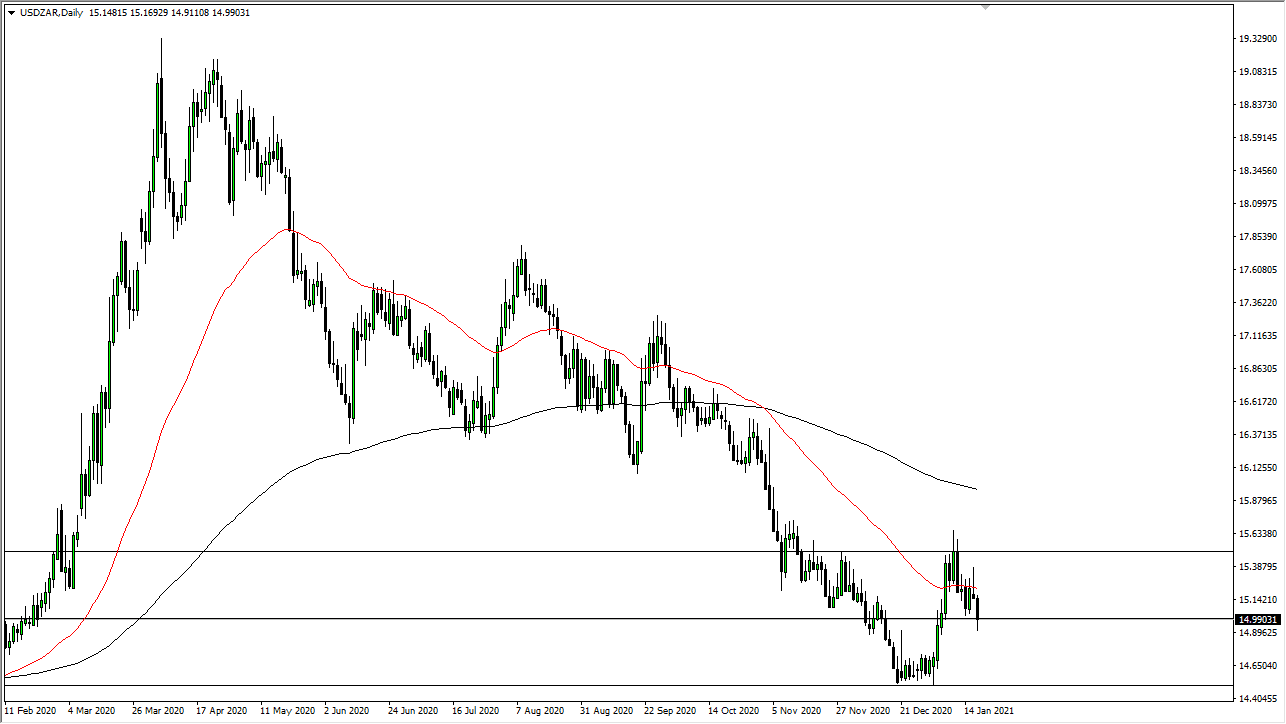

The US dollar initially nudged just a bit higher against the South African rand to kick off the trading session on Tuesday, but then fell towards the 15 level. That is an area that will attract a certain amount of attention due to the fact that it is a large, round, psychologically significant figure, It is likely that we will continue to go lower, mainly because the trend has been intact for so long and people continue to focus on the idea of the “reflation trade”, and South Africa having quite a bit of commodities makes for an attractive target in general. The market is likely to continue to look at commodity currencies as a potential asset to own, because commodities in and of themselves should continue to be attractive when you have massive amounts of stimulus coming out the United States.

Furthermore, breaking down below the bottom of the candlestick for the trading session on Tuesday opens up the floodgates for a potential move down to the 14.50 rand level. This is an area that has been supportive in the past, one that had been previously important as well, so it is likely that we will continue to see an area of both buying and selling. Given enough time, this is a market in which you will probably continue to sell short-term rallies, especially closer to the 15.50 rand level.

The 50-day EMA sits just above and the technical analysis in general will continue to push towards the downside, so simple momentum probably is one of your biggest allies if you are trying to get short of this market. As far as buying is concerned, I would need to see this market break above the 200-day EMA at the very least, perhaps even higher than that. If I am looking to buy the US dollar, I will probably do it against other currencies in more liquid markets than this emerging market currency pair, which can be erratic at times.