The USD/JPY pair has been moving in a narrow range between the 103.56 support level and the 104.19 resistance level, stabilizing around the 103.82 level at the beginning of this week's trading. Although the dollar recovered against the rest of the other major currencies, it was still the weakest against the yen. Global financial markets are awaiting the incoming US administration’s new plans for the US and global economy in the face of the pandemic.

Biden intends to re-join the Paris Climate Agreement and cooperate once again with the World Health Organization. He plans to pursue relations with the Europeans and other countries and to return the United States to the Iran nuclear deal. Nevertheless, many Americans will continue to embrace Trump's “America first” agenda, especially as the US economy struggles to recover from the coronavirus pandemic.

After the announcement of the number of US weekly unemployment claims, it was reported that consumer spending fell in December for the third month in a row, as the rise in COVID-19 cases led people away from shopping during the critical holiday shopping season. Accordingly, the US Commerce Department announced that US retail sales fell by -7%, seasonally adjusted, in December from the previous month, a decline that Wall Street analysts had not expected. Sales were also down in October and November, even as retailers tried to get people to shop for Christmas gifts early by offering deals before Halloween.

The report covers about a third of all consumer spending. Services such as hair cutting and hotel accommodations, which have been hit hard by the epidemic, are not included. The unexpected drop highlights the troubles in the US economy as the pandemic worsens this winter. Employers laid off jobs last month for the first time since April. Layoffs appear to be continuing, as the number of people seeking unemployment benefits jumped last week to the highest level since August.

This left many Americans with little to spend, but the $600 stimulus checks sent to most Americans are expected to boost the economy in the coming months. With vaccines distributed more widely, economists expect the US economy to recover at a healthy pace in the second half of this year.

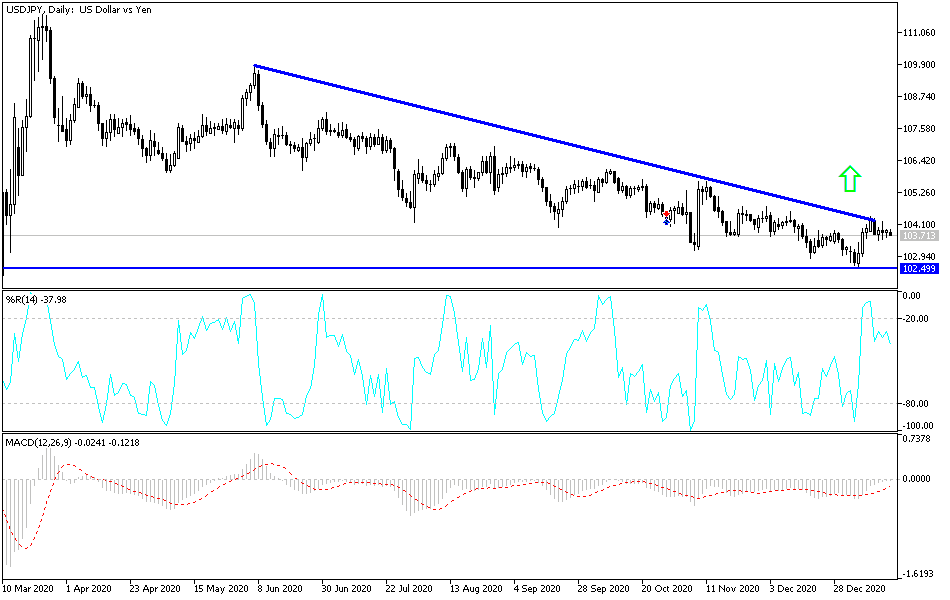

Technical analysis of the pair:

The tight performance on the daily chart of the USD/JPY foreshadows a strong move in the coming period, especially with its stability below the support 104.00. The bears' control will increase further, with the support levels at 103.35, 102.80 and 101.90 as the next targets. On the upside, there will be no shift in the current bearish outlook without breaching the 106.00 resistance level. I still prefer to buy the currency pair from the dips, as the technical indicators are still pointing to strong oversold areas. There is a good chance of the pair bouncing back up.

Today, the currency pair does not expect any important US economic data, as it is a national holiday.