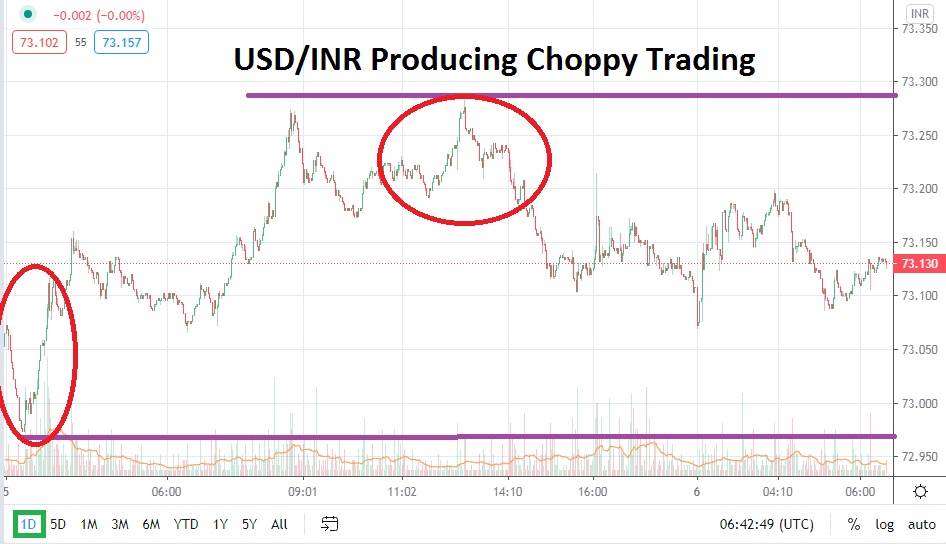

The USD/INR has bounced off of low water marks and reversed higher short term, but the Forex pair has not steered too far away from support levels, which are still acting as legitimate targets. The past two days of trading have produced choppy results with quick reversals dominating the landscape. Short-term traders have certainly been challenged the past two days if they were looking for fast market conditions as they tried to take advantage of the USD/INR volatility.

As of this writing, the USD/INR is near the 73.120 level, which is intriguingly within a known trading range. Global risk appetite has been rather fragile the past two days and some markets are only now returning to full trading volume after holiday vacations. If the USD/INR can incrementally lower near term and sustain its value, speculators may suspect that a resumption of the bearish trend is likely.

An important support level technically looks to be the 73.060 mark. If the USD/INR can penetrate this barrier and trade below the price, speculators could not be blamed for believing that another test of the 73.000 juncture will reignite and values could aim for lows made early on the 4th of January around the 72.750 mark, before a reversal higher was experienced.

The test of lower values only two days ago likely came about as financial houses entered trades after returning from the New Year holiday. These lower values of 72.850 to 72.750 may be a target for speculators, but they should not assume the levels will be re-established too quickly. Traders should be content for the time being to speculate on downside actions with selling positions and look for the bearish trend within the USD/INR to slowly move lower while using take profits to cash in winnings.

Selling the USD/INR continues to look like the best wager from a risk/reward scenario. Resistance near the 73.190 should be monitored; if it proves adequate it could be another indication that bearish momentum will develop again short term. Global risk appetite may appear rather mixed for the time being, but it certainly has not vanished completely and the USD/INR bearish trend remains intact as long as current values prove they can be sustained and used as a launching ground for selling positions.

Indian Rupee Short-Term Outlook:

- Current Resistance: 73.190

- Current Support: 73.060

- High Target: 73.280

- Low Target: 72.850