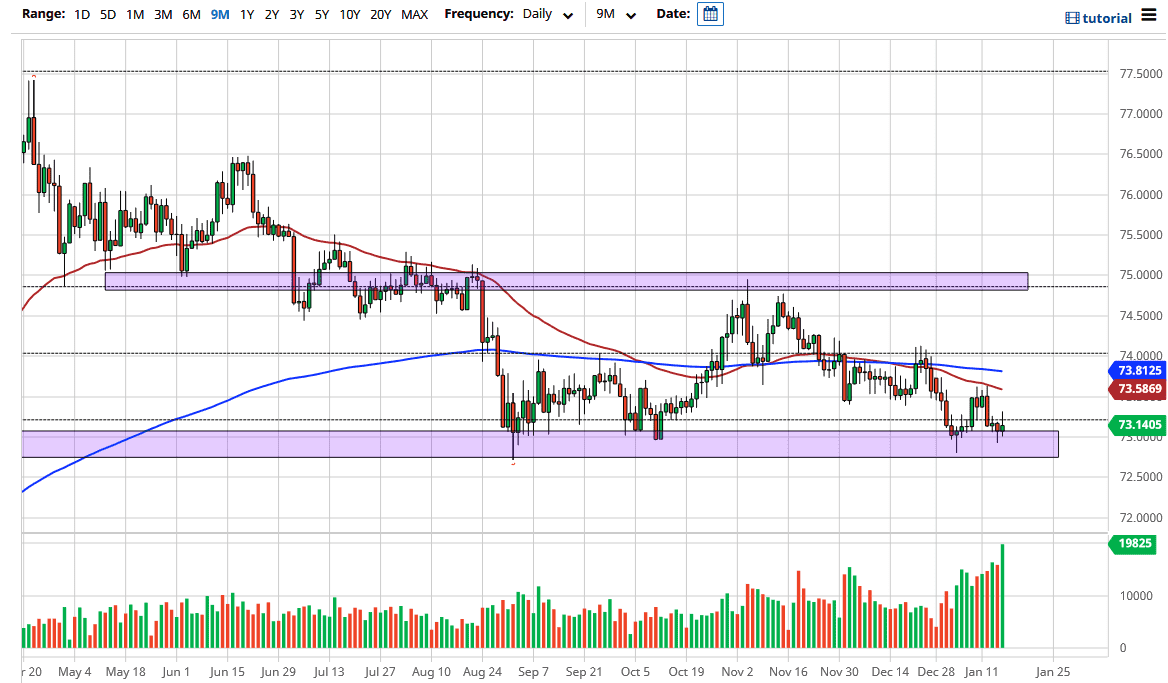

The US dollar rallied a bit against the Indian rupee during the trading session on Friday but then gave back the gains and ended up forming a bit of an inverted hammer. If we break down below it, then we go looking to break down below the bottom of the hammer from the previous session. That of course would be a very strong sign for the Indian rupee and a major “risk on” type of move. Considering that the two candlesticks contradict each other, it is very likely that we continue to see a lot of choppiness, which does make quite a bit of sense considering we are sitting on top of the ₹73 level.

Even if we do break to the upside, I believe that the ₹73.50 level will offer resistance, especially as the 50 day EMA is sitting right there as well. We have seen selling at that area previously, so I think it would return yet again. Ultimately, the market looks as if it is trying to build up the momentum necessary to break down significantly. If we do break down below the support area, it is likely that the market then goes looking towards the ₹72 level after that. We have been in a major consolidation area, so breaking down below the ₹73 level does suggest that we are going to go much lower.

The US dollar got a little bit of a lift due to the fact that the interest rates rallied a bit during the trading session on Friday, that of course pressed the US dollar higher at least in the short term. I think that ultimately the massive amounts of stimulus will continue to throw money at emerging markets, and of course India’s a great place to do it as it is one of the world’s fastest growing economies. Longer-term, I do think that we continue to go lower because we had seen the Indian rupee crushed during the pandemic, and I do think that eventually we will continue to see a bit more of a normal exchange rate. All things being equal, I will revisit this every couple of days but right now I have no interest in trying to buy this market because the greenback will continue to be used to finance the global reflation trade going forward.