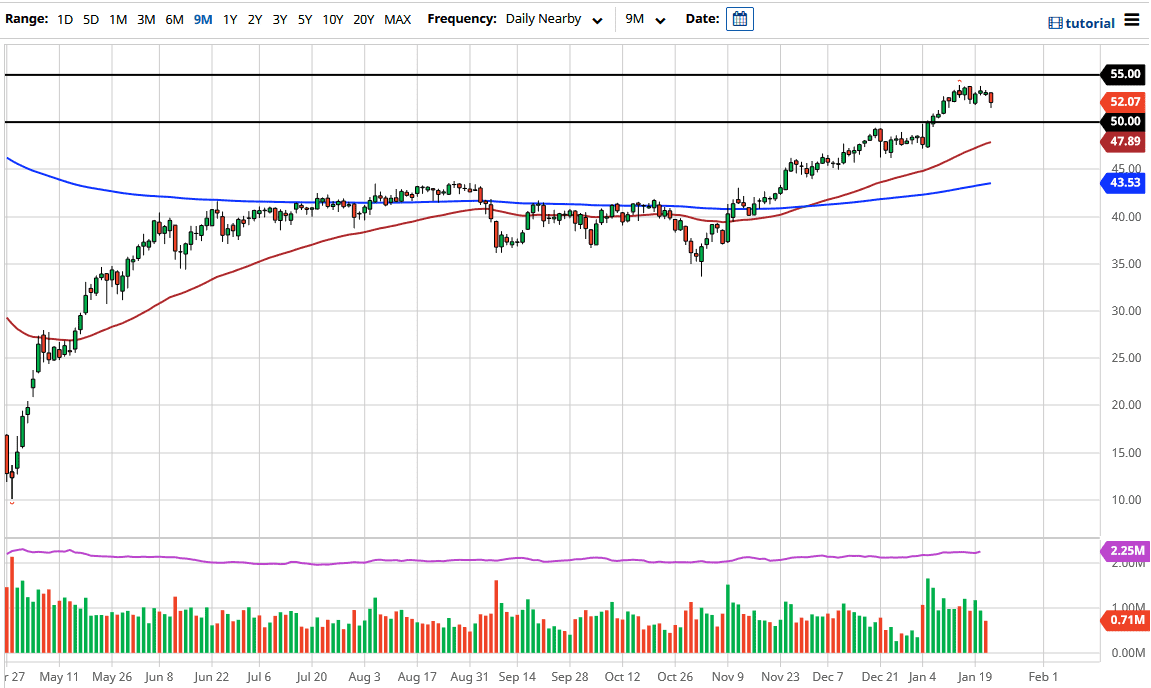

The West Texas Intermediate Crude Oil market fell during the trading session on Friday, breaking down below the $52 level. This was a rather significant move during the day and the market is forming a second shooting star in a row. That is a very negative sign, suggesting that perhaps we could see further downside pressure. Ultimately, the $50 level underneath will continue to offer a bit of a target and a significant support level. Furthermore, the market will probably continue to see a lot of psychological support due to the fact that the 50-day EMA is reaching higher.

To the upside, the $55 level looks to be very resistive, and I think that given enough time, there will be sellers in that area. However, the short-term outlook for this pair is most certainly to the downside, as we continue to see a bit of confusion. The area between the $50 level and the $55 level will probably be for short-term range-bound trading, but in general we have formed a couple of shooting stars on the weekly chart and that typically leads to a bigger move.

When you look at the bigger picture when it comes to demand, it is likely that the crude oil market might be moving based upon the idea of stimulus. The idea of stimulus being as big as it once was might be somewhat laughable, and in that case, it almost certainly means that the price of crude oil will suffer. After all, there are several members of the Senate that have publicly stated they are not in any rush to pass stimulus, and most certainly would not be bothered to do it at $1.9 trillion. Beyond that, we should keep in mind the fact that demand for crude oil was weakening long before the pandemic, and the inventory number that just came out showed that there was an actual build of crude oil in the United States, not a draw down. Unless you think the economy is suddenly going to take off to the upside, it is very difficult to imagine that crude oil will continue to go higher. Further exacerbating this is the fact that shale oil is now becoming more profitable.