Speculators who have been pursuing the long-term bullish trend of the NZD/USD have important technical ratios to consider. The present value of the Forex pair is hovering within the upper realms of its higher value. After achieving a high of nearly 0.72960 in early January, the NZD/USD did experience a reversal lower until the 18th of this month. However, since then, an incremental move higher has been demonstrated.

Traders may feel rather attracted to the bullish momentum of the NZD/USD, but at these higher levels speculators may wonder how much more ground can be attained higher. To answer that question, traders are welcome to look at long-term charts and consider the values the NZD/USD was trading in 2018 and 2017. There are no guarantees the Forex pair will venture higher into the stronger values for the New Zealand dollar, but there is reason to suspect it might.

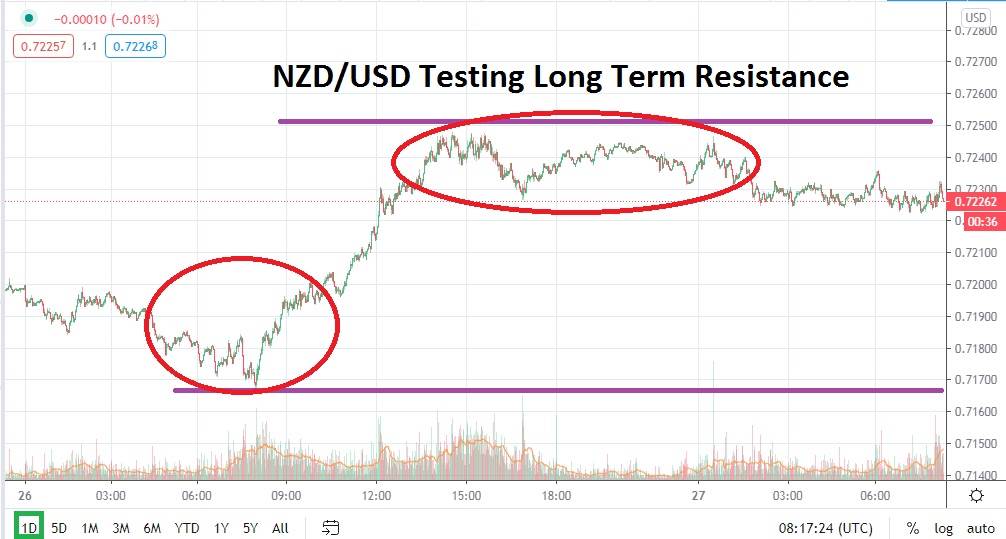

Current values for the NZD/USD may prove to be an important testing ground as psychological parameters are explored by programmed trading software. If the NZD/USD is able to sustain its current higher values and build a solid foundation of support above the 0.72000 mark, this may be an indication that bullish sentiment may create additional momentum. Resistance within the 0.72500 to 0.72960 junctures has proven tough earlier this month, but if the NZD/USD proves consistent in the short term, buyers of the Forex pair may prove they have the ability to take the New Zealand dollar higher.

The NZD/USD has produced a rather capable march higher in value since being taken to low water marks when coronavirus fears hit global markets early last year. What may intrigue speculators of the NZD/USD is the fact the value of Forex pair actually touched its pre-coronavirus value of December 2019 back in August of 2020. Meaning, the additional ground achieved higher since late summer of 2020 by the NZD/USD has been part of a bigger Forex move.

Buying the NZD/USD continues to be the attractive speculative wager. Conservative traders may want to use close stop losses near current support levels as protection. Buyers of the NZD/USD should understand that current resistance levels may prove tough in the short term and cash out winning positions. However, looking for additional upside momentum from the NZD/USD remains the practical speculative choice.

NZD/USD Short-Term Outlook:

- Current Resistance: 0.72500

- Current Support: 0.72050

- High Target: 0.72960

- Low Target: 0.71750