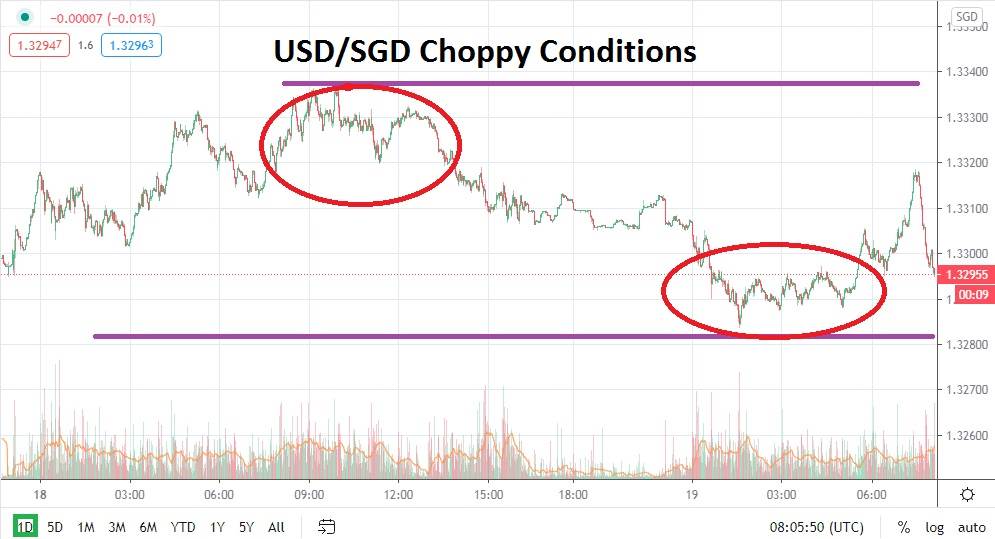

The USD/SGD continues to trade within the upper realms of its value range and conditions have proven to be choppy for speculators. Stubborn traders may continue to be enticed by the potential of downside momentum because of the USD/SGD’s heights, taking into consideration its last three months of trading. Yet, recent price action may be proving difficult for traders to capture a sizeable movement if bearish moves are the only direction sought.

However, there is reason to suspect that the USD/SGD will see its bearish trend reignited and this is certainly an additional problem for traders who press forward with selling positions. Going against the trend in trading often can be expensive and painful. Technically, the USD/SGD does look like it is perhaps valued too high, but it depends on what timeframe you are considering. There is a large difference between a one-day and a three-month chart.

Short-term speculators may be wise to look for smaller moves and use limit orders to enter and exit their positions. The USD/SGD does have plenty of volume, which allows traders the capability to monitor Forex action and use market orders, but this can also prove to be a nerve-wracking routine for traders who may become too emotional. The USD/SGD is currently priced within its lower value realms via a one-day chart and traders with an optimistic bearish perspective may believe that downside action will continue to develop.

The problem is that the past few days of trading have seen reversals emerge and kill bearish moves abruptly. So, the question is how much you believe in the current ability of the USD/SGD to achieve further downside momentum in the short term. Stop loss ratios should be used and the 1.33000 level may feel like a tempting mark to believe resistance will prove adequate. However, the 1.33000 juncture has been penetrated higher often in the past few days of trading.

From a risk/reward scenario, it seems logical that there is more downside momentum to capture than upside. Traders should make sure they have realistic goals in the short term which seek a limited amount of value via pips in the USD/SGD when pursuing selling positions. Shorting the Forex pair remains the tempting choice, but speculators need to brace for potentially more choppy conditions in the meantime.

Singapore Dollar Short-Term Outlook:

- Current Resistance: 1.33130

- Current Support: 1.32830

- High Target: 1.33330

- Low Target: 1.32540