The West Texas Intermediate crude oil market initially rallied during the trading session, but turned around to form a shooting star after the inventory numbers came out mixed. After all, there was a serious lack of demand out there, just as we have been seeing for some time. However, there is also stimulus, so it is possible that we may see the reflation trade takeover. In fact, I think stimulus is basically what has been pushing the market higher for a while, not necessarily the true demand.

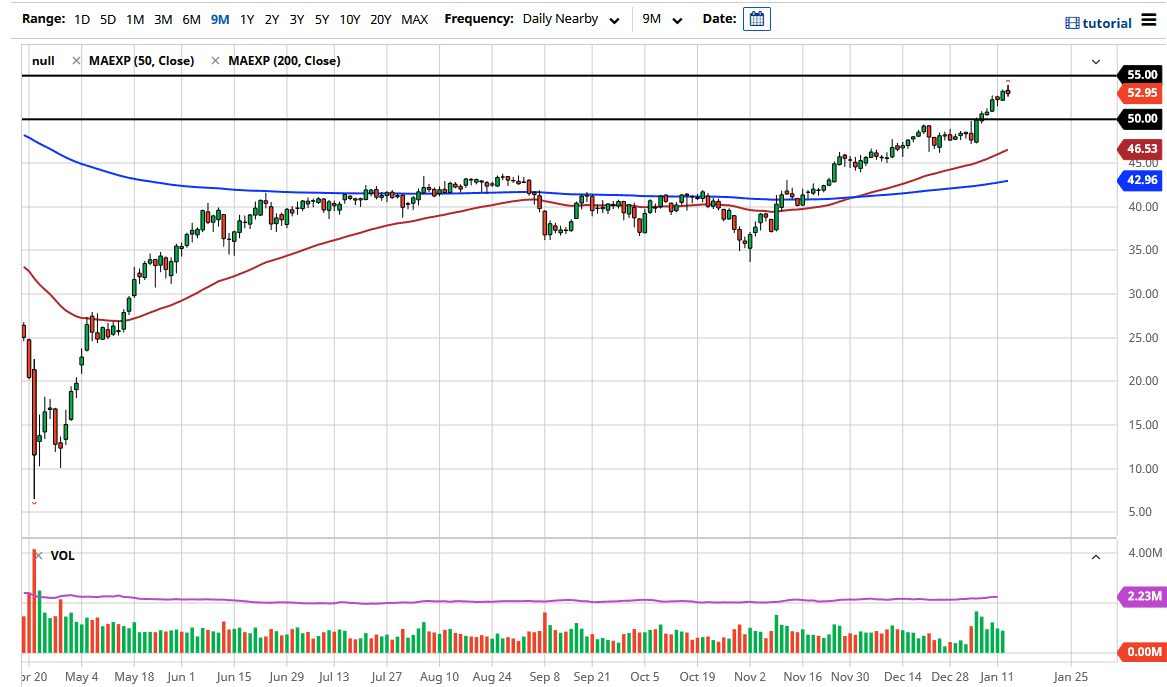

To the downside, there are plenty of areas in which buyers would get involved, but I believe that the most obvious area is the $50 handle. It is a large, round, psychologically significant figure, and that in and of itself will attract a certain amount of attention. There is structural support down to the $47.50 level as well, based upon that massive candlestick that shot towards the $50 level on January 5. As long as we stay above there, then we are still essentially in an uptrend, and it is worth noting that the 50-day EMA is racing towards that area as well.

To the upside, the $55 level is resistance as well, due to the fact that it is a large, round, psychologically significant figure and an area that has been important in the past. At this point, we are likely to fluctuate between the $50 and the $55 levels, while we try to figure out what to do next. There is not enough demand for crude oil to go higher for the long term, but in the short term, it is probably all about the US dollar falling and stimulus. I think this will be a “push/pull” type of situation and will probably remain so until we get clarity as to whether or not the recovery will continue. The next couple of weeks will be very choppy and range-bound, so that is probably how you are going to have to trade the markets on the whole, using small positions to go back and forth in this region. If we do break above the 35 dollars level, then we need to take a look at a potential move towards the $60 level.