In response to a stronger US dollar, the price of gold fell to the level of $1901 in Wednesday's session before returning to stability around the level of $1926 as of this writing. Despite the decline, gold prices are still high by about 1% this week, as the price of gold jumped to the level of $1960, its highest in two months. Gold increased gains by 24% in 2020, and the yellow metal is looking to extend this rise in 2021 amid fears of inflation. Silver, the sister commodity to gold, gave back its early gains in mid-week trading. Silver futures fell 1.34%, to $27.27. All in all, silver is up close to 3% this week.

After Democrats won two seats in the US Senate in Tuesday's Georgia runoff election, gold markets did not react positively. Minerals were expected to explode since Democrats regained majority control in Washington, allowing President-elect Joe Biden to push ahead with more fiscal stimulus.

But the electoral competition may have been compensated for by a stronger dollar and higher treasuries. The benchmark 10-year Treasury Bond Index rose 0.084% to 1.039%, reaching a ten-month high in overnight trading. One-year bonds rose 0.006% to 0.107%, while 30-year bonds jumped 0.109% to 1.813%.

The US Dollar Index, which measures the greenback against a basket of six major rival currencies, also rose 0.08%, to 89.50, from an opening at 89.44. The index had a bearish start to 2021, dropping around 0.5%. A weaker price is good for dollar-denominated goods because it makes them cheaper for foreign investors to purchase.

Meanwhile, financial markets are monitoring current events on Capitol Hill, Washington. After a mass rally, pro-Trump protesters stormed Congress, though the situation was contained after President Trump pleaded with them to "remain peaceful" and "go home peacefully" in a video that was quickly censored by social media platforms.

Relative to other metals markets, copper futures rose to $3,656 a pound. Platinum futures fell to $1116.30 an ounce. Palladium futures fell to $ 2,449.50 an ounce.

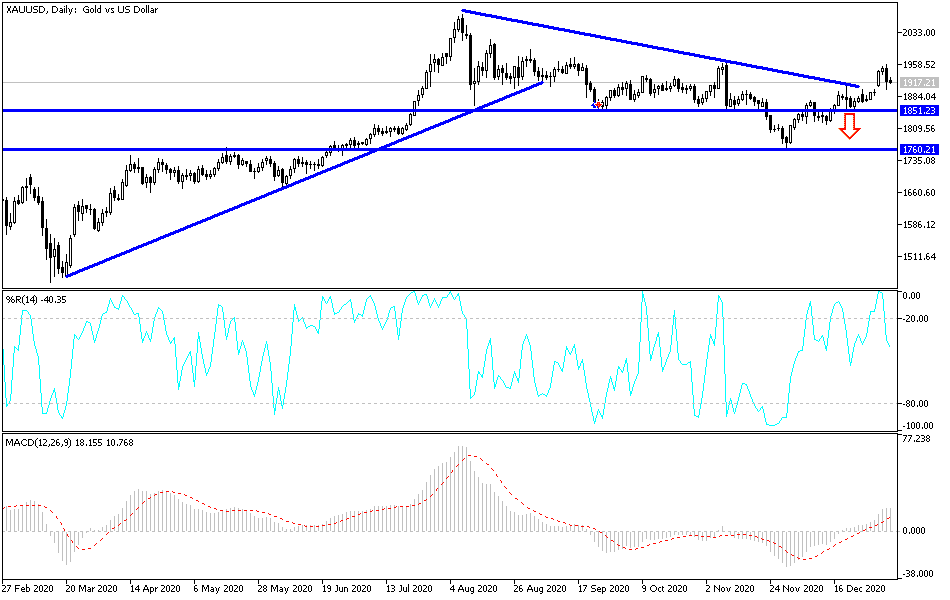

Technical analysis of gold:

I still prefer to buy gold from every downward level. Political anxiety in the US will be an opportunity for gold investors to benefit from the market’s appetite for safe havens, with gold being one of its most important elements. The closest support levels for buying gold are 1915, 1900 and 1882. On the upside, if gold stabilizes above the psychological resistance of $1900, the general trend will remain bullish and will motivate investors to buy, waiting for stronger gains. The concern that prevails in the markets about the emergence of new strains of coronavirus and the restrictions on global economic activity may motivate investors to buy gold. Today, in addition to the extent of investor risk appetite, the price of gold will interact with the announcement of inflation figures in the Eurozone, US unemployment claims and the ISM Service PMI.