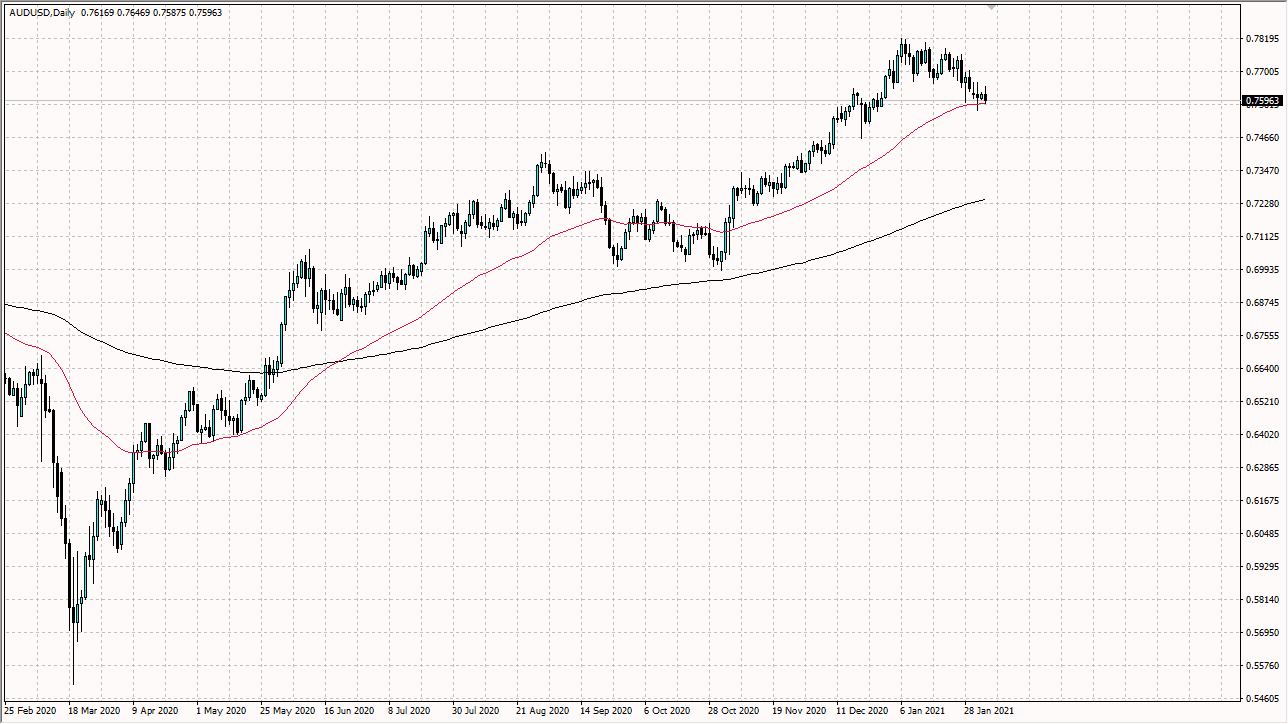

The Australian dollar initially tried to rally during the trading session on Thursday but gave back the gains above the 0.76 level in order to fall towards the 50 day EMA yet again. Ultimately, this is a market that looks as if it is trying to make a decision and it is worth noting that the last four candlesticks have been very neutral, so therefore it has been very difficult to trade the Australian dollar most of this week. Unless you are a short-term scalper, this has not been a fun week for you.

If we can break above the highs of the week, then it is likely that we could go looking towards the 0.78 level eventually. It will be interesting to see how this pair behaves after the Friday session, due to the fact that it is the Non-Farm Payroll session, and that of course can have a major influence on what happens with the greenback. I do think that given enough time we will probably see some type of reaction one way or the other. Remember, the Australian dollar is based upon the idea of inflation and commodity demand, something that goes hand-in-hand. With all of the stimulus around the world, a lot of traders have anticipated that the Aussie will be in high demand due to need for more steel, aluminum, and other hard assets such as copper.

It is worth noting that China is struggling with the coronavirus again, so pay attention to the economic numbers coming out of that country. They are starting to wane just a bit, which could weigh upon the Australian dollar going forward. As things stand right now though, we are still very much in an uptrend, so it is not a huge surprise to think that perhaps if we break to the upside, we go looking towards the 0.78 handle, possibly even looking towards the 0.80 level over the longer term. As far as selling is concerned, we need to clear the 0.75 level to the downside on a daily close for me to start considering that. Granted, we only about 100 pips from doing so, but I need that last little bit of reassurance to start looking for potential selling opportunities. Stimulus being rammed through Congress may help, but we will have to see whether or not the US government “goes big.”