Continuing its bearish outlook, the USD/JPY pair moved down to the 103.72 support level, after attempts to correct upwards to the 104.40 resistance level. This performance still confirms just how dominant the bears are. Markets are in a state of cautious anticipation of the new US administration and the introduction of more US stimulus plans to counter the effects of the pandemic. The US is still suffering from its lead in the number of COVID-19 global injuries and deaths.

In the latest US measure to contain the epidemic, health officials at the CDC announced that anyone traveling to the United States would soon need to show evidence of a negative test for COVID-19.

COVID-19 is spreading strongly in the US, with more than 22 million cases reported to date, including more than 375,000 deaths. The new measures are designed to try to prevent travelers from introducing new forms of the virus that scientists say could spread more easily. The CDC order is set to go into effect in about two weeks, on January 26. Air travelers are required to take a COVID-19 test within three days before departing their flight to the USA, and to present written evidence of the test results to the airline. Travelers can also provide documents stating that they have been infected in the past and have recovered. Airlines are to ban passengers from boarding the plane if they do not have evidence of a negative test result or a previous infection. In this regard, Robert R. Redfield, Director of the Center for Disease Control and Prevention, said in a statement: "Testing does not remove all risks. But when combined with stay-at-home time and daily precautions like wearing masks and social distancing, it can make travel safer, healthier and more responsible by reducing the spread to airplanes, airports, and destinations."

Survey data from the Japanese Cabinet Office showed that the overall assessment of the Japanese economy declined for the second month in a row in December. Accordingly, the Current Conditions Index of the Economic Watchers Survey, which measures the current state of the economy, decreased to 35.5 in December from 45.6 in November. A reading below 50 indicates pessimism. The Expectation Index indicating future activity rose to 37.1 in December from 36.5 the previous month. In October, the expected reading was 49.1.

The US dollar fell as stock and bond markets stabilized, although there is still risk ahead as the Fed continues talking about curtailing the quantitative easing program in the coming weeks and testing investor sentiment, in addition to market expectations for a bearish dollar. Accordingly, the dollar was sold again in the wake of the declines that occurred on Monday in the stock and bond markets. This sparked earlier profit-taking for investors in bets against the US currency. As a result, government bond yields slowed.

Yields had risen sharply in the past week, which strengthened the dollar in the process, due to a set of political developments and statements from a number of members of the Federal Open Market Committee (FOMC) who will collectively decide the US interest rate and other monetary policies next year. Last week's Democratic victory in the Georgia State elections was a game-changer for the dollar in some way,s because it gave the Democratic Party an absolute majority in Congress and the incoming president, Joe Biden, more freedom to pursue his agenda.

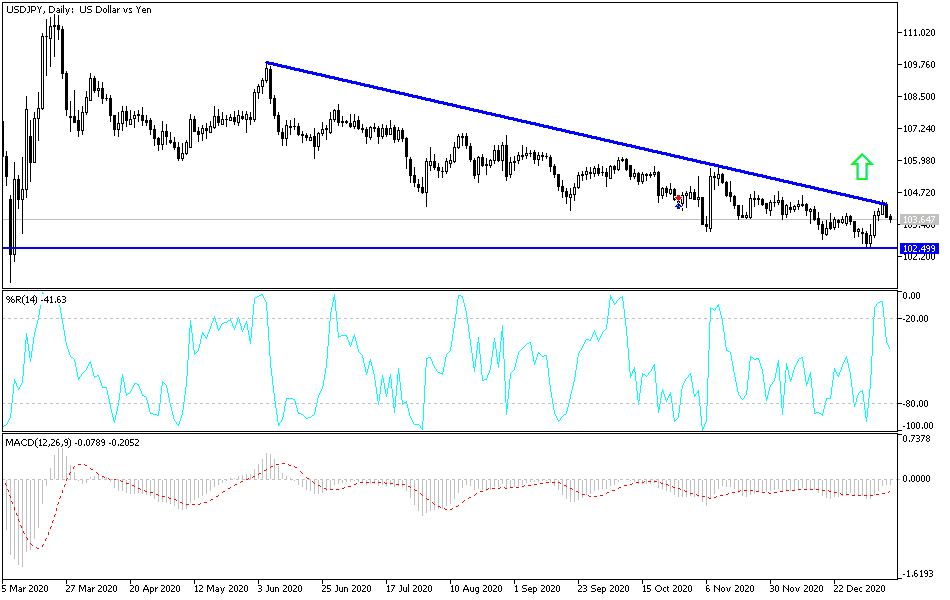

Technical analysis of the pair:

Bearish sentiment for the USD/JPY is still stronger, and stabilizing below the support level of 104.00 increases bearish momentum and thus the possibility of moving towards stronger support levels at 103.65, 102.90 and 102.00. On the upside, there will be no trend reveresal without first breaking through the 106.00 resistance level. This requires more confidence in the markets that efforts to contain the coronavirus are bearing fruit and that the global economy will already witness a strong momentum with vaccines during 2021.

In addition to investor risk appetite, the currency pair will be affected by the announcement of US inflation figures today and statements by monetary policy officials of the Federal Reserve Bank.