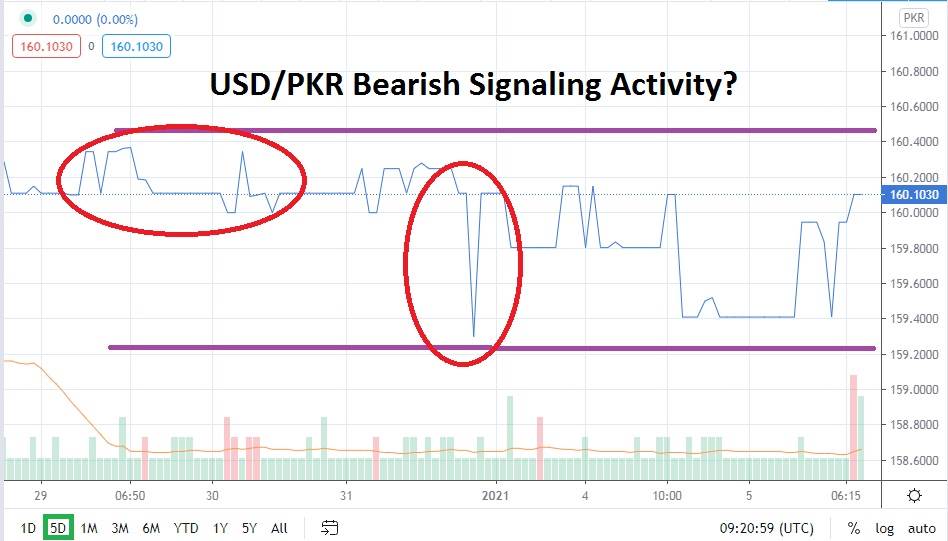

The USD/PKR may appear rather consolidated to many traders in the Forex market. However, speculators within the USD/PKR who have been intrigued by the Forex pair’s rather quiet trading the past few weeks may be inclined to suspect that a potential bearish cycle is about to be reengaged. Resistance levels have been incrementally decreasing and support levels have proven vulnerable the past week of trading, while technical charts demonstrate values below which could become targets for sellers.

The USD/PKR remains a speculative trade with a potential for volatility to ignite at any time. However, speculators who are able to manage their leverage and monitor the USD/PKR carefully while also using limit orders may be keen to pursue the potential bearish momentum. Yesterday’s trading essentially tested support level lows seen in December, but it is November values which traders who want to be sellers are likely focusing on.

On the 17th of November, the USD/PKR reached a low of approximately 157.7500 before seeing a reversal higher develop. But after achieving a high of 161.0000 on the 24th of November, the USD/PKR was trading lower near 158.5000 late in November. Since late November, the USD/PKR has been trading in a rather choppy and comfortable price band, but interestingly, the Forex pair didn’t seriously test the 161.0000 mark again. And, in fact, the USD/PKR has been able to display a decrease of resistance levels since the 22nd of December.

Traders of the USD/PKR do need patience; the trading volumes in the Forex pair remain lackluster and when large transactions officially take place they can cause bursts of volatility. While the Forex pair is not the most transparent within the trading world, it still does tend to trade with a loose correlation to other currency pairs. The USD/PKR may continue to produce a bearish trend near term, and for traders looking for serious downward movement to occur, the 158.9000 level is a target to monitor.

Speculators, however, in the short term, should look for smaller moves and focus on the 159.7000 to 1.5950 junctures. If these values below see their support proven vulnerable, the USD/PKR may be ready to create a solid speculative trade for those who have the capability to manage their risk-taking efficiently. Selling the USD/PKR looks like a legitimate opportunity.

Pakistani Rupee Short-Term Outlook:

- Current Resistance: 160.3600

- Current Support: 159.7500

- High Target: 160.5000

- Low Target: 159.2000