The US dollar has found a little bit of support near the 1.26 level against the Canadian dollar during the trading session on Thursday, as oil markets have cooled off a bit. Furthermore, the US dollar is a bit oversold and a lot of what has been driving the value of the US dollar lower has been the idea of massive amounts of stimulus coming out of America. There has been a bit of cold water thrown on that concept during the trading session by Senators Lisa Murkowski and Mitt Romney, as well as a few other ones. The U.S. Senate does not look like it is ready to move very quickly when it comes to stimulus and therefore a repricing of the greenback may be necessary.

Nonetheless, there will be stimulus so that is not something that most people should worry about. The reality is that sooner or later they will have to do something to help the economy and of course their friends in the banking sector. Because of this, I do think that the US dollar will be sold off eventually, but a short-term bounce is certainly something that you could see in this oversold market.

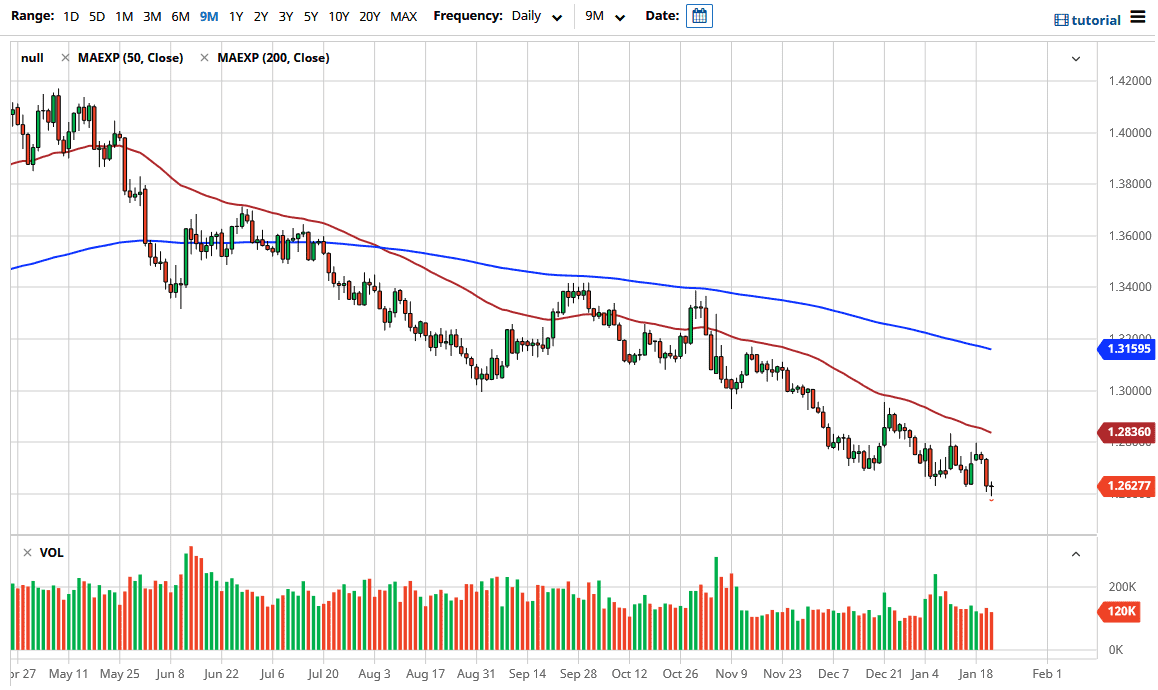

The 50 day EMA above is hovering just above the 1.28 handle, so that could be an area where we would see a certain amount of selling, just as the 1.30 level would be interesting as well. A bounce towards that area will probably be met with significant resistance unless of course the stimulus package completely comes on Don and does not look likely to happen. That is almost impossible to imagine because Wall Street has trained politicians in the United States to offer more stimulus every time there is a tantrum, and I can guarantee you that if stimulus is taken off of the table there will be a massive tantrum. So that being said the trade still favors the downside but perhaps not in the short term. If we do break down below the 1.26 level, then it is likely that we go looking towards 1.25 handle underneath which of course is a large, round, psychologically significant figure. Pay attention to crude oil, that obviously will have its effect on this market as well, as the Canadian dollar is so highly levered to that market.