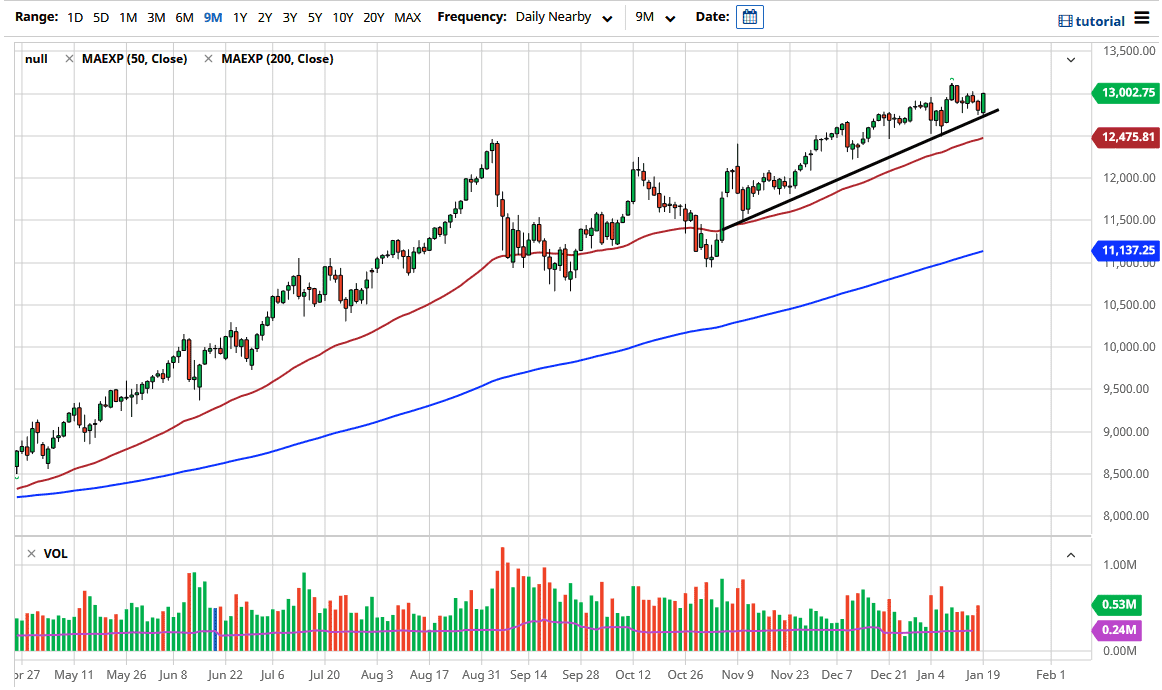

The NASDAQ 100 rallied quite significantly during the trading session on Tuesday, bouncing from a significant support level in the form of a very obvious uptrend line. Furthermore, the market also has a significant support underneath at the 50-day EMA close to the 12,500 level. It is only a matter of time before the buyers return any time we pull back.

The 13,000 level is roughly where we closed during the trading session on Tuesday, and it is very interesting for traders to be there. If we can break above the top of the candlestick during the trading session, then it will continue to push this market to the upside, perhaps reaching even higher given enough time, because we have a lot of money flowing into technology companies, and the NASDAQ 100 has been one of the bigger performers over the long term.

To the downside, any time we pull back, people will start to look at that idea of stimulus again, and we have Netflix reporting after the market close, so that could have a little bit of an influence as well. When you look at the previous consolidation area, it argues for a move towards the 14,000 level, and based upon the way we have been behaving as of late, it is not a real stretch to think that could happen. After all, we are in a nice uptrend and at a reasonable rate of gain.

The one thing that could stand in the way is a strengthening US dollar, but that is probably one of the smallest concerns for this particular market. However, people are starting to rush towards bond markets again, which could have people running from stocks. I believe that any time we get a significant pullback, though, it will only be yet another opportunity in a long tradition of buying dips going forward. In fact, I do not really have a scenario in which I would be a seller of this market, at least not anytime soon, as trying to short this market is like stepping in front of a moving train. The fact that we have closed at the very top of the candlestick also is a good sign, so I think this market will continue much higher.