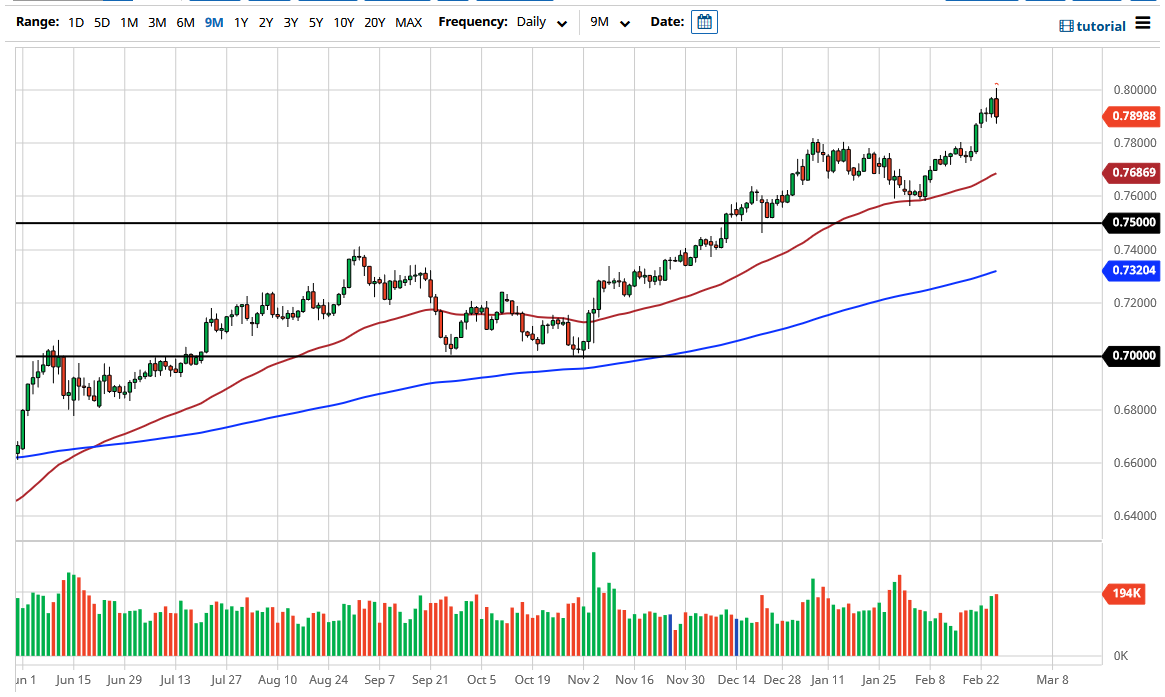

The Australian dollar initially tried to rally during the trading session on Thursday to touch the 0.80 level, which of course is a large, round, psychologically significant figure. Furthermore, the level is important on longer-term charts, so it does make quite a bit of sense that we have seen a turnaround. The 0.79 level has offered a certain amount of support, but I think we probably could even drop down to the 0.78 level where there will be even more support. This is an area that we had broken out from and have not retested. That makes quite a bit of sense as a significant attempt on trying to prove “market memory”.

The 50 day EMA is starting to reach towards the 0.78 handle, which of course is an area that we are watching due to that previous breakout. With that being the case, I think there are a couple of different reasons for traders to get involved in general. Furthermore, the market has been rallying based upon the commodity trade, which of course has been extraordinarily strong as of late. With that, I think we continue to see traders pay close attention to whether or not the “reflation trade” takes off.

However, the other thing that could have caused major problems during the trading session was the 10 year note in the United States. After all, the interest rates in the 10 year note spiked to reach the 1.50% level, and it caused some algorithmic trading and what I can see around the markets. That being said, the Federal Reserve is likely to do something to keep rates under control given enough time, but recently they have stated that they are not concerned about interest rates, union that we could see a little bit more downward pressure on the bond markets in general, driving up those rates. That does make the US dollar a bit more attractive, at least in the short term, and that has perhaps caused quite a bit of the noise. That being said, we are still in a huge push to get into commodities, and as a result the Australian dollar will be one of the big winners. If and when we can break above the 0.80 level on a weekly close, then this market will go looking towards much higher levels, perhaps with an initial move towards the 0.90 level.