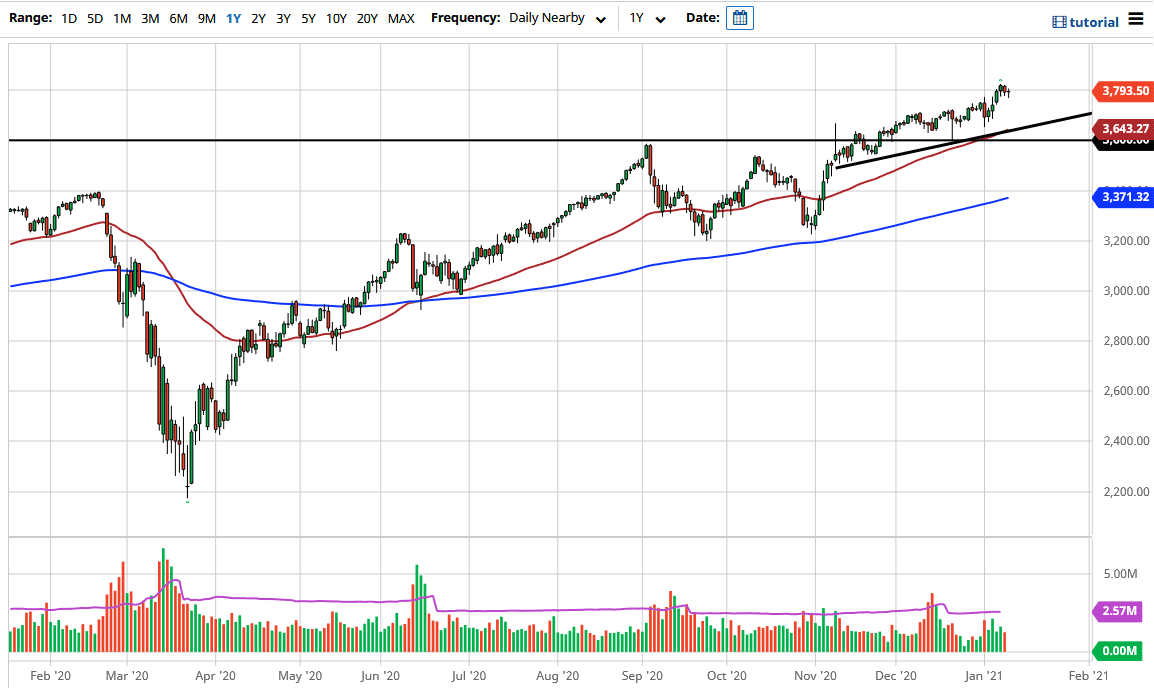

The S&P 500 fluctuated during the trading session on Tuesday, just as we saw during the previous two sessions. This is a market that continues to see a lot of buying pressure every time we pull back, and what we are seeing here is the market simply dancing around the 3800 level, trying to figure out what to do next. The market breaking above the 3800 level on a decisive candle is exactly what the market needs to see in order to go higher for the long term.

The market has been in an uptrend for quite some time due to the fact that stimulus has been a major driver of money into asset markets around the world. The massive amounts of liquidity thrown into the market needs to go somewhere, so one of the most obvious places for a lot of money managers will be the S&P 500. This has been a major driver of the stock markets for the last 13 years, and some people even make an argument for the entire situation being set up in 1998 when Long Term Capital Management blew up, and the Federal Reserve stepped into the private markets to backstop that massive implosion that could have brought down a significant portion of the global markets.

What is interesting is that we are heading into earnings season, which will cause a little bit of noise, and could offer nice buying opportunities based on short-term pullbacks due to the fact that we care about liquidity, not earnings. Price will go up given enough time, so I have no interest in trying to short this market, with the 50-day EMA underneath offering support at the uptrend line. The 3600 level underneath is massive support as well, and it is the top of a larger consolidation area that we had been in, between that level and the 3200 level. By extrapolating that consolidation area measured move on the breakout, we could go looking towards the 4000 level. I do believe that buying on the dips continues to work, and if you are cautious about your overall position size, you could very well find this is a nice way to build up a larger position.