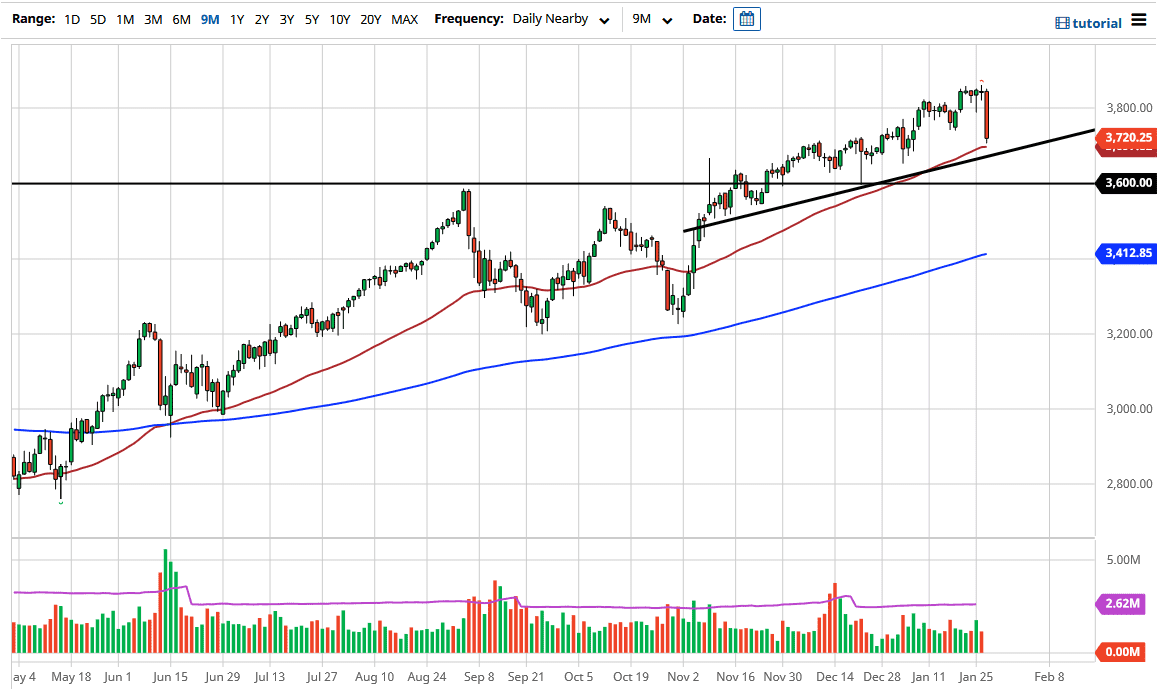

The S&P 500 has been hammered during the trading session on Wednesday to reach down towards the 3700 level. This candlestick is very rough looking, and I think that what we are going to see here is a serious fight near the 50 day EMA and of course the uptrend line. The 3700 level is an area that I think continues to offer a certain amount of support. If we break down below this trend line, then we could go looking towards the 3600 level after that.

A lot of this is probably due to hedge funds having to liquidate positions in order to get out from underneath the short squeeze that is being seen as a handful of stocks right now. That has absolutely wiped out some hedge funds, and those who were taking massive losses even had to sell profitable positions to cover some of those shorts. Ultimately, I think that the uptrend will eventually continue because the Federal Reserve will do what it can to save Wall Street as it always does.

Speaking of the Federal Reserve, they had the FOMC statement and press conference during the trading session, suggesting almost nothing new. Part of this may have been a bit of a tantrum by Wall Street that they did not get more monetary policy thrown at them. Nonetheless, I think that they will eventually start to look at “value” as the reflation trade continues to be in the forefront of a lot of trading minds.

To the upside, I still see a target of 4000 over the longer term, so I think that what we will see is a little bit of noise over the next couple of days, only to see the uptrend can continue. If I wanted to short this market, I would do it via puts, and certainly not getting involved directly. The market will continue to see a lot of noise out there, but if you are cautious enough you can start to piece together a position. Granted, the Wednesday session was very difficult, but this is a market that will find a reason to go higher given enough time as the market continues to do the same as it has done for months, so I will be waiting for some type of supportive candlestick or something like that to get involved again. In the meantime, I will let everybody else risk their trading capital.