The US dollar is still suffering from low risk appetite, as investors await the release of US unemployment numbers and the minutes from the recent meeting of the Federal Reserve. This pushed the USD/JPY pair towards the support level at 102.60, its lowest since March 2020, before settling around 102.75 as of this writing. In general, despite increasing access to the vaccine, January 2021 looks bleak around the world as COVID-19 spreads and mutates itself from Britain to Japan to California, filling hospitals and threatening livelihoods again as governments shut down companies and race to find solutions.

England has returned to lockdown. Mexico City hospitals are receiving more COVID-19 patients than ever before. Germany recorded its highest daily death rate so far on Tuesday. South Africa and Brazil are struggling to find a place for the dead. Thailand is fighting an unexpected wave of infections.

An increasing number of countries are reporting cases of a new, more contagious variant that has already spread across Britain. Commenting on the concern, WHO Director-General Tedros Adhanom Ghebreyesus said: "We are in a race to prevent infection, reduce cases, protect health systems and save lives while rolling out two highly effective and safe vaccines for the high risk population. It's not easy. These are the hard miles.”

A report from the Institute of Supply Management showed an unexpected acceleration in the pace of growth in US manufacturing activity during the month of December. Accordingly, the ISM said that the Manufacturing PMI rose to a reading of 60.7 in December after dropping to a reading of 57.5 in November, and any reading of the index above the 50 level indicates growth. Economists had expected the index to decline to 56.6.

With the unexpected increase, the manufacturing index reached its highest level since reaching 61.3 in August 2018.

Commenting on the result, Timothy R. Fury, Chair of the ISM Manufacturing Business Survey said: “Manufacturing performed well for the seventh month in a row, with demand, consumption and inputs registering strong growth compared to November. Labor market difficulties in member companies and their suppliers will continue to restrict the growth of the industrial economy until the coronavirus (COVID-19) crisis ends.”

The unexpected increase in the main index came as the New Orders Index rose to 67.9 in December from 65.1 in November, while the Production Index jumped to 64.8 from 60.8. The Employment Index rose to 51.5 in December from 48.4 in November, indicating a return to job growth in the manufacturing sector. Meanwhile, the report showed that the Supplier Delivery Index rose to 67.6 in December from 61.7 in November, indicating deliveries are slowing at a faster rate. “The Supplier Delivery Index reflects the difficulties that suppliers are still facing due to the effects of COVID-19,” Fury said.

The Price Index jumped to 77.6 in December from 65.4 in November, reaching its highest level since May 2018. Oren Klashkin, Chief US Economist at Oxford Economics, said: “Manufacturing was fairly good in 2020, but looking to the future, the evolving recovery dynamics will lead to a slower growth of factory activity in 2021. Factories will face headwinds from the recent resurgence of the virus, slowing economic recovery, and ongoing disruptions and shortages in the supply chain."

The ISM is expected to release a separate report on Thursday on service sector activity for the month of December. The Service PMI is expected to decline to 54.5 in December from 55.9 in November.

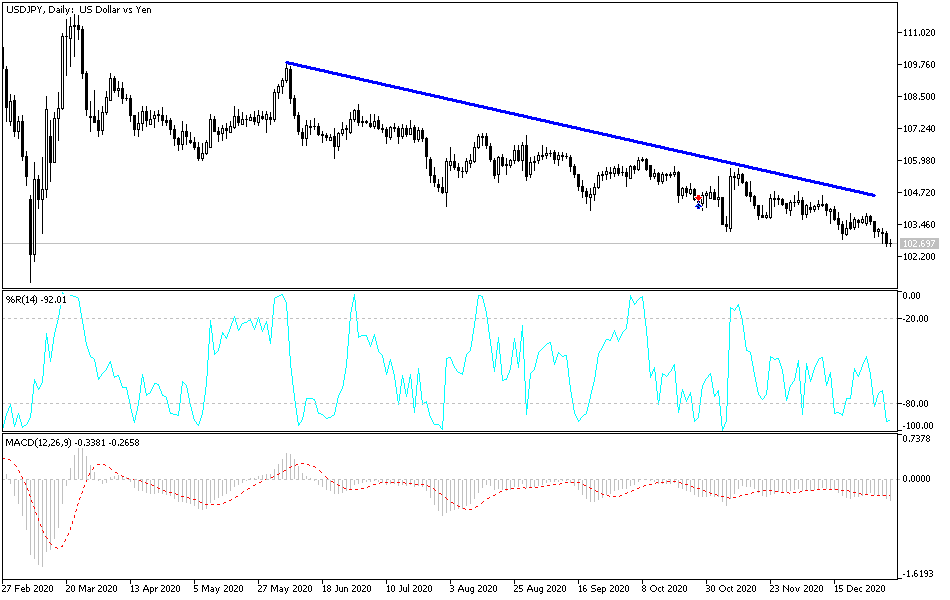

Technical analysis of the pair:

There is no change in my technical view of the performance of the USD/JPY pair, as the general trend remains bearish, and the recent losses have pushed the technical indicators into strong oversold areas. Long trades are expected to be triggered by more sales. The closest buying levels for the currency pair are currently 102.55, 101.90 and 101.00, respectively. On the upside, the reversal of the current trend would happen if the pair were to breach the resistance level at 106.00. I still prefer to buy the currency pair from every downside.

In addition to the extent of investor risk appetite, the currency pair will be affected by the announcement of the reading of the ADP Index to measure the change in the number of non-agricultural jobs, factory orders and oil inventories, as well as the announcement of the minutes of the last meeting of the Federal Reserve Bank led by Jerome Powell.