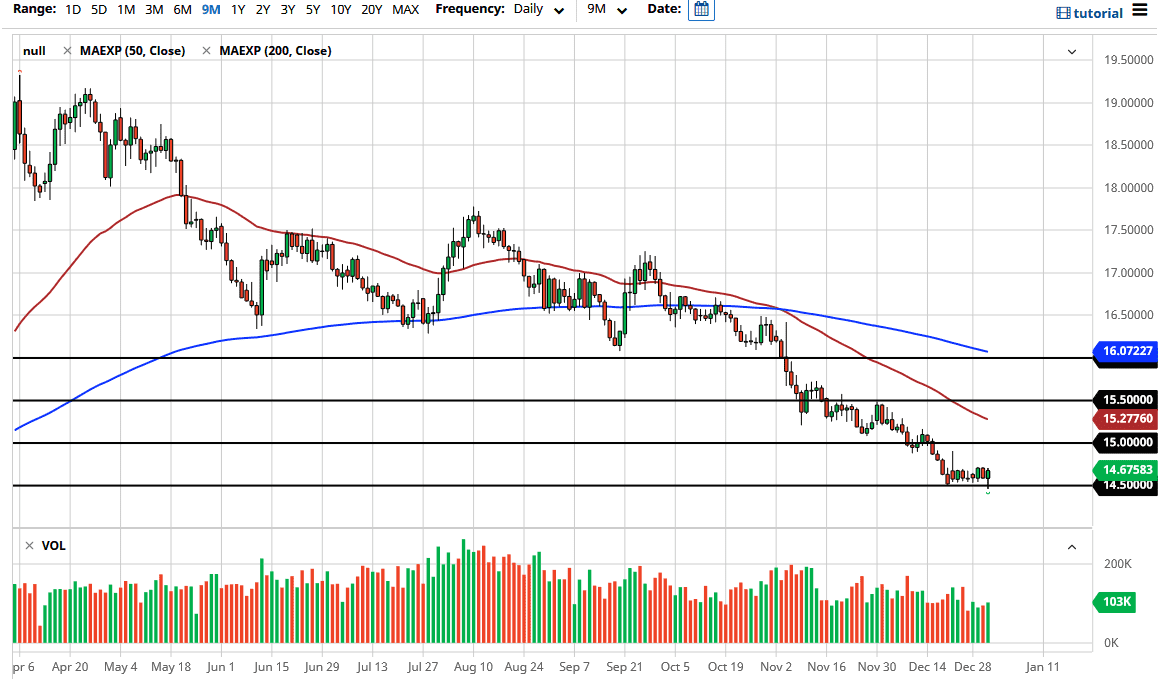

The USD/ZAR pair pierced the 14.50 level during the trading session on Thursday, but then turned around to show signs of strength as a bit of profit-taking occurred. Furthermore, there has been a serious lack of volume, so it is not a huge surprise to see that the market could not come up with a bigger and longer-term move. The shape of the candlestick ended up forming a hammer, which suggests that we could get a bit of a bounce. I am not overly enthusiastic about buying at this point; I simply think that it will continue to offer selling opportunities given enough time.

The 15 rand level above would be the initial target for a bounce, but that bounce should end up being sold into. This is a market that continues to see the US dollar lose strength, and emerging market currencies get a boost from that. I do not think that we will suddenly collapse, but it is worth noting that the South African rand is one of the few currencies out there that offers a significant amount of interest rate differential, and therefore is attractive for traders in an environment that offers almost nothing in the realm of yields.

You should also take a look at the 50-day EMA, which is currently at the 15.27 rand level as potential resistance as well. If we bounce from here, there will be plenty of opportunities to short this market in time. I do think we will go lower than we have so far. However, if we were to break down below the bottom of the candlestick for the trading session on Thursday, then it would open up the floodgates. There is no argument as far as I can see to start buying this currency pair, unless something very “risk off” happens from a macroeconomic standpoint. I think it is simply a matter of finding value, as the South African rand loses a little bit of value in a bounce.