The US dollar recovered after the Federal Reserve announced its monetary policy decisions, which contributed to gold's decline to the $1832 level before stabilizing around $1845 at the beginning Thursday's session. Gold prices retreated, achieving losses for the fifth trading session in a row. At the same time, with global stock markets dropping sharply due to concerns about the rise in coronavirus cases and tightening closure restrictions in several places around the world, the decline in the price of gold was somewhat limited.

Overall, US stimulus talks remained a focus after US Senate Majority Leader Chuck Schumer said Democrats would go ahead with President Joe Biden's $1.9 trillion coronavirus relief plan without Republican support if needed.

A report by the US Commerce Department showed that new orders for US manufactured durable goods rose much less than expected in December. The department said durable goods orders rose 0.2% in December after rising by an upwardly revised 1.2% in November. Economists had expected durable goods orders to increase 0.9% compared to the 1% jump reported in the previous month.

In its first monetary policy decision of 2021, the US Federal Reserve kept interest rates unchanged as widely expected, and revealed that it plans to maintain its asset purchase program at the current pace. According to the bank’s decisions, it will maintain the target range for the federal funds rate between 0% to 0.25%, and said again that it expects to leave rates at levels close to zero until labor market conditions reach levels consistent with the maximum number of job opportunities and inflation is on its way.

The statement accompanying the bank’s decision also revealed that it plans to continue buying bonds at a rate of at least $120 billion per month. The statement reiterated the assertion first issued last month, when the Fed said it would maintain asset purchases at the current rate until "more substantial progress" is made toward its goals of maximizing employment and price stability.

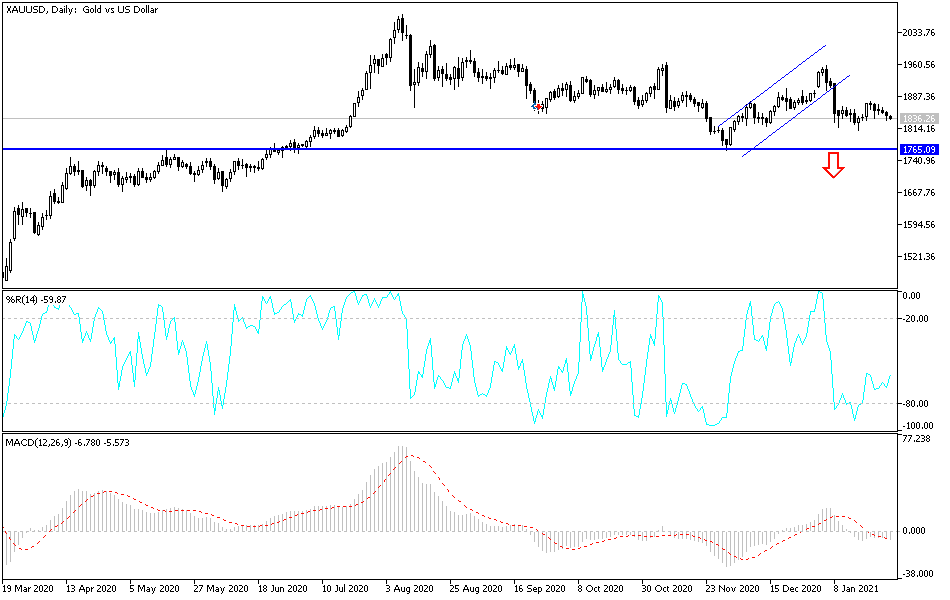

Technical analysis of gold:

On the four-hour chart, the price of gold has formed a new bearish channel, and the support levels at $1832, $1822 and $1800 will represent the bottom of that channel, and with it the technical indicators move to strong oversold areas. The $1800 psychological support level is a powerful bearish target. I still prefer to buy gold on every dip. On the upside, as I mentioned before, the psychological resistance level of $1900 will remain an important bullish target.

The price of gold will be affected in the upcoming trading sessions by the strength of the dollar and the extent of investor risk appetite, along with global vaccination efforts and stimulus plans.

Today's economic calendar:

Markets will focus on the release of US economic growth rates for the fourth quarter of 2020, in addition to the number of weekly unemployment claims and new US home sales.