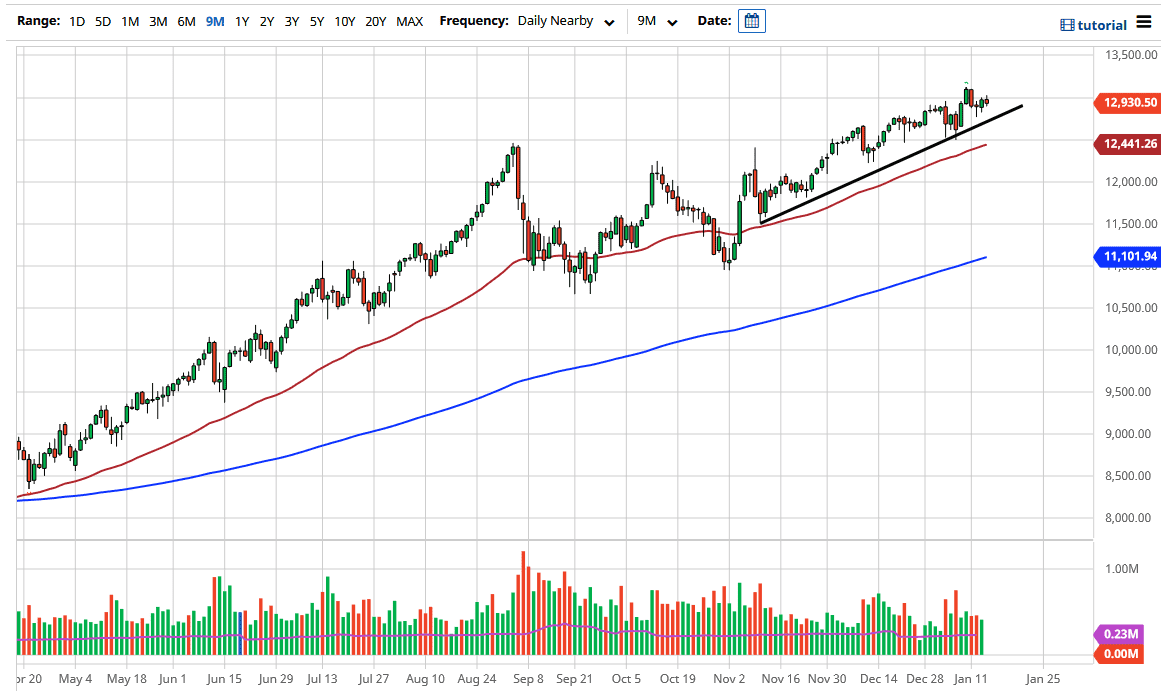

The NASDAQ 100 pulled back just a bit after initially trying to rally during the trading session, as Thursday ended up being less than thrilling. However, traders are going to be paying close attention to Joe Biden and his stimulus plan, which may or may not be as big as once hoped. That being said, the technical analysis is still very positive for this market given enough time, and a little bit of sideways action really will not change much at this point in time. We have seen buyers jump into this market every time it dips, and I suspect that will continue to be the case.

Just below current pricing, you can see that there is an uptrend line that I have been paying close attention to and has been somewhat reliable over the last several months. I think that would be your first support level on any pullback, and then most certainly the 12,500 level and the 50 day EMA both could offer support as well. After that, then you would be talking about 12,000 below. All things being equal, I do not see an interest in shorting this market and any pullback will more than likely just end up being thought of as a value opportunity.

I think at this point in time, shorting is all but impossible due to the fact that stimulus will continue to push the narrative on Wall Street, and give traders hope of being bailed out. Stimulus works for markets until it stops. I think that is essentially the game that we have been playing for 13 years, and I do not see that changing anytime soon. Because of this, I think that only the foolish step in and try to short this market. Based upon previous consolidation you can make an argument for a move towards the 14,000 level, which at this point in time could happen quicker than most people think.

Keep in mind that we just entered earnings season, so that could be a bit of volatility here and there, but at the end of the day this is still a “buy on the dips” type of scenario, just as it has almost always been. With that in mind, pay attention to the US dollar as a weakening greenback certainly helps stocks as well.