The West Texas Intermediate Crude Oil market has looked very sluggish throughout the trading session on Thursday, as it appears that we are starting to run into a significant amount of exhaustion. This makes quite a bit of sense considering that the stimulus package in the United States may end up being smaller than originally anticipated. Joe Biden may not be able to get the $1.9 trillion package through Congress if the recent comments from Republicans like Mitt Romney and Lisa Murkowski have anything to say about it. In fact, they do not seem very pressed to get it done very quickly. If that is the case, this could take some of the “wind out of the sails” of the bullish reflation trade.

Furthermore, you have to wonder whether or not there is any true demand coming anytime soon. After all, the market has clearly seen a lack of demand before the buyers came about, and now that we have the virus ravaging the economy and destroying businesses left and right, do think that we simply go right back to the way things were is a bit of wishful thinking as far as I can see.

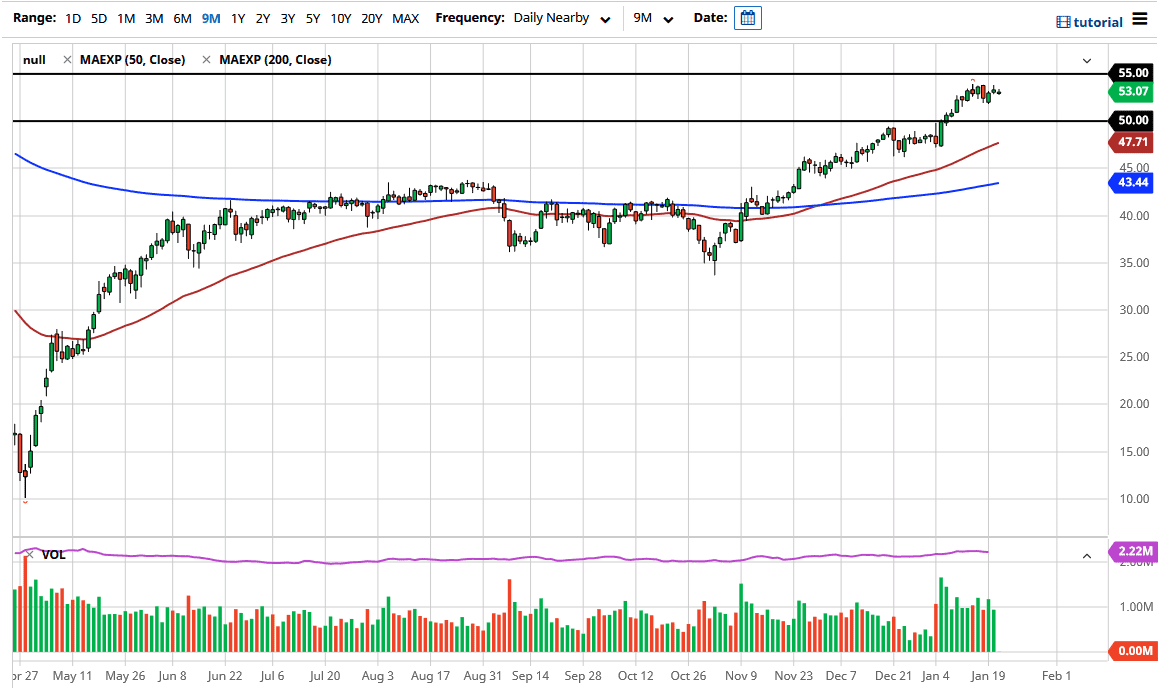

Ultimately, think this is a market that will probably continue to be very noisy in this general vicinity, perhaps using the $55 level as resistance while using the $50 level underneath as support. We are essentially in the middle of that area so this is an area where I would expect to see a lot of uncertain trading to say the least. I think given enough time we will probably see market participants try to discern a longer-term direction, but right now I think we are essentially stuck in this five dollar range. Beyond that we have the US dollar which looks as if it is trying to strengthen a bit, and if that is the case that could cause some issues in this market as well. The candlestick is not much to read into but it is preceded by a shooting star so that tells me enough to know that this is a market that does not have anywhere to be anytime soon. With that in mind, I think that if you are a range bound trader you can look at these two levels to trade off of in the short term, at least until we get some clarity when it comes to demand, something that we may not have for a while.