The USD/BRL remains a technical trader’s delight because of its rather choppy values, which are consistently delivered within a rather consolidated range. The USD/BRL continues to trade seemingly adrift from the reality of other major currencies against the US dollar. While many emerging market Forex pairs have demonstrated strong bearish trends, the USD/BRL continues to languish within a fairly tight value range.

Technically, the USD/BRL offers traders the opportunity to monitor the market and use limit orders as support and resistance levels are tested. Speculators often need to be patient with the USD/BRL to see tangible moves exhibited in order to launch their trades, but by using quick-hitting take profits, which do not seek too much in the way of momentum, a trader can find success. However, traders also need to be able to control their emotions and know that in order to achieve profitable results with the USD/BRL they must not deviate from their goals. One of the worst mistakes a trader can make is to change their value targets in the middle of a trade; the decision often occurs because emotion has outmuscled logic.

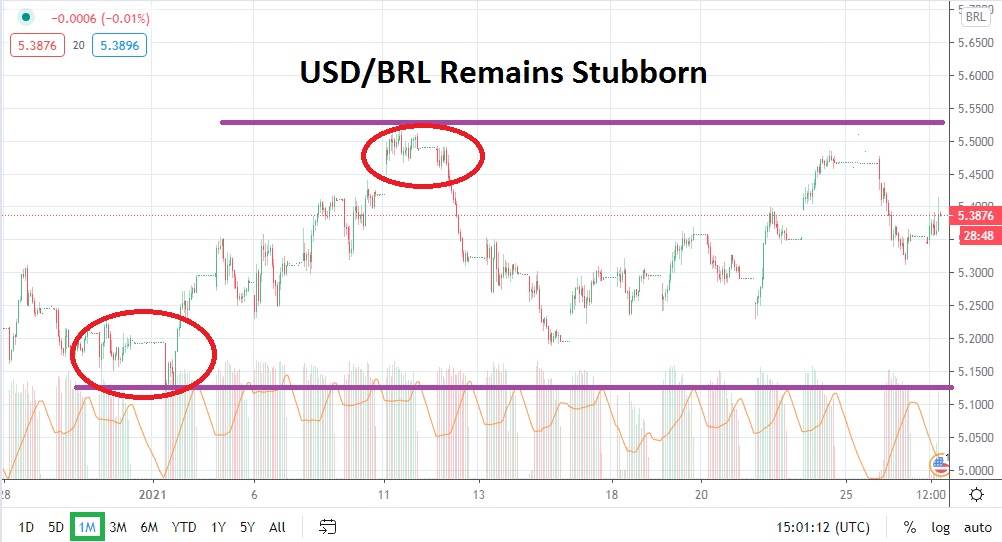

Intriguingly, resistance levels for the USD/BRL remain adequate and have proven they have the ability to create reversals lower. The 5.4700 to 5.5100 junctures have been durable and can still be used by conservative traders as a place to launch selling positions, if they have the patience to see these levels tested again. In the past six months of trading, the USD/BRL has delivered a range of essentially 5.0000 to 5.8100. The heaviest trading has occurred within the 5.1500 to 5.6500 levels, approximately.

Yes, some technical traders may argue that the USD/BRL has achieved a slightly bearish trend since highs of 5.7800 were touched in late October. However, the bearish momentum of the Forex pair was seemingly stopped in early December when the USD/BRL moved within a breath of the 5.0000 mark. Since then, there have been two surges higher, and both times the 5.4800 juncture has sprung a reversal lower. Traders who have the ability to wager on longer trades may find this information useful, but short-term speculators need to understand that technically the USD/BRL produces choppy values, and looking for sustained moves which break high resistance and low support levels may prove difficult.

The USD/BRL is not outside the scope of global trading sentiment, but it appears the Brazilian real also has its own dynamic mechanics, which affect its value via transactions from financial institutions and economic implications driven by the Brazilian government. It should be remembered that the current value of the Brazilian real, which could be called weaker compared to the bearish trends of many other major currencies, may be considered as a positive thing within Brazil for its important export companies.

The USD/BRL needs to be treated carefully and, until it breaks out of its rather strong consolidated value range, traders should look for quick trades and rely upon limit orders to speculate within the Forex pair. Selling the Brazilian real for speculators when the USD/BRL moves towards the 5.4300 to 5.4700 junctures remains attractive technically. Buying the USD/BRL on moves lower should be considered too, because support levels around the 5.2800 to 5.2300 junctures have proven significant.

Brazilian Real Outlook for February:

Speculative price range for USD/BRL is 5.0700 to 5.5700.

Support at 5.2300 has proven durable on many occasions in January; if it is broken lower, the 5.1500 to 5.0700 junctures should be watched.

Resistance at 5.4800 has been rather consistent, but the 5.5700 value above is a strong mid-term mark.