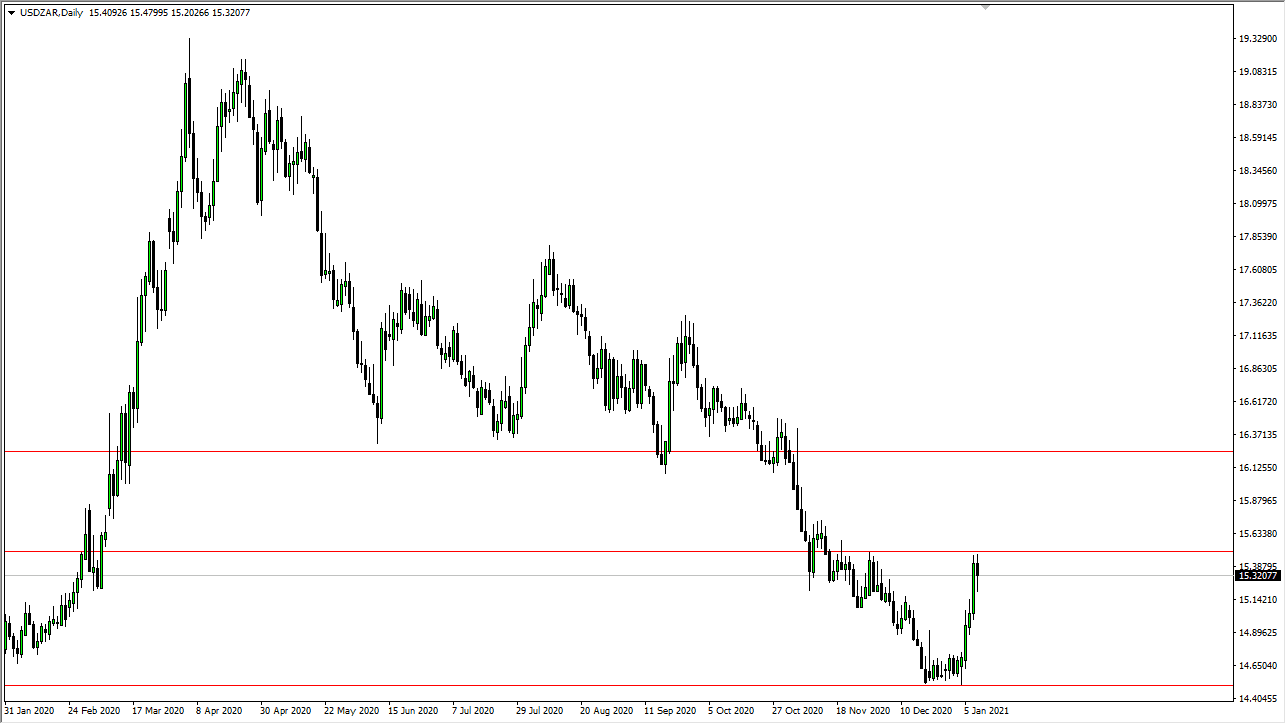

The US dollar rallied during the trading session on Friday, reaching towards the 15.50 rand level. However, we fell rather hard from there after the non-farm payroll numbers came out at -140,000 for the month of December. At that point, the US dollar fell hard, but we have since seen a bounce in order to form a hammer. The question now is whether or not this will be a hammer that builds up enough pressure to finally break above the 15.50 level, or if it will end up being a “hanging man” over the next few days.

If we break down below the bottom of the candlestick, that would be a selling opportunity, opening up a possible move down towards the 14.50 rand level. On the other hand, if we were to break above the 15.50 rand level, especially on a daily close, then we could go looking towards the 16.25 rand level. One thing that is worth paying attention to is that interest rates are rising in the 10-year note in the United States, and that could continue to attract inflows into the US dollar, despite the fact that stimulus should be working against it.

You should also keep in mind that there are a lot of concerns about South Africa right now, not the least of which is the fact that there is a mutant strain of coronavirus rampaging through that country, so many people are concerned about the global economy. It is also worth noting that the US dollar had reached extremes underneath on the long-term charts, so it does suggest that perhaps a bounce was necessary. I do not know that the US dollar is ready to take off to the upside, but price action would change my mind rather quickly. It is only a matter of time before we have to make a short-term decision, based upon both the 15.50 level above and the bottom of the candlestick that we just printed. Once we get that move, then I know where the next couple of handles are most likely to print. I would be patient enough to wait for that move, but it should not take too awfully long.