The West Texas Intermediate crude oil market rallied a bit during the trading session on Tuesday as we continue to see the “reflation trade” come into play. This should favor crude oil, at least for the short term, despite the fact that demand is less than stellar. One of the main drivers is the idea that as the economies open up, that should drive crude oil higher, at least based on demand.

From a fundamental standpoint, Saudi Arabia has recently self-imposed cuts that could continue to push crude oil higher in the short term. Furthermore, the US dollar has been falling and this is a market that is priced in those US dollars, so it will take more of those dollars to buy a barrel. Another potential driver of higher oil prices is the fact that the United States continues to see an overall malaise in drillers jumping back into the markets, although one would think that if we get too much higher to the upside, the drillers will come back en masse. If that is going to be the case, you still have an argument for a short-term pop to the upside, but it is only a matter of time before we see sellers come back into the market.

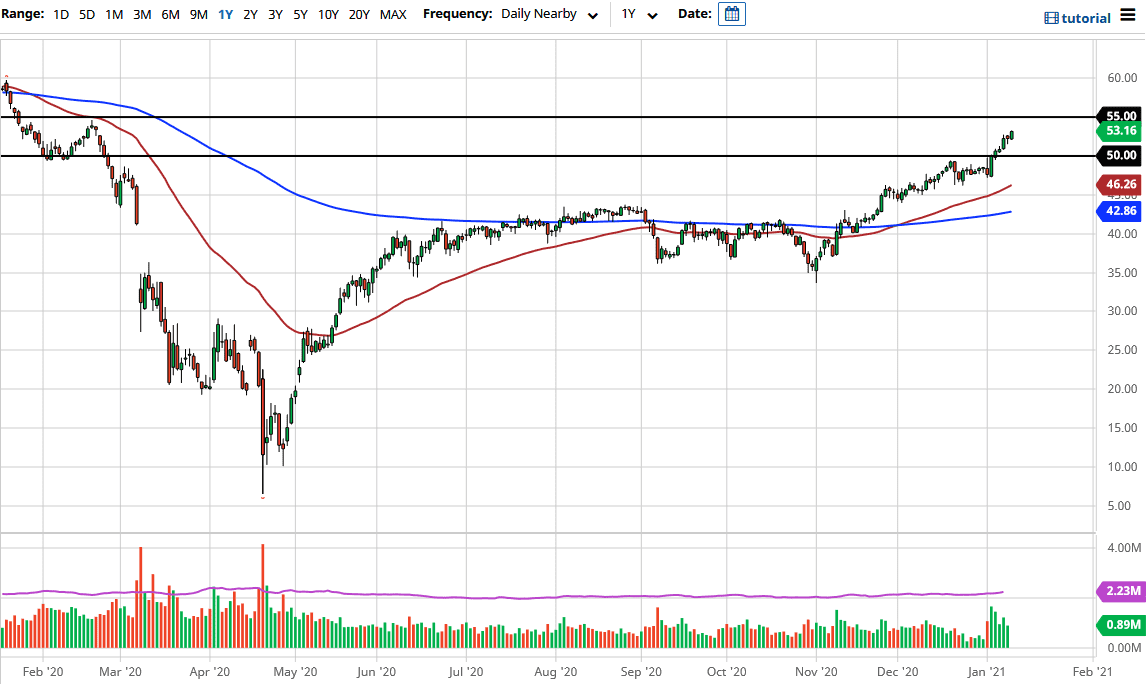

If we can break above the $55 level, then the market will probably go looking towards the $60 level, which is even more resistive, so it will be even more difficult to break above there. Unless we get a massive boom this year, the crude oil markets simply will not be able to sustain a huge move to the upside. This is simply a reflexive trade, and for the next month or two we will probably continue to see buyers jump in and pick up dips in commodities, oil included. If we do see a reversal of the currency markets, that could be the first sign that the commodity markets could get hit, because it needs to see cheap US dollars in order to strengthen from a long-term standpoint. I have no interest in shorting this market, at least not yet; but I certainly will be paying attention to multiple crosscurrents to see when it is time to reverse.