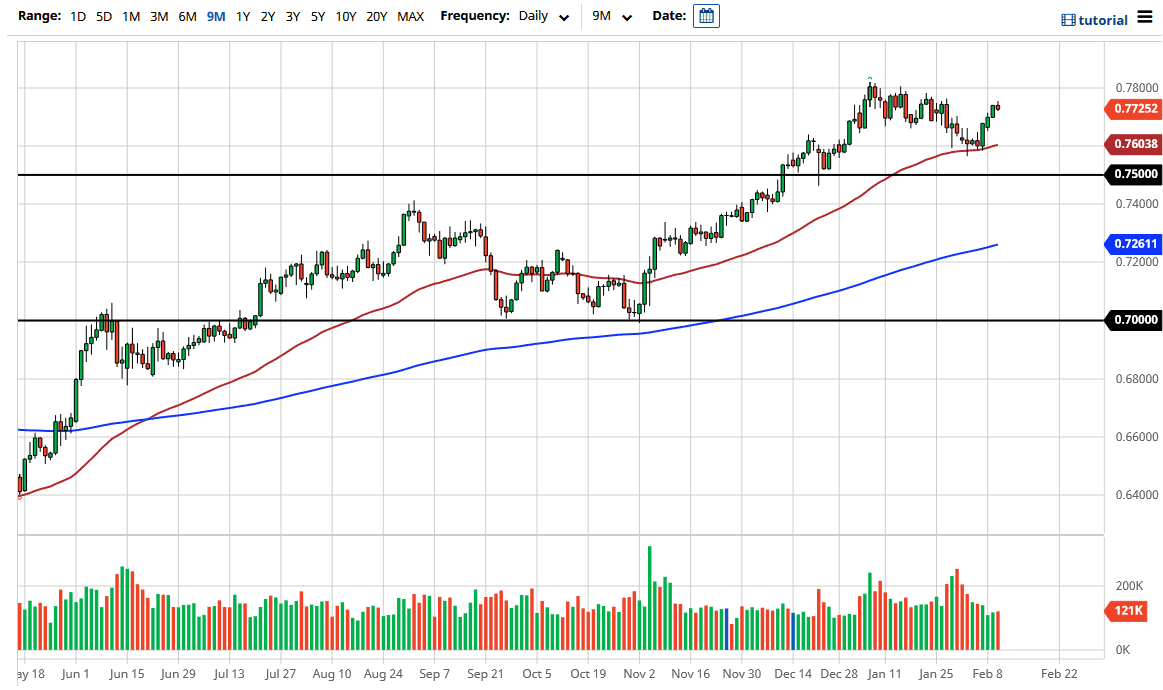

The Australian dollar fluctuated during the course of the trading session on Wednesday as we reached towards the 0.7750 level. This is an area from where we had seen some selling in the past, but I think the action over the last several days tells us that the Aussie dollar is likely to continue going higher, perhaps based upon the idea of massive stimulus coming out of the United States, so we should see a massive jump into the commodities market.

The 50-day EMA underneath is significant support, assuming that we even get down to that level. The 0.76 level underneath is where it currently sits, so I like the idea of finding plenty of support between there and the psychologically/structurally important 0.75 handle. That is an area that I think will attract a lot of attention in and of itself, so if we were to break down below that level, I think at that point we would see the Australian dollar struggle quite a bit.

In general, the market is trying to put up the necessary momentum to reach towards the 0.78 handle, perhaps even break above there to go looking towards the 0.80 level. That is an area that is crucial for the longer term, and I think that a break above the 0.80 level would start to see more of a “buy-and-hold” scenario in the Aussie, as it would allow the market to go towards the 0.90 level over the longer term. This would be a continuation of the overall reflation trade and a breakdown of the US dollar, so if we can break above the 0.80 level, it could kick off a multi-year trade. Until then, we still have a lot of noise to deal with, and I suspect it will be a lot of back and forth between now and a true decision of either breaking out to the upside, or a significant break down below the support underneath. In the short term, expect a lot of messy trading with more of an uptrend attitude, as we have seen such a massive move to the upside from the bottom over the last several months. The Aussie is not a currency that I am looking to sell right now, at least not until we break down below that 0.75 handle.