The NASDAQ 100 fell hard during the trading session on Wednesday as it was announced that it the Democrats will be taking the Senate. This had a lot of people concerned, but at the end of the day we did see recovery. The question at this point is whether or not there will be enough stimulus to make the market happy. Furthermore, we have to think about the idea of whether or not the Democrats are going to impose restrictions on technology companies or not. There are a lot of questions to answer this point in time, so I would not be quick to jump into this market right now.

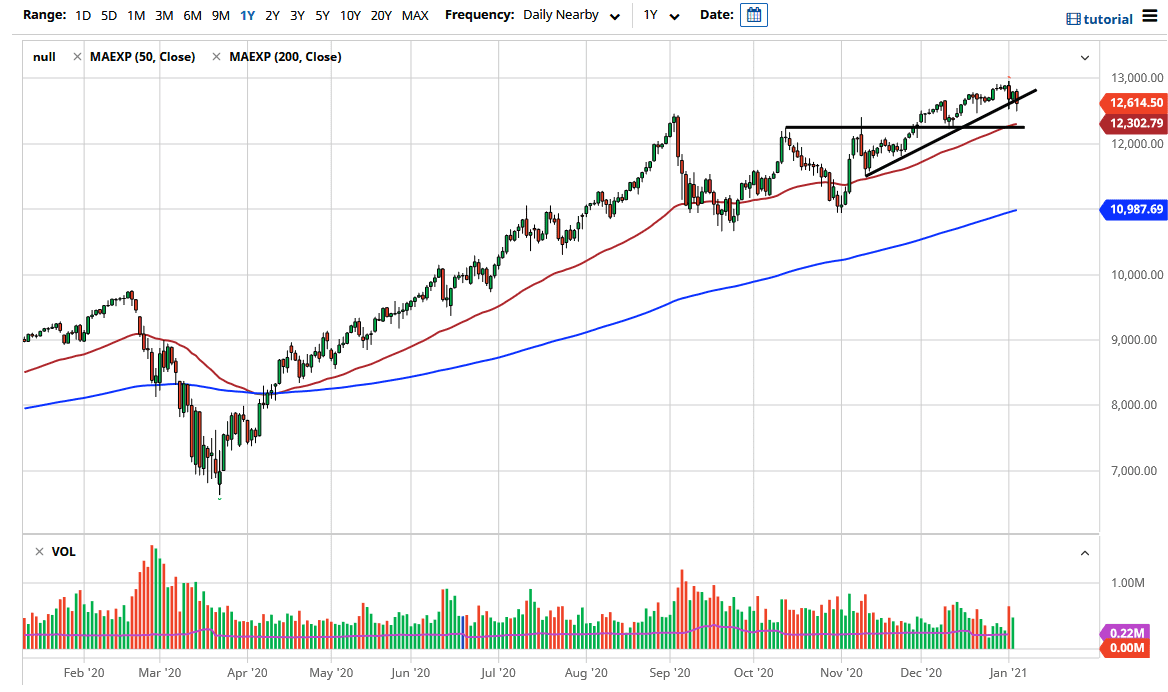

Stimulus will probably override most things. However, to the downside, I see the 50-day EMA and the 4300 level as potential support. Beyond that, I think the 12,000 level will also come into the picture as well. Nonetheless, it is only a matter of time before we go looking towards the 13,000 level. Breaking above there opens up the possibility of a move towards the 14,000 level, so long-term traders will be aiming for that due to the fact that we had previously been consolidating in a rectangle that measures for that move.

One thing is for sure: the reality is that the NASDAQ 100 has been one of the bigger movers and, as a result, it will continue to be going forward once traders are allayed of their concerns. After all, moderate Democrats will probably be major players out there, so it should not be assumed that the market is necessarily going to see massive regulation. Even though the Democrats run all three branches of government, there are some Democrats in certain states who are extraordinarily conservative and will still have to worry about being re-elected. In other words, although the US is starting to lean more left in the short term, the reality is that it may not be as left as originally thought. I believe the next couple of days will show where we go next, but as long as we have loose monetary policy, I think eventually that will overcome everything else, as it has over the last 13 years or so.