The West Texas Intermediate Crude Oil market has been somewhat quiet to kick off the week, essentially forming an inside candlestick from the perspective of the negative Friday candlestick. When you look at the weekly chart, there are a couple of shooting stars, which suggests that perhaps we may have further to go to the downside. Whether or not we get some type of major breakdown or not is a completely different question, but at this point it is a real possibility due to the fact that stimulus simply is not going to be as big as once thought. Even if the Democrats choose to use reconciliation in the Senate, that means a whole slew of the potential factors when it comes to the size of stimulus will be valid or able to be implemented.

If that is the case, it certainly does something to the narrative of stimulus driving oil prices higher. Furthermore, we have recently seen a massive build in stockpiles in America, which does nothing for the idea of demand. Beyond that, we had started to see demand really drop off significantly before the coronavirus hit, so it is a bit of a stretch to think that we are going to suddenly see massive amounts of demand for any sustainable amount of time simply because the US government is throwing money around.

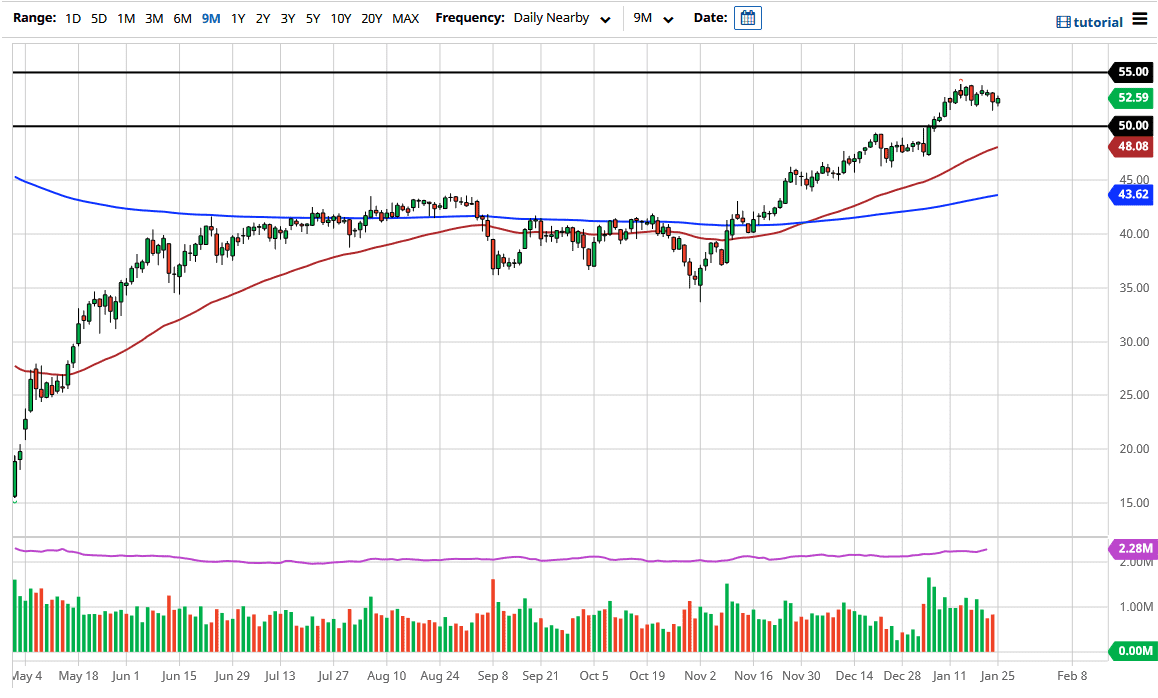

To the downside, the 50-day EMA is at the $48 level, and it is starting to reach towards higher levels. The $50 level above there could be significant support, so we should probably be paying attention to that figure, as it is a large, round, psychologically significant figure and an area where we had seen a previous breakout. I think it does make sense to see the market go looking towards that level, but whether or not we can break through there is a completely different question, and is something that I think we will have to look at later. As far as buying is concerned, I am a bit hesitant to do so in the short term, but I recognize that a move to the $55 level would be the most likely outcome.