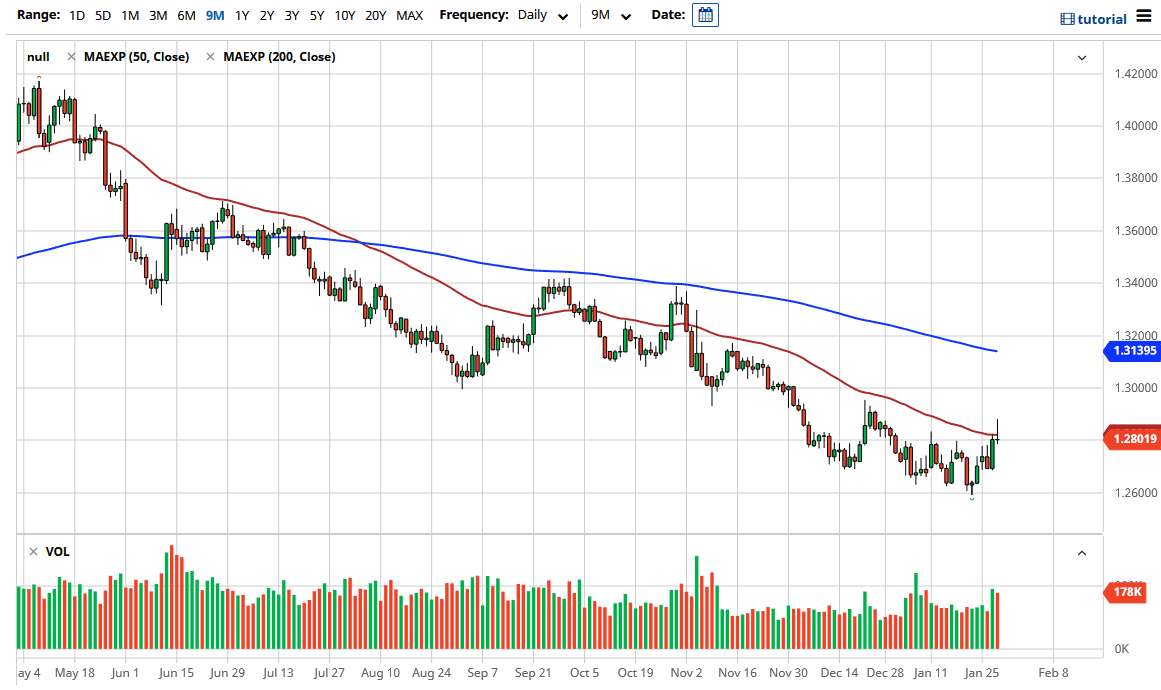

The US dollar initially rallied against the Canadian dollar during trading on Thursday but has found resistance above the crucial 1.28 handle. Not only is this an area where we have seen selling in the recent past, but we have also had the 50 day EMA approach it. By the end of the day, we ended up forming a bit of a shooting star which is a sign of exhaustion. While the US dollar has been oversold for a while, the reality is that it is not just oil that will be driving the Canadian dollar at this point. In fact, the Bank of Canada is starting to look more and more like a bank that is thinking about normalizing rates. Granted, we have a long way to go before anything close to “normal” happens, but it certainly looks much more likely to be tighter than the Federal Reserve.

Having said all of that, oil does remain elevated and a lot of people are betting on the “reflation trade.” With that in mind, I do think that is very possible that we do see the market continue to grind lower and on a break of the lows of the trading session I would be more than willing to short this market, but I am not looking for some type of major meltdown. I believe that the 1.26 level underneath will offer a certain amount of support, and therefore I think it will take a lot of effort to get below there.

On the other side of the trade, if we do break above the top of the shooting star then I suspect that the market will go looking towards the 1.30 level. That is an area that I would anticipate even more resistance at, as it is a large, round, psychologically significant figure. All things being equal, we are in a downtrend, but I also would point out that the 1.26 level is the beginning of massive support on longer-term charts. I am not sure how much further we go to the downside without breaking the US dollar. You look at the US Dollar Index, it is also at an extreme low level where there is a lot of support. There is a major argument right now about the reflationary trade and whether or not the dollar gets hammered, because interest rates are starting to rise which works against the dollar falling apart at the same time. This explains some of the choppiness.