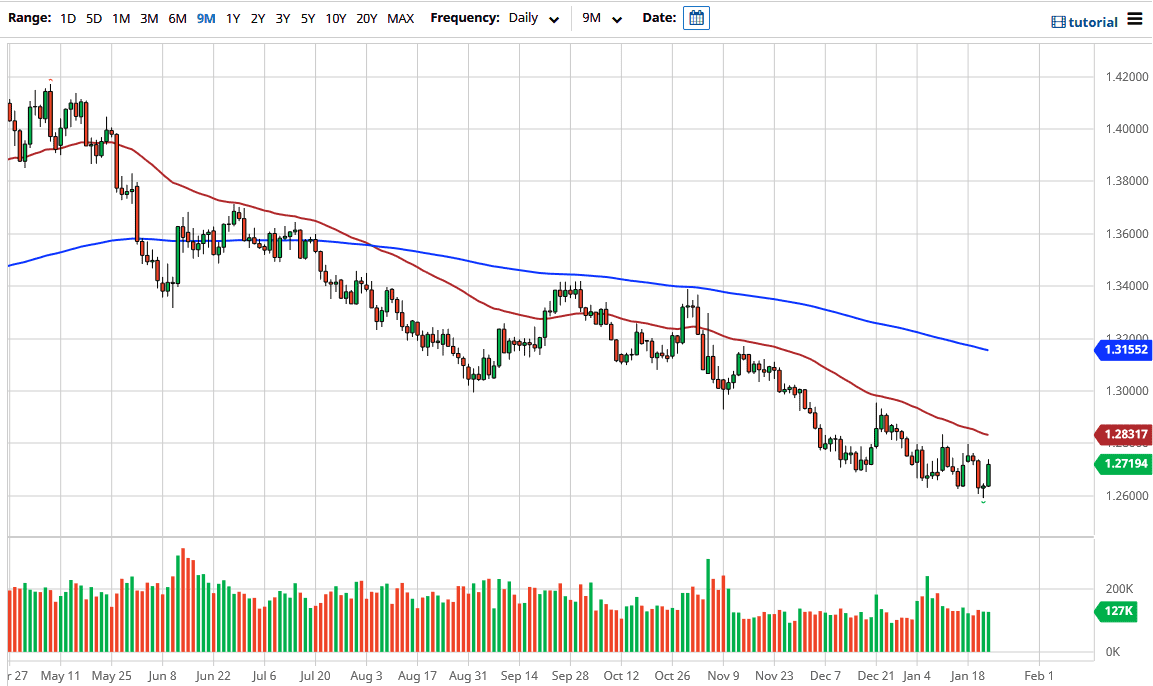

The US dollar rallied a bit during the trading session on Friday amid concerns regarding demand for crude oil and a stretched US dollar. That combination suggests that we will see buyers in this pair given enough time, and we are looking at the possibility of a basing pattern. Whether or not it lasts for any significant amount of time is a completely different question, but at this point, the 50-day EMA above could be the initial target.

Short-term pullbacks will probably find support at the 1.26 level, but I would not be looking for a breakdown unless crude oil markets take off again. The weekly chart suggests that there is a lot of exhaustion in the crude oil market, so it makes sense that we would see a reaction in the CAD as a result. To the upside, I think that we could go as high as the 1.30 level without breaking the overall trend, and it could tie up quite nicely with the crude oil market.

The 200-day EMA sits near the 1.3150 level, which is also an area where we have seen a significant amount of resistance in the past. This is a market that is trying to figure out whether or not it can go further to the downside, and when you look at longer-term charts, it makes sense that there could be significant support underneath, especially when you look at the weekly and monthly chart. In other words, the next couple of weeks may determine whether or not the uptrend turns things around or if we break down rather significantly.

The US dollar has been moving lower based upon the idea of stimulus being very strong, which could drive up the demand for crude oil. Further bolstering the argument for this pair going lower is the fact that the Canadian economic figures as of late have shown inflation rising, which is good for a currency. However, we are still well below a significant trend to the upside when it comes to inflation in Canada, so I think it is somewhat limited as a possible catalyst.