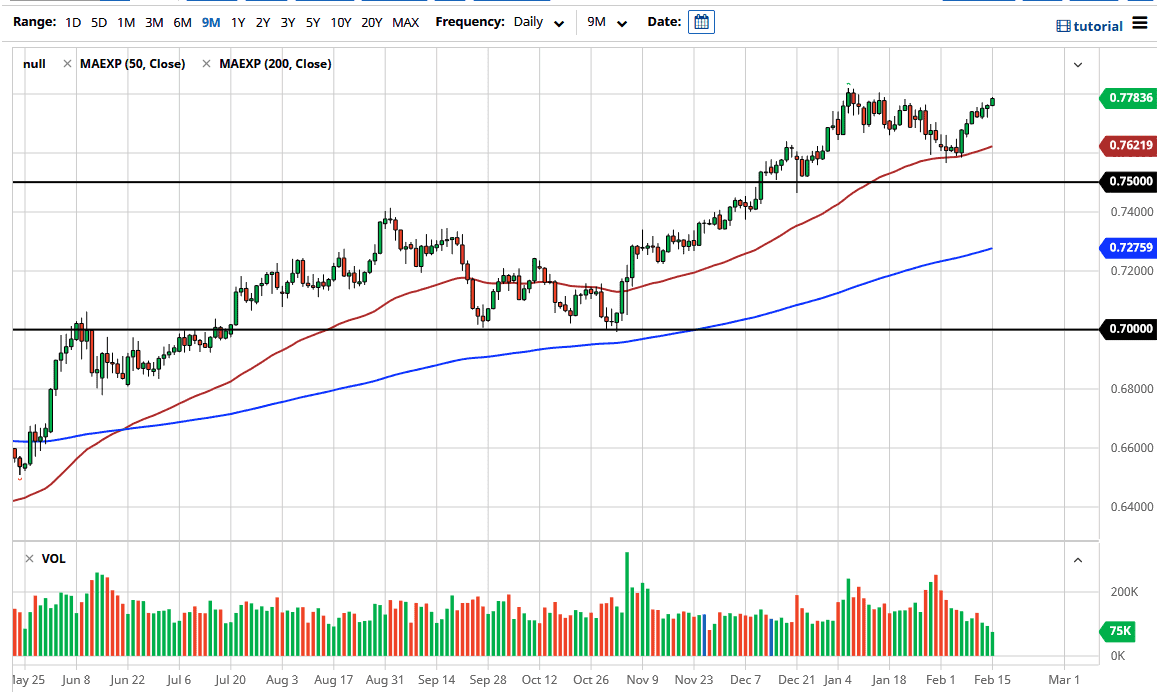

The Australian dollar rallied a bit during the trading session again on Monday to kick off the week on a positive note. The 0.78 level above has been resistance more than once, so I do think that it will take a significant amount of momentum to finally break above it. If we do, then it allows the market to go looking towards the 0.80 level after that. I think we can look at a daily close above the 0.78 as an opportunity to get long again.

To the downside, it is possible that the market could go as low as the 50-day EMA to find buyers, but I am not even sure that we will get that low before it turns around. I will be looking at the daily closes ahead to see whether or not we get a supportive candle, assuming we pull back. Some type of supportive daily close is what I would be looking for, perhaps a hammer or a significant green candlestick. On the other hand, if we get that daily close above the 0.78 level, then I am willing to start buying and hanging onto the 0.80 level. The 0.80 level above is a major level on the monthly charts, so I think a lot of people will be looking at this market as a longer-term “buy-and-hold” type of scenario, as it is where we have seen huge moves in both directions take off from.

To the downside, if we were to break down below the 50-day EMA, then it opens up the possibility of a move down to the 0.75 handle. The 0.75 handle being broken below should send this market to go looking towards the 200-day EMA. I do not necessarily think that is going to be the case, but if there is some type of major “risk off event”, the Australian dollar will get hammered. I think we are going to see a bit of choppy behavior in this general vicinity, but in general, the bullish attitude should continue to be the main attraction here, so it will likely be a scenario that traders will continue to look at as whether or not there is a “reflation world” happening.