The US dollar initially tried to rally a bit during the trading session on Thursday to break above the 50 day EMA temporarily. However, we have since pulled back as it looks like emerging markets will continue to be an area where people are willing to put money towards. In fact, Goldman Sachs stated during the trading session that they were improving their outlook for emerging markets, and that of course has money looking towards places like South Africa. In fact, they had suggested that South Africa was one of the economy is that would rebound the hardest in 2021.

Currently, South Africa does have major issues when it comes to the coronavirus strain that is there, but ultimately this is a market that is looking beyond that short-term problem, as the vaccine will eventually be widespread. The rollout of the vaccine has been rather disappointing so far, as it has been sluggish. However, eventually the vaccine will be widespread and then could really start to put this pandemic in the rearview mirror. If that is going to be the case, the market is likely to see the emerging market currencies on the whole go higher and value, not just the Rand.

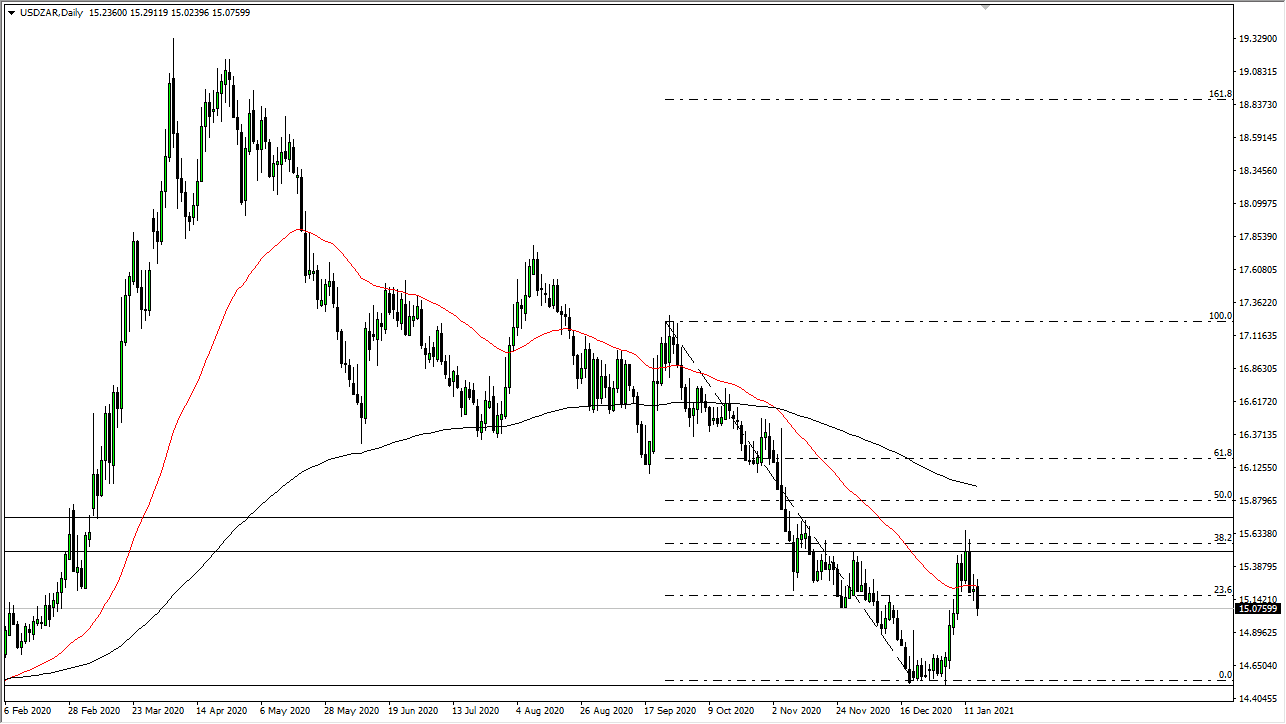

To the upside, I see a significant amount of resistance at the 15.50 level above that extends to the 15.75 level, which is an area that had been noisy in the past. In fact, it also features the 38.2% Fibonacci retracement level from the most recent leg lower, so I think it suggests not only that we should continue to go lower, but perhaps with a significant amount of momentum as well. This is typically the case when you only see a 38.2% pullback on the Fibonacci retracement tool.

The 200 day EMA sits just above the 15.97 Rand level, which also is slightly above the 50% Fibonacci retracement level. Ultimately, I think that is not until we break above there that you can take a serious look at buying the greenback against the Rand, because of the ferocity of this move. It is worth noting that the 14.50 level had been important in the past, so the fact that it is recently offered support should not be a huge surprise. If that gives way, then we can really start to accelerate to the downside.