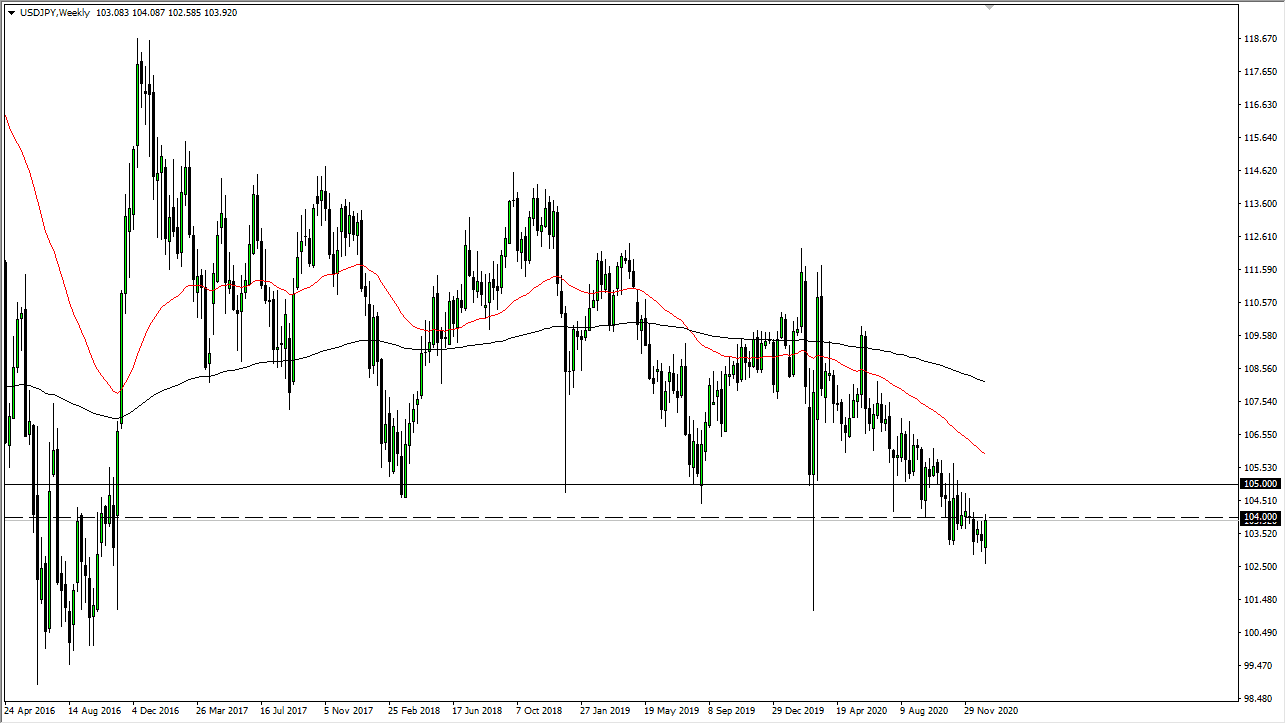

USD/JPY

The US dollar initially fell against the Japanese yen during the course of the week, only to turn around and reach towards the ¥104 level. This is an area in which we have seen a significant amount of resistance, and that resistance extends all the way to at least the ¥105 level. It is because of this that I think rallies will continue to be repelled in this range, with short-term traders taking advantage of signs of exhaustion in a market that has been in a downtrend for quite some time.

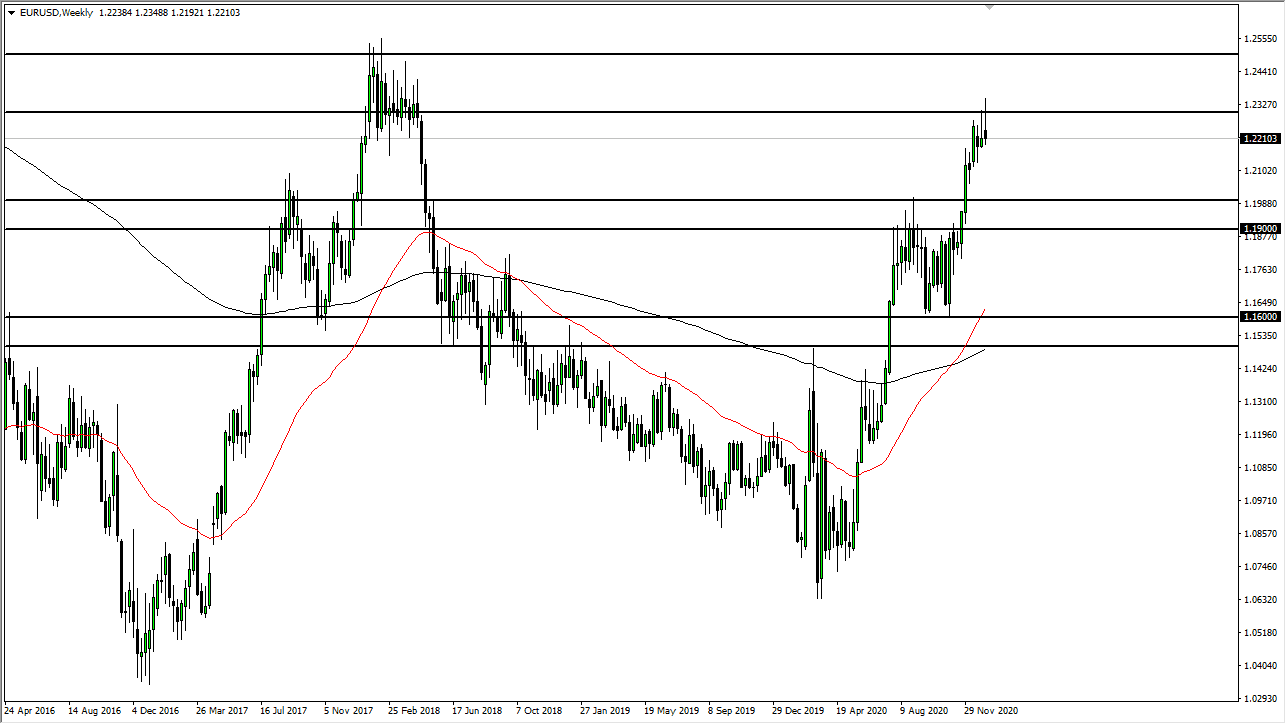

EUR/USD

The euro rallied pretty significantly during the course of the week, breaking above the 1.23 handle. However, we have turned right back around as 10-year yields have risen in the United States, thereby driving up demand for dollars. As we close out the week, we are getting closer to the 1.22 handle, and we have formed a massive shooting star. If we can break down below the bottom of the weekly candlestick, it is very likely that we will go lower, perhaps trying to build up a bit of value underneath that people can use to their advantage. The next week or two may continue to see the euro weaken a bit, but not necessarily from a long-term standpoint.

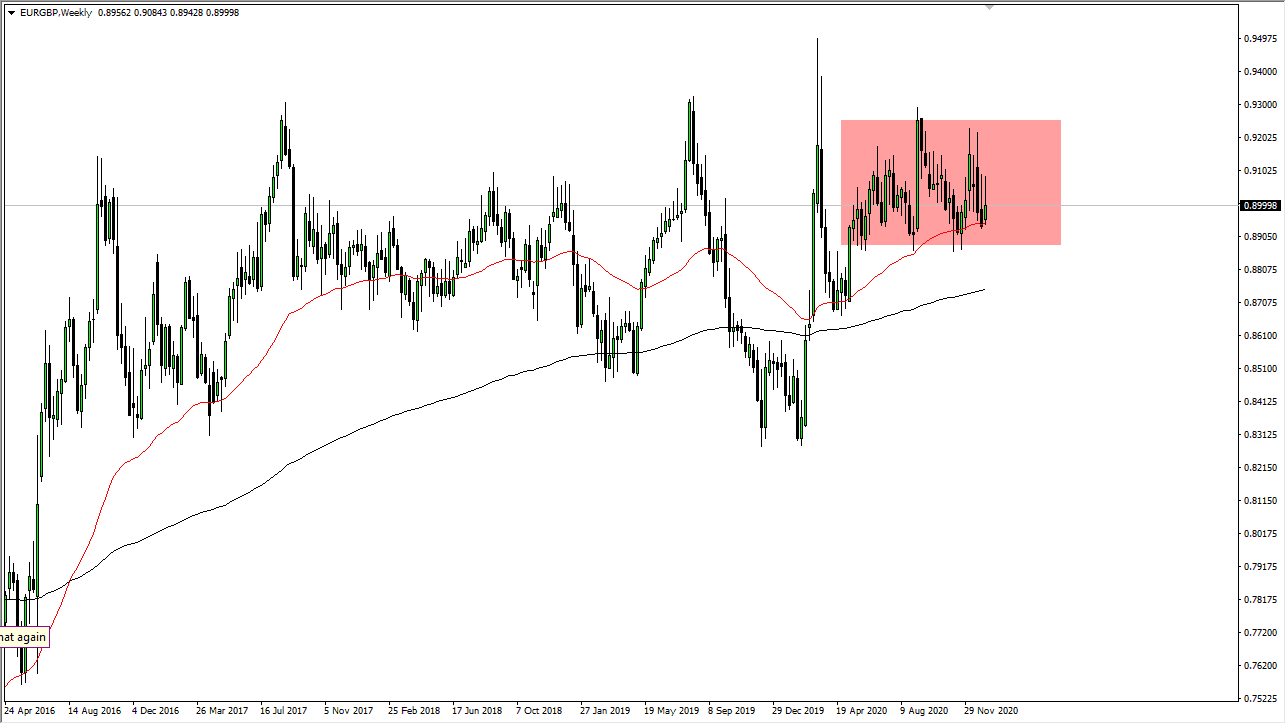

EUR/GBP

The euro initially rallied against the British pound during the course of the week, but we have seen a lot of pushback at the 0.91 handle. This is the second shooting star-shaped candlestick in a row, and I think this sets up for more euro weakness just as the EUR/USD pair has. I do not think that this is the beginning of a bigger trend, just that we may have to see this pair go looking towards the 0.87 level given enough time. The British pound does look somewhat strong, while the euro has been running into a major resistance barrier against the greenback, which of course has an effect on this pair.

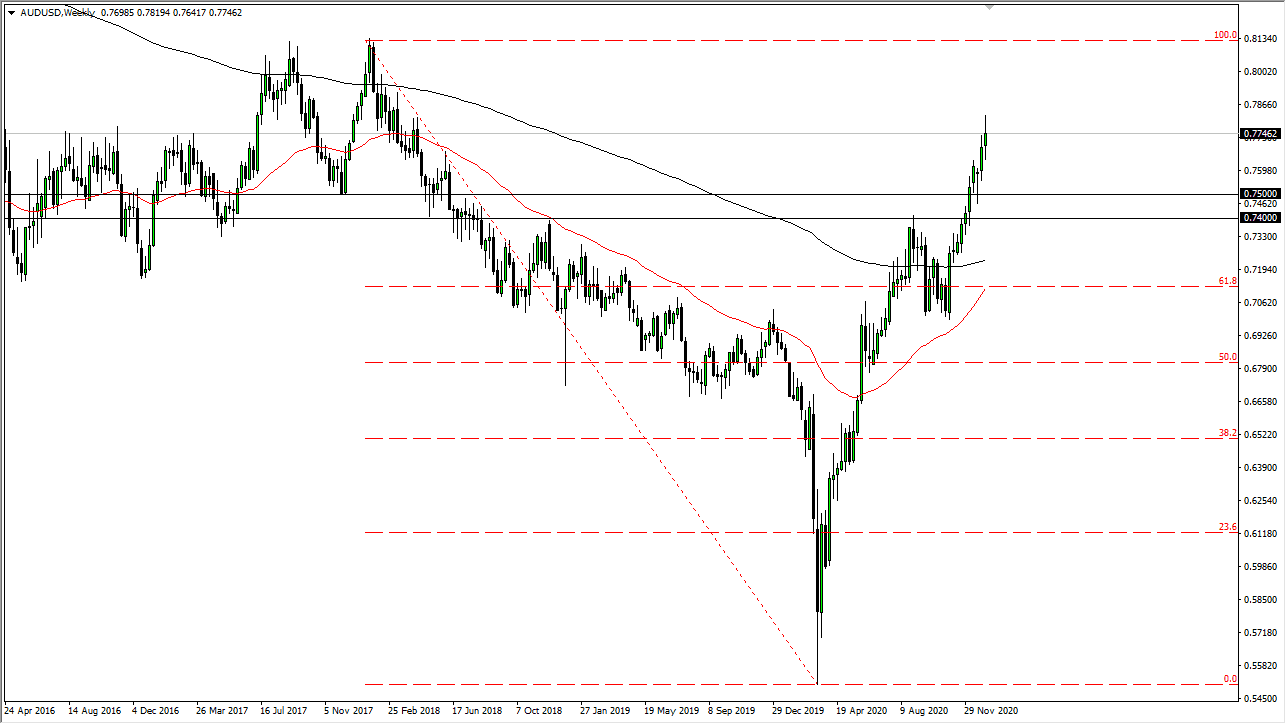

AUD/USD

The Australian dollar fluctuated during the course of the week, and even rose as high as the 0.78 level. However, we have pulled back from there on Friday and it looks like we are getting a bit extended. Much like with the euro, I believe that the US dollar is oversold. We are likely to see some type of pullback to reach towards the 0.76 level, where buyers will probably continue to jump in. Remember, stimulus coming out of the United States should continue to push commodities higher.