Gold prices rose again and stabilized around $1855 as of this writing. After selling off for two weeks in a row, the price of gold moved to the support level of $1810 per ounce, the lowest price of the yellow metal in a month-and-a-half. The gains in gold coincided with the decline of the US dollar, especially after the statements of incoming US Treasury Secretary Janet Yellen on the financial stimulus. Accordingly, the US Dollar Index (DXY), which measures the performance of the US currency against a basket of six competing currencies, declined to the level of 90.40. In the same performance of gold, silver futures closed higher at $25,320, while copper futures settled at $3.6335, up $0.0315 dollars from the previous close.

In pre-prepared remarks, Yellen called for additional incentives to address the impact of the ongoing coronavirus pandemic, saying the government needs to "act big." At the same time, Yellen acknowledged the growing national debt facing the incoming administration, but claimed that the benefits of another relief package would far outweigh the costs. "I think the comfort that we provide to those who need it most and to small businesses have the best chance of providing relief to those hard hit by the pandemic and creating a significant amount of spending for every dollar spent," she said. "They will create jobs throughout the economy."

Yellen also said that targeting relief for those most in need during the pandemic could help the economy recover in the short term.

Among her plans, she said, additional funding for the Supplementary Nutrition Aid Program (SNAP), extended unemployment insurance, plus additional incentives and relief for small businesses will be essential.

Gold is trading in a cautious situation that prevails in global financial markets. From China, the fourth-quarter GDP growth rate exceeded the projected (quarterly) growth of 3.2% with a growth of 2.6%. December retail sales missed expectations (year-on-year) at 5.5% with a change of 4.6%. The fourth-quarter annual GDP growth exceeded the projected 6.1% annual growth, with a growth of 6.5%.

In Germany, the Harmonized Consumer Price Index for December matched expectations (year-on-year) of -0.7%. On the other hand, the current state of ZEW surveys and economic sentiment beat expectations. In Japan, industrial production for the month of November fell below expectations (year-on-year) at -3.4%, to record -3.9%.

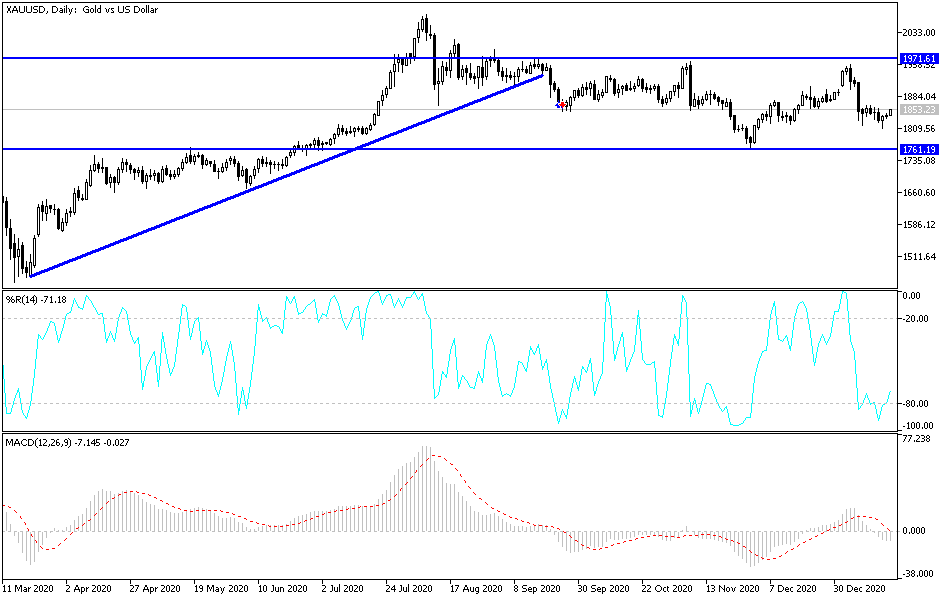

Technical analysis of gold:

In the near term, and according to the performance on the hourly chart, it appears that the price of gold is trading within a downward channel formation, which indicates a significant short-term bearish bias in market sentiment. Therefore, the bears will look to move towards $1,829 or less, to $1,819. On the other hand, the bulls will be looking to bounce to the $1,850 level or higher at $1,860.

In the long term, and according to the performance on the daily chart, it appears that gold is trading within a downward channel formation, which indicates a long-term bearish bias in market sentiment. The price of gold has now stabilized at the 38.20% Fibonacci level on the way to the downside. It appears to be closer to reaching oversold levels for the 14-day RSI. Therefore, the bears will look to extend the current downtrend towards the 50% and 61.80% Fibonacci levels at $1769 and $1694, respectively. On the other hand, the bulls will target long-term gains around the 23.605 Fibonacci level at $1.927 or higher at $2.002.