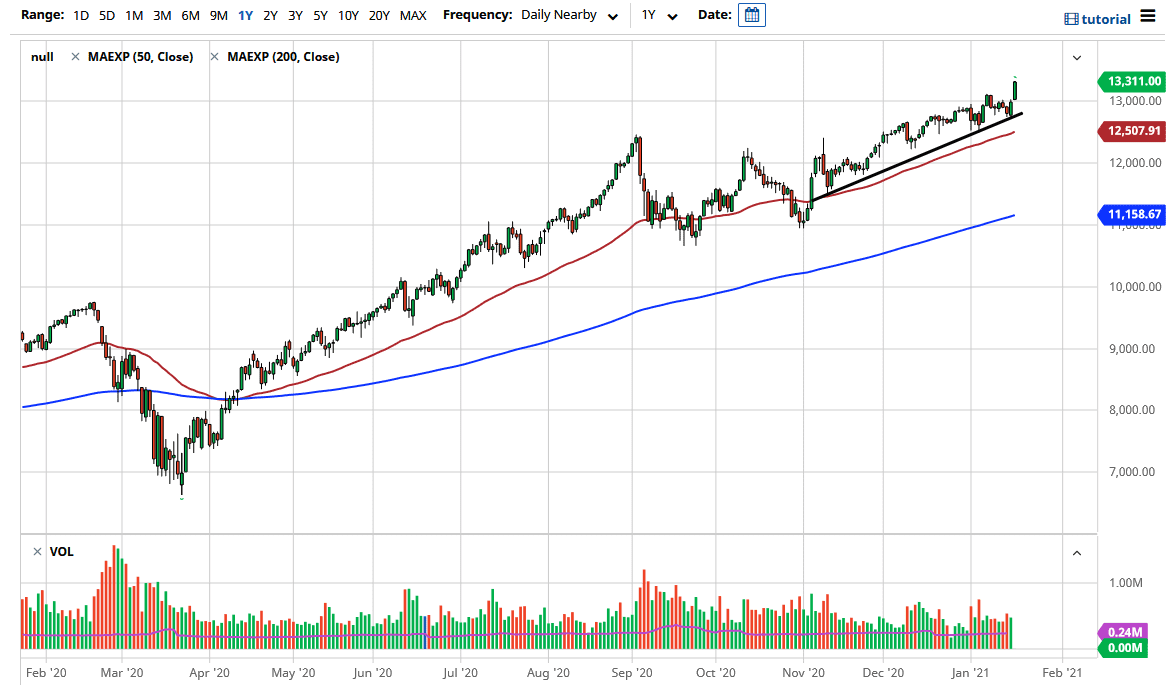

This is a market that has clearly broken above the 13,000 level, so I am more than willing to buy dips at this point in time and I do recognize that this is a market that will continue to see a lot of bullish pressure over the longer term. The 13,000 level of course is a large, round, psychologically significant figure, but it was also the scene of resistance previously that should now flip over to support.

Netflix was one of the main drivers of the NASDAQ 100 during the day as it had an incredible earnings beat the previous night, and as the NASDAQ 100 is not an equal weighted index, it makes sense that it had a bit of an outsized influence on the market. The fact that we close that the very top of the candlestick is also a very bullish sign so at this point I do not see any argument in trying to go against the grain. Quite frankly, this is just like the S&P 500, there is always a reason for people to step in and bail it out. With that, I look at pullbacks as value opportunities near the 13,000 level, and of course the uptrend line that I have drawn on the chart. The 50 day EMA sits at 12,500 which is also a support level, and then after that I think there is even more support at the 12,000 handle. In fact, I do not really have a scenario in which I am a seller that I can think of at the moment, and any time that I would be short of this market would probably be due to some type of “black swan event.” Those are typically short-term in nature anyways, so that would be more or less a “one-off” type of situation.

I have been saying for a while that I think this market is going to go to the 14,000 handle, so if you are patient enough you should be able to take advantage of the overall uptrend and build upon a larger position in order to increase your gains. That being said, do not overleveraged yourself because corrections could be sudden and sharp.