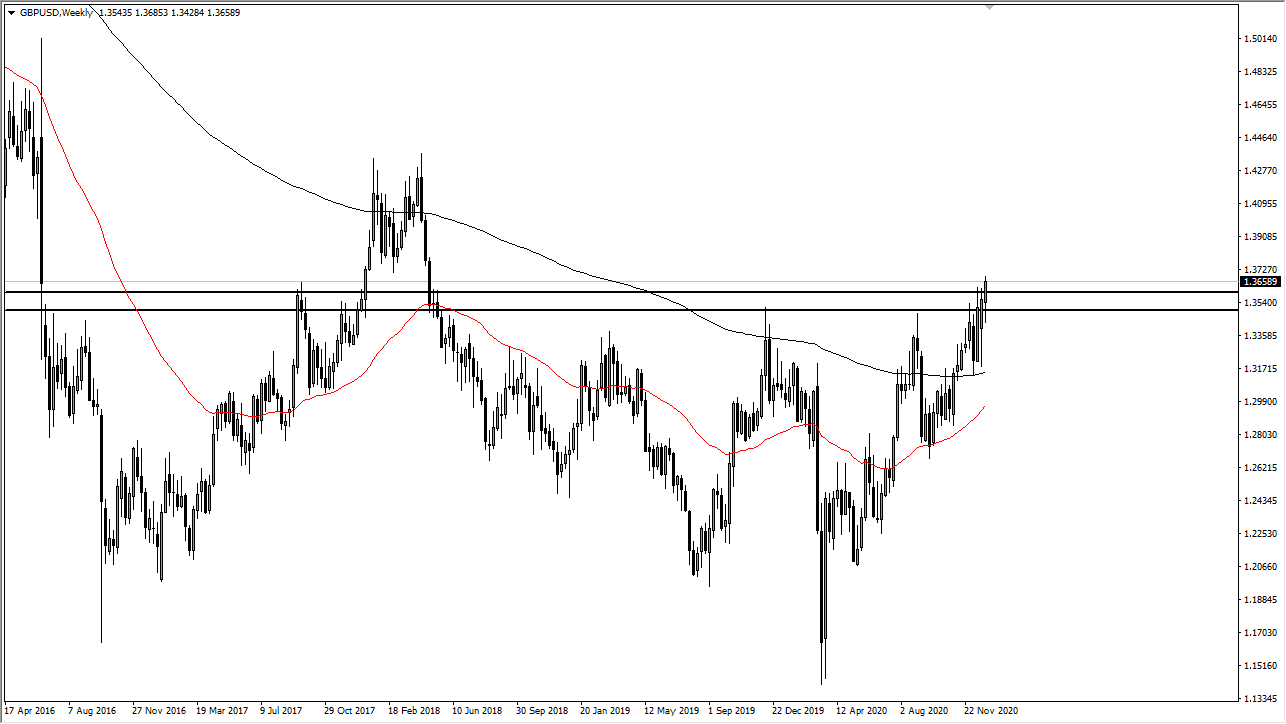

GBP/USD

The British pound pulled back a bit during the previous week but continues to look very bullish, as we have broken above the 1.36 handle. We will continue to go much higher, perhaps reaching towards the 1.40 level. The British pound looks as if it is going to continue to gain at the US dollar's expense. This is not so much a sign of the British pound being so favored as it is the US dollar losing strength. Pullbacks all the way to the 1.35 level should attract a bit of a bid.

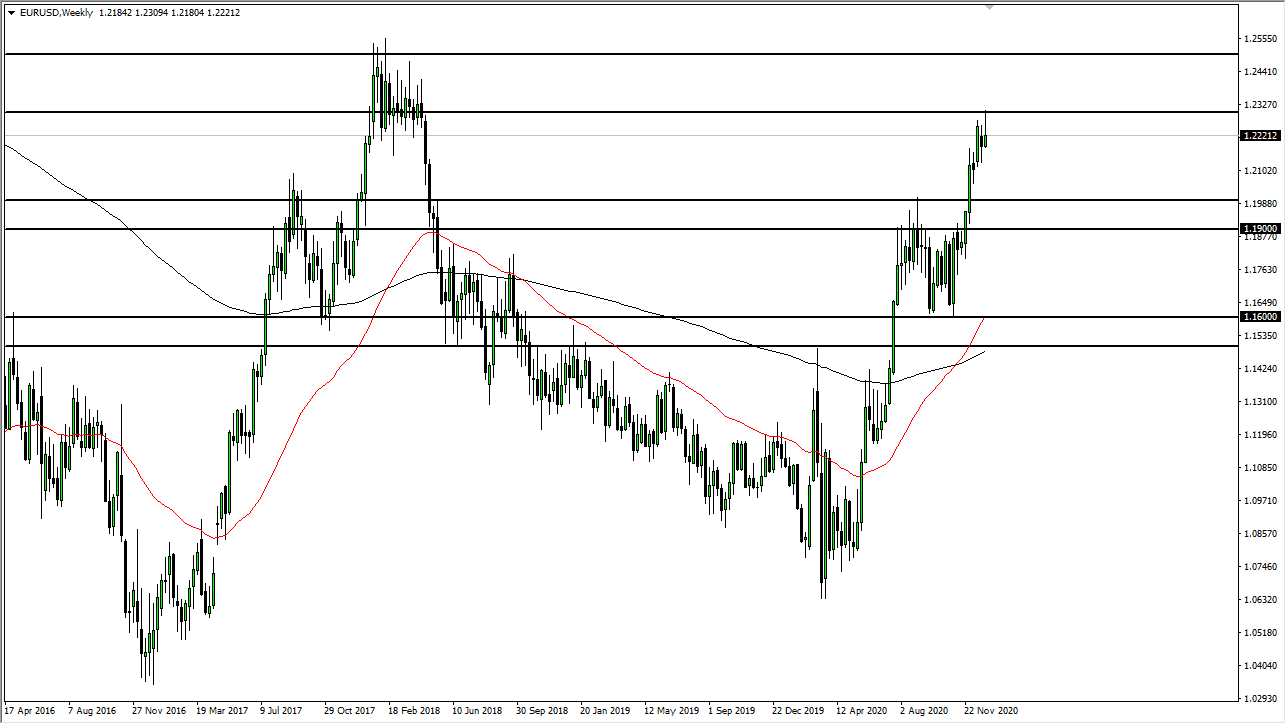

EUR/USD

The euro had a very bullish week, slamming into the 1.23 level. However, this is an area that is very important on long-term charts, so it should not be a huge surprise that the area between the 1.23 level and the 1.25 level is going to be very difficult to overcome. The fact that we did end up forming a shooting star tells me that we are not ready to do that, so what we will see next is a bit of a pullback, followed by upward pressure. The 1.20 level underneath could be massive support as well, but I do not even know that we will get that far to the downside. I would look for signs of support underneath to take advantage of the upward momentum again.

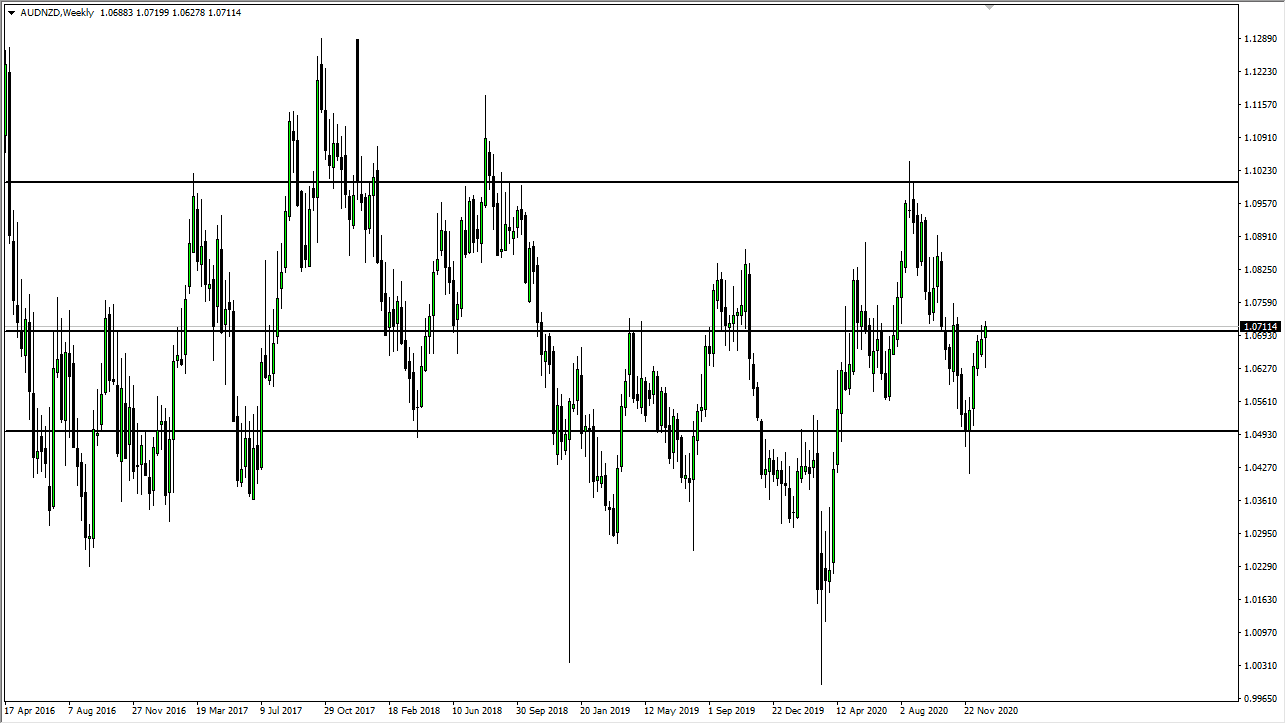

AUD/NZD

The Australian dollar initially fell during the course of the week against the Kiwi dollar, but you can see we have turned around to form a hammer. The hammer sits right at the 1.07 level and shows that we may try to take off to the upside again. If we can break above the range for this week, I think that we could go looking towards the 1.08 level, and then eventually the 1.10 level. I do not think we will get that far this week, but this market certainly shows a proclivity to continue grinding higher.

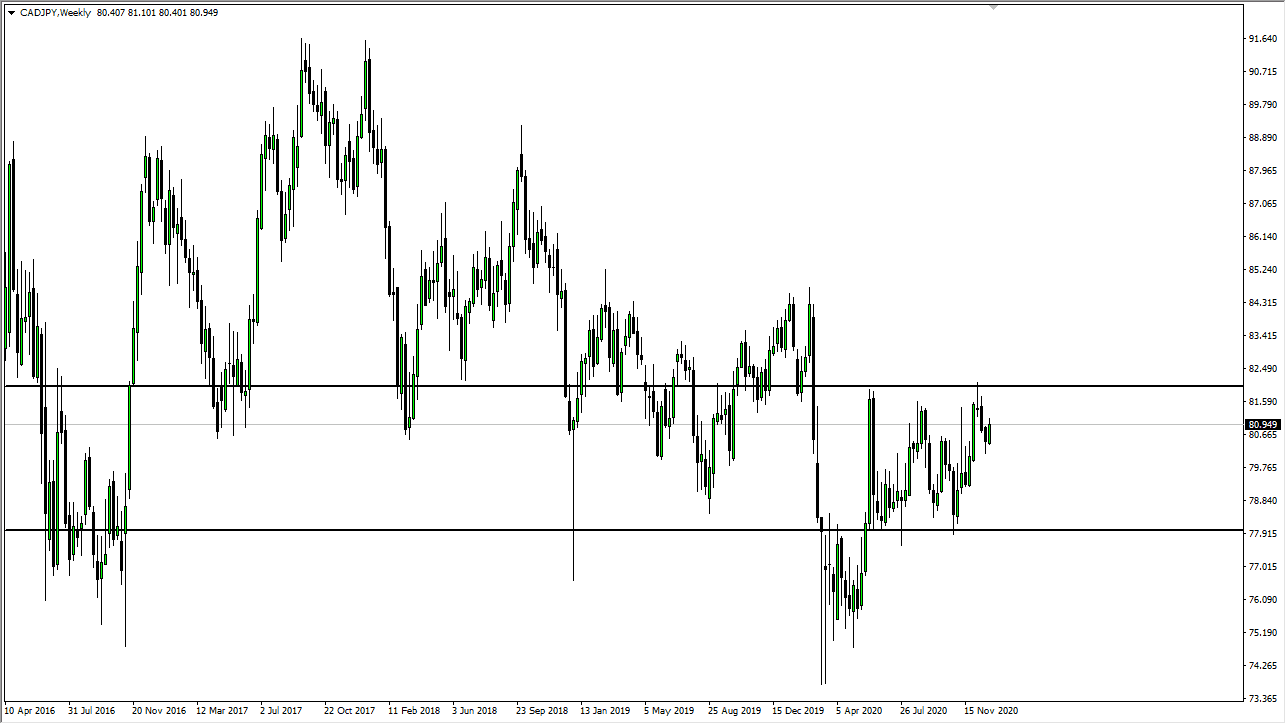

CAD/JPY

The Canadian dollar had a strong week against the Japanese yen, but the Japanese yen has not been an exactly strong currency recently, with perhaps the lone exception being against the US dollar. Looking at this chart, it looks as if we are getting ready to go towards the ¥82 level. This is a market that will continue to see more of an upward proclivity, especially if oil can gain a bit.