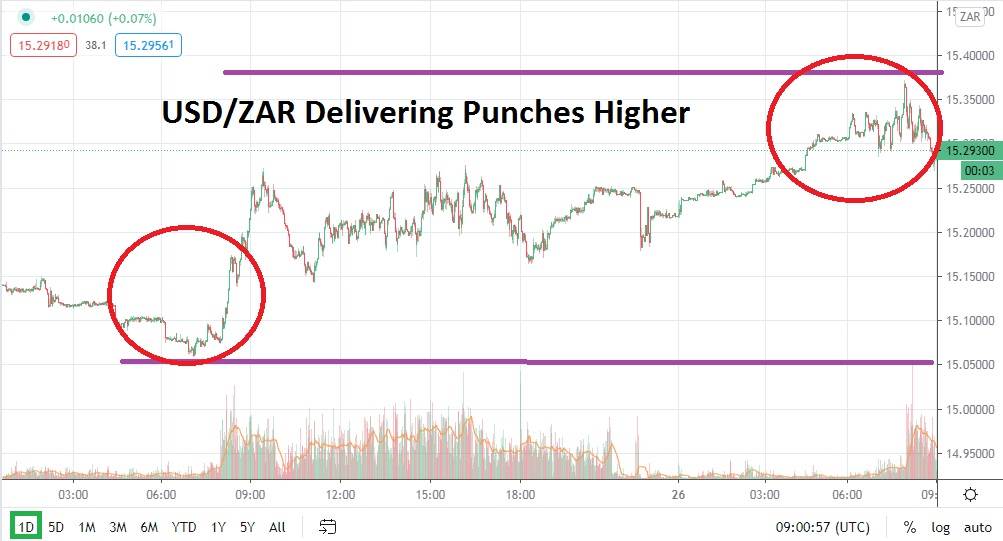

The past few days of trading have seen strong upward momentum develop in the USD/ZAR, but this follows a test of important support levels. January has produced rather impressive short-term trends, and traders who are not short-term players may be feeling the heat if they have a position going against their perceptions.

The USD/ZAR remains within the secure depths of its long-term bearish trend, but as of this writing, the Forex pair is challenging important resistance levels. After trading within sight of the 15.40000 level early this morning, the USD/ZAR has traded lower, but the move has been rather unimpressive and speculators should remain cautious as they gauge their technical opinions regarding direction.

If current resistance proves vulnerable near the 15.38000 mark, it could signal that a test of the highs seen on the 11th and 12th of January may prove tempting as high targets. However, if current support junctures between 15.20000 and 15.15000 are approached near term, this could spark the belief among traders that the recent moves of the USD/ZAR have been too enthusiastic upwards and that bearish momentum will be reestablished.

Traders need to use risk management precisely when wagering on the USD/ZAR for short-term endeavors. Conditions may remain rather choppy and not produce a solid direction to find an advantage. However, there is reason to suspect the bearish trend of the USD/ZAR can find momentum, but the question is when. Perhaps current conditions in South Africa are playing a role in the recent bullish trend of the USD/ZAR. The new coronavirus variation has caught the attention of investors and tougher lockdowns are being enforced. If this is the case and proves to be correct, traders should monitor resistance levels carefully.

If the USD/ZAR is able to sustain its current value range and not puncture resistance junctures higher, this may indicate that more tranquility is emerging within the Forex pair. Speculators may believe that bullish moves higher may run out of steam and the USD/ZAR will see its bearish trend again become a force. Selling the USD/ZAR with limit orders and looking for downside movement is speculative, but it may prove a worthwhile choice near term.

South African Rand Short-Term Outlook:

- Current Resistance: 15.382200

- Current Support: 15.20000

- High Target: 15.59000

- Low Target: 14.97000