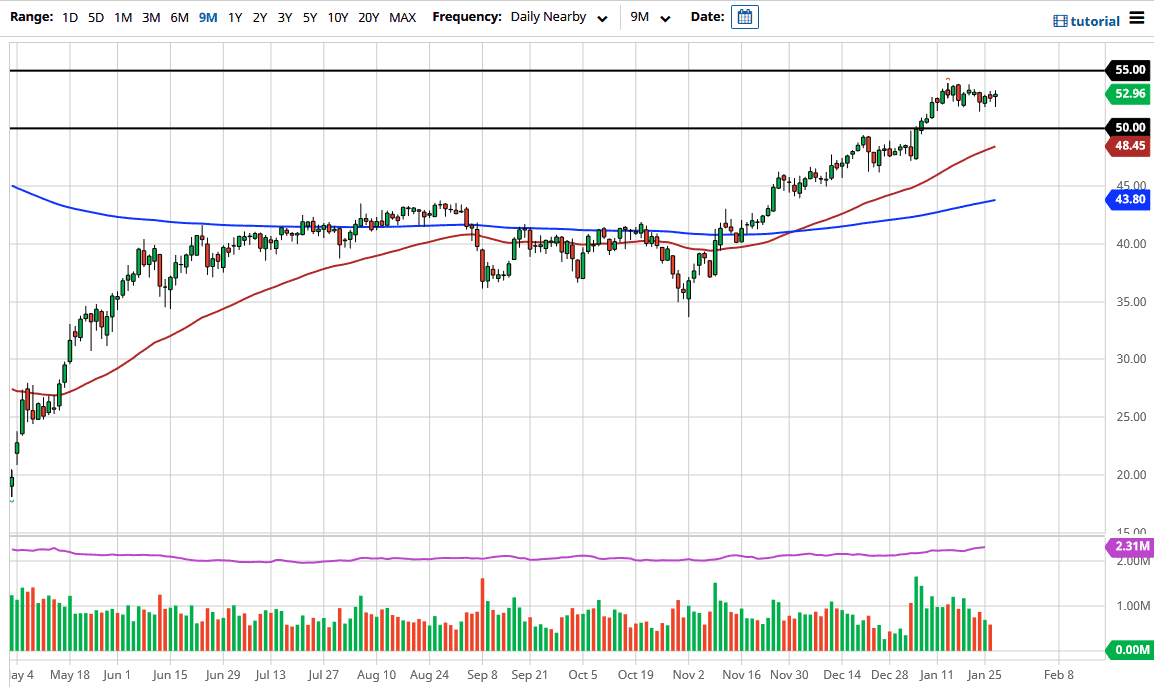

The West Texas Intermediate Crude Oil market has been very noisy during the course of the trading session on Wednesday, as the market simply has no idea what to do with itself currently. We are essentially between two major levels, with the $50 level underneath offer significant support and then of course the $55 level above offers significant resistance. Looking at the candlestick for the trading session and it shows just how confused we are, so I have to look at the longer-term chart.

The longer-term chart does suggest that there is a lot of resistance above, as we had formed a couple of shooting stars previously, suggesting that there is a lot of resistance just above. The $55 level being broken to the upside would not only be bullish due to the fact that the large figure was overtaken, but it would also be the market breaking above the top of two shooting stars, which is an extraordinarily bullish sign.

All things being equal, I think it does make a lot of sense that we are going to continue to see choppy behavior and I do think that will be the story overall. At the very least, we need to understand that the market got ahead of itself, so working off some of the froth probably makes the most sense. Furthermore, the market is likely to see a lot of questions asked about whether or not there is going to be enough demand going forward, but it is worth noting that there was a significant draw of inventory announced during the day. At the same time though, gasoline demand has been falling rather significantly. That could continue to be something that warns of future problems, so I think we are simply at an inflection point right now trying to figure out whether or not we can continue to go higher. I believe that the five dollar range that we are and right now will kick off the next major move. I also believe that there is a significant amount of instability in the financial markets right now that could lead to a sudden rush in one direction or another. The volatility during the trading session was quite drastic, but at this point I think we still have a lot of sideways action ahead of us in the short term.