The West Texas Intermediate Crude Oil market rallied a bit during the trading session on Thursday, as we start to head towards the jobs figure. Crude oil does look a little bit tired, but I do think that it is only a matter of time before the buyers will continue to push to the upside. However, I think that the market is very unlikely to simply rip higher, because there are a lot of questions when it comes to crude at this point.

The first question you have to ask is whether or not there is enough demand? The idea is that stimulus could drive commodities higher in general, including crude oil. That being said, I think that it only moves the market so far. At this point, now we have to wonder whether or not people actually be using it. So far, we have not seen a lot of demand and unless that changes, eventually gravity will come back into play.

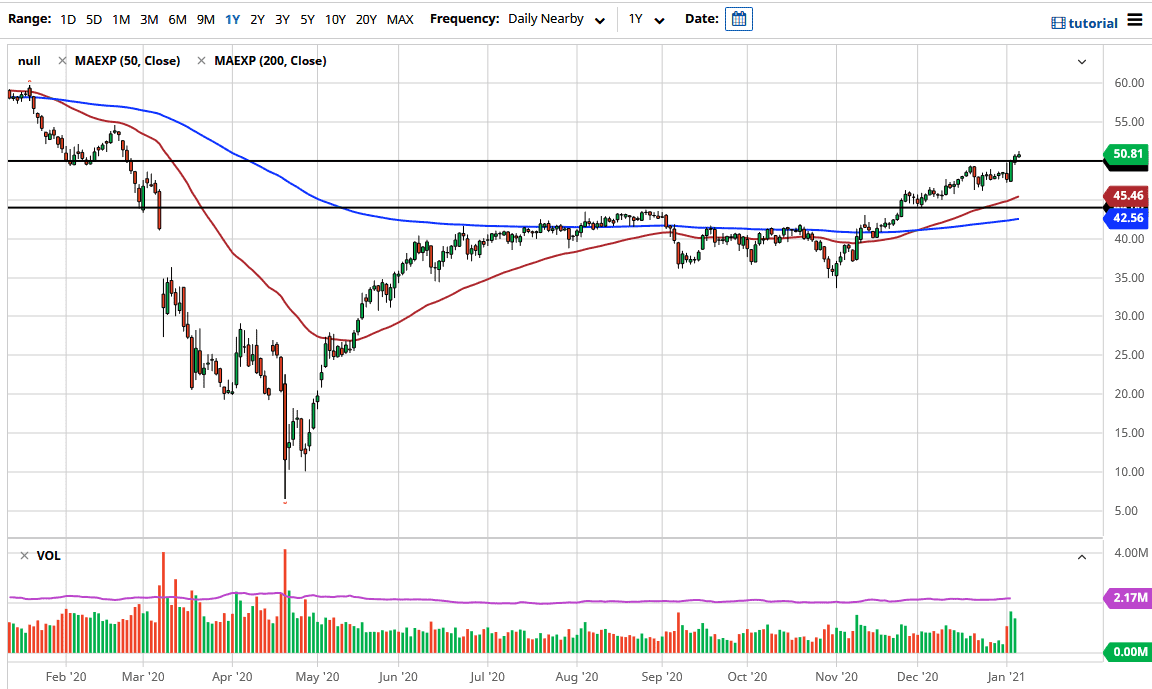

The 50 day EMA underneath should offer a significant amount of support though, especially near the bottom of the candlestick from Tuesday as it shows so much bullish pressure. To the upside, I think that the market could go looking as high as the $55 level, then probably run into a significant amount of trouble at that point. I have no interest in trying to short this market quite yet, but as I said we are going to have to worry about the massive amount of demand destruction by the coronavirus lockdowns in the meantime. One has to wonder how long it is going to be before we see some type of storage issue as well, but those issues are things that we are going to be worried about later. I think in the short term we are simply going to go back and forth right around this area, so at this point I think what we are going to see is more hack and slash type of movement.

I would anticipate that there would be a lot of noise after the jobs number, but at the end of the day I would not be surprised at all to see Friday somewhat unchanged. In fact, I anticipate that the next several days will probably be somewhat choppy in this market. Longer-term, we have a little bit more upside before we start running into trouble.