With the inauguration of President Joe Biden and the end of the Trump era, which had brought unprecedented economic success to the US, the USD still received some support, though likely temporary. It is noteworthy that the USD/JPY pair retreated to the support level at 103.44 at the beginning of Thursday's trading, amid a strong bearish performance. Joe Biden's presidency will not be characterized by "America first", but will likely be focused on globalist agendas.

"Democracy has triumphed," Biden declared.

The new president denounced “the lies that are told for the sake of power and profit” and spoke about the challenges ahead, and importantly, the growing COVID-19 virus that has killed more than 400,000 people in the United States, as well as economic pressures.

Biden has an ambitious first 100 days that includes a push to speed up the distribution of COVID-19 vaccines to Americans and pass a virus relief package worth $1.9 trillion, though Democrats now say that the bill won't even be brought to the House floor until March, at the earliest. On the first day of his presidency, Biden planned a series of executive actions to roll back the Trump administration's initiatives and also plans to grant citizenship to 11 million immigrants who entered the country illegally.

The United States recorded a total of 2,760 additional deaths reported in the past 24 hours, according to the latest data from Johns Hopkins University. With this, the total number of deaths in the United States from the deadly disease rose to 401,763. During the same period, 175,371 new cases were reported throughout the country, bringing the total number of people infected with the disease to 24,254,144.

In the hardest-hit state of California, 23,800 people were infected and 146 died on Tuesday from the virus. Meanwhile, the number of people currently reported to be hospitalized due to COVID-19 in the country has decreased to 123,820. Of these, 23,029 patients were admitted into intensive care units, according to the latest update published by the COVID Tracking Project.

The test-positive rate decreased again. Of the nearly 1.70 million people who have been tested for coronavirus, 10.06% have been diagnosed with the disease.

Globally, 60 countries have reported new cases or community transmission of the new variant of the coronavirus, which was first identified in the United Kingdom. Zimbabwean President Emerson Dambudzo Mnangagwa announced the death of Minister of Foreign Affairs and International Trade Seboussou Moyo due to COVID-19 on Wednesday. Germany extended the national lockdown until the middle of next month and introduced tougher measures.

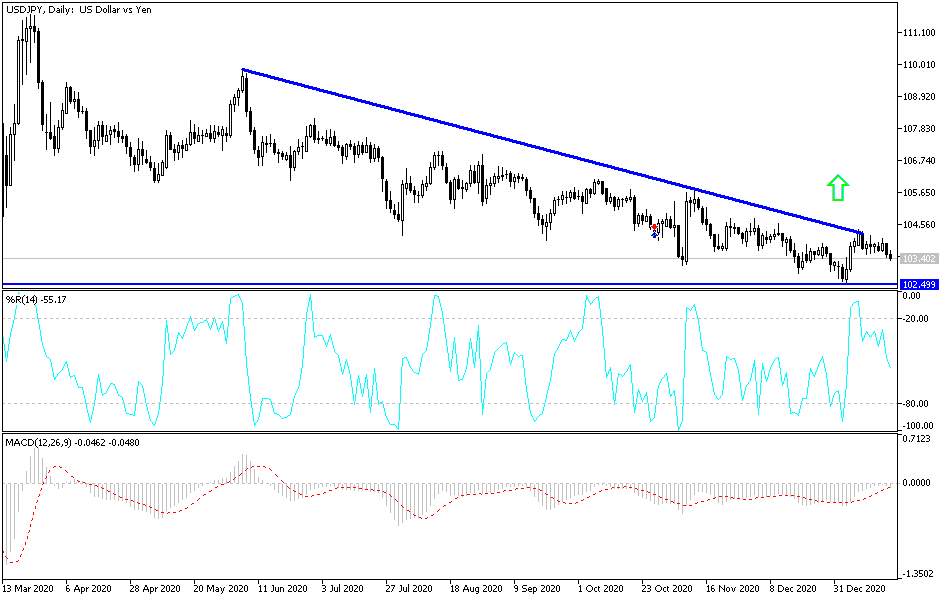

Technical analysis of the pair:

The USD/JPY is still bearish, and stability below the 104.00 support level heralds a stronger downward movement to the next support levels at 103.35, 102.90 and 102.00. These levels will push the technical indicators to strong oversold areas, and it is therefore better to buy from them. On the upside, according to the performance on the daily chart, a breach of the 106.00 resistance will be an important stage for changing the current bearish direction.

In addition to the extent of investor risk appetite, the currency pair will react to the announcement of US economic data, the number of weekly unemployment claims, with a strong reaction likely to occur if the number is more than one million claims. This is in addition to the Philadelphia Industrial Index reading, building permits and US house sales.