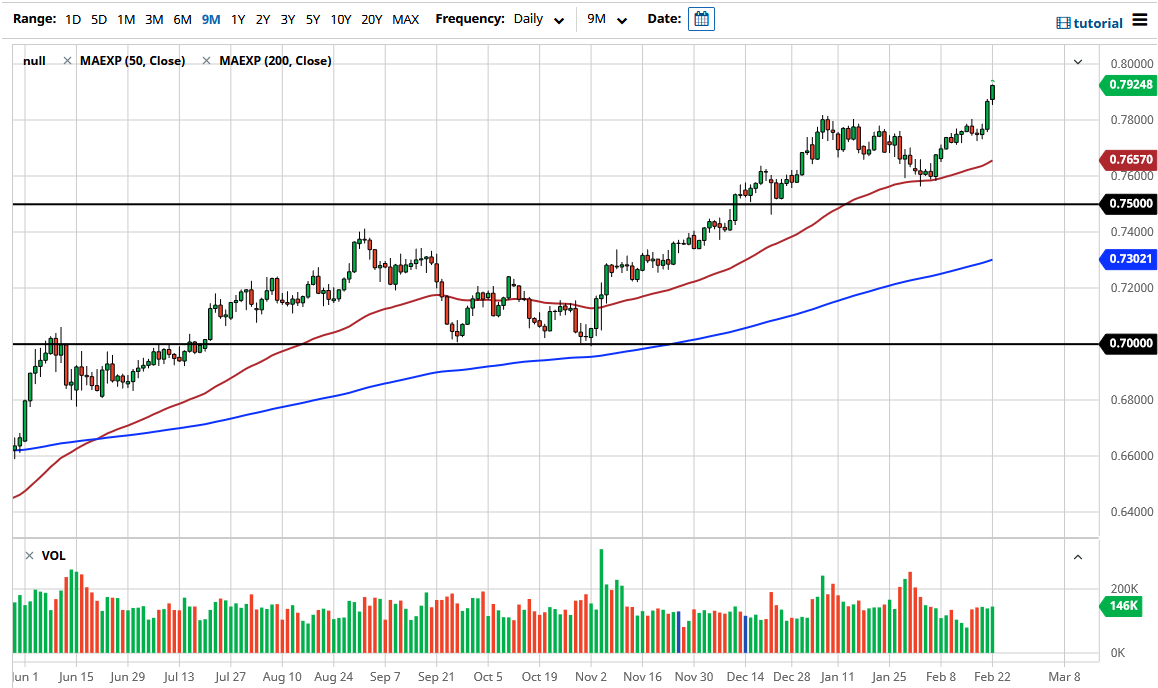

The Australian dollar rallied a bit during the trading session on Monday but was just a bit more sluggish than we had seen during the Friday session. At this point, the market looks as if it is trying to break towards the crucial 0.80 level, an area that has massive ramifications on the monthly chart. The 0.80 level is an area where we have seen a major “flip” in the overall trend more than once. If we can break above the 0.80 level rather significantly, then that could lead to the Australian dollar shooting straight up in the air for a bigger move. At this point, the market could very easily go looking towards the 0.90 level.

In the short term, I believe that dips will more than likely be bought, as the break above the 0.78 level was a good sign. The Friday candlestick was extraordinarily convincing, as we closed towards the top of the range. This is more of the “reflation trade” showing itself in the Forex markets, as the Aussie is so highly levered to commodities in general. Having said all of that, I do believe that the 0.80 level is going to be very difficult to get beyond, so I do not expect this to be a very quick move. I think that the 0.80 level will cause a lot of noise in the market, so at this point we will have to see whether or not we can keep up the bullish pressure.

I think the best way to deal with this market is to buy short-term pullbacks on short-term charts in order to pick up little bits and pieces of positions to take advantage of what has been a clear move to the upside. As far as selling is concerned, I have no interest in doing so, but I do recognize that there are some concerns about the 10-year note. The 10-year note seeing rates rise has the US dollar looking a little bit more attractive in this situation. I believe that as long as the Australian dollar can stay above the 0.75 level, it will remain a market that has to be bought and not sold. Yes, it has been a bit parabolic over the last couple of months, but most traders are just now starting to push the “commodities super cycle” that the narrative seems to have flipped to.