The USD/JPY currency pair is trying to correct higher, but attempts to rebound to the upside are still weak. For two weeks in a row, the pair's gains did not exceed the 104.40 resistance level, which confirms that the bulls need strong momentum to be able to make a real shift in the general bearish trend. The pair's losses last week reached the 103.32 support level and closed the week's trading flat around the 103.77 level. Overall, the Japanese yen, which traded relatively steadily at the start of the New Year 2021, is mainly driven by the recovery in the world's third largest economy. So far, the economic numbers have been disappointing, something that could put pressure on safe-haven assets.

Last Friday, the Japanese Manufacturing Purchasing Managers' Index (PMI) reading in January came in at 49.7, down from 50 in December - and any reading below the 50 level indicates contraction. The Services PMI came in at 45.7, down from 47.2 last month. The Composite PMI - which includes the manufacturing and services sectors together - fell to 46.7, down from 48.5 in December.

The three indicators recorded declines in production, employment, new orders, prices and business confidence.

Japan posted a contraction for the third month in a row as the CPI declined by -1.2% year-on-year in December, down from -0.9% in November. Tokyo saw price falls for utilities, food, transportation, medical care, culture and entertainment. According to the Ministry of Internal Affairs and Communications, core inflation, which excludes fluctuations in energy and food, decreased at an annual rate of 1% in December. On the trade front, Japanese exports rose at a slower-than-expected 2% pace, below the median estimate of 2.4%. Imports fell 11.6% year-on-year in December, better than market expectations of 14%.

Prior to that, the Bank of Japan announced at its first monetary policy meeting for 2021 to keep interest rates unchanged at -0.1% and keep standard 10-year government bonds at 0%. Officials expect Japan's GDP to reach 3.9% growth in the next fiscal year, up from previous expectations of 3.6%.

After reporting a much larger than expected increase in US unemployment claims in the previous week, the Labor Department released a report showing that initial unemployment claims declined in the week ending January 16th. According to the report, claims fell to 900,000, down by 26,000 from the previous week's revised level of 926,000. Economists had expected claims to drop to 910,000 from the 965,000 reported in the previous week.

Even with a bearish review, the number of claims in the previous week represented the largest number since it reached 1.011 million in the week ending August 22nd. Meanwhile, the US Labor Department said that the less volatile four-week moving average rose to 848,000, an increase of 23,500 from the previous week’s revised average of 824,500. Commenting on the numbers, Lydia Bosor, Chief US Economist at Oxford Economics, said: “The outlook for fiscal stimulus indicates that besides the spread of the vaccine on a larger scale, there is a brighter outlook for the labor market, but as the epidemic continues, claims are expected to remain high in the near term."

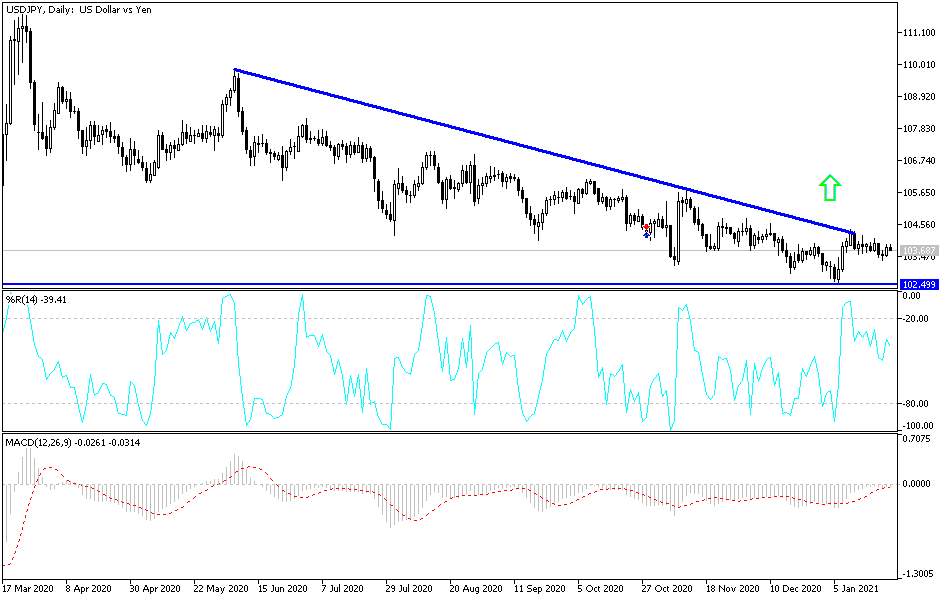

Technical analysis of the pair:

The USD/JPY pair is still within the range of its descending channel, and there will not be a real shift in the trend without first breaching the 106.00 resistance level. Stability below the support 104.00 still indicates a strong bearish performance. At the same time, a move towards the support levels at 103.30, 102.75 and 101.90 will push technical indicators into strong oversold areas.

The currency pair will be affected by the extent of investor risk appetite, as well as interaction with the future of stimulus for the US economy and global efforts to contain COVID-19.