For three trading sessions in a row, upward momentum pushed gold towards the $1875 resistance level, confirming a bullish outlook. However, with the recovery of the US dollar, profit-taking sales triggered a fall, as a result of which the price of gold collapsed to the support level of $1837, before it quickly rebounded to the top and closed the week's trading flat around the $1855 level. Despite the strength of the dollar, continued optimism about further stimulus from the Biden administration supported gold. All in all, gold futures rose 1.4% over the past week.

A report released by the National Association of Realtors showed that US existing home sales unexpectedly rebounded in December, jumping 0.7% to an annual rate of 6.76 million. In November, home sales fell 2.2% to a revised rate of 6.71 million. The recovery surprised economists, who had expected existing home sales to decline 2.1% to 6.55 million from 6.69 million originally from the previous month.

Most economists believe that the United States can recover strongly once people are vaccinated, but the situation is still horrific because the disease has closed companies and schools. Nearly 10 million jobs have been lost since last February, and nearly 30 million families lack safe access to food. The United States tops global figures with 24.8 million confirmed cases of coronavirus and more than 415,000 deaths.

On Saturday, China celebrated the anniversary of the start of a 76-day lockdown in the central city of Wuhan, where the virus was first detected in late 2019. A World Health Organization inspection team is in the city to investigate the origins of the virus. On Sunday, the National Health Commission said that 19 additional cases had been discovered in Hebei in the past 24 hours. The northeastern province of Heilongjiang has reported 29 more cases, partly linked to an outbreak at a meat-processing plant. Beijing, where nearly 2 million residents have been ordered to undergo new tests, has reported two new confirmed cases.

There are currently 1,800 people in China being treated for COVID-19, 94 of whom are in critical condition, with 1,017 others undergoing isolated surveillance.

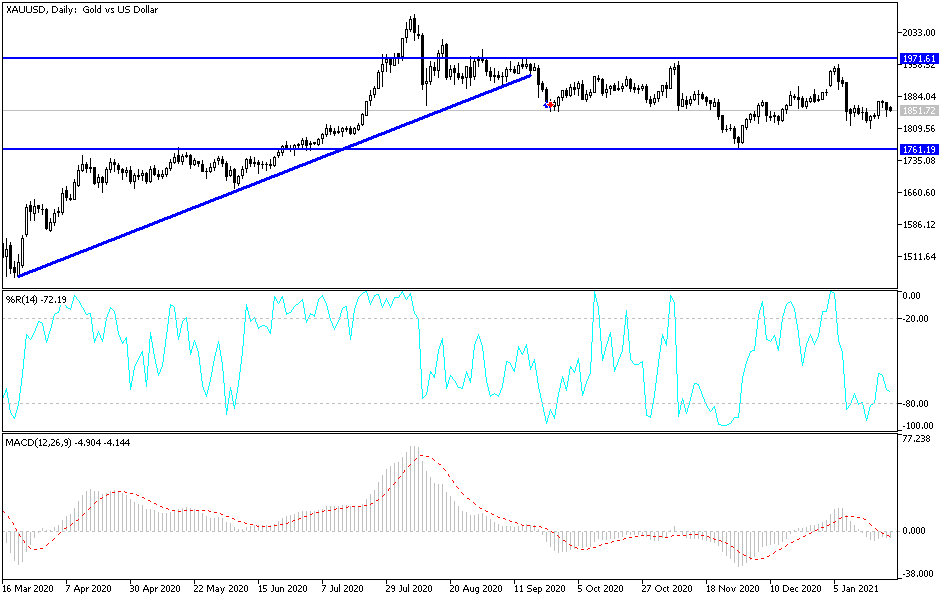

Technical analysis of gold:

According to the performance on the 4-hour chart, the price of gold formed a descending channel that may postpone a rush to the psychological resistance of $1900 for some time. This resistance is important to the bullish trend. On the downside, the $1810 support level is of great importance for bears to take over and move to stronger descending levels. I still prefer to buy gold from every downside. The closest gold buying levels are currently $1833, $1820 and $1795, respectively.

The price of gold will be affected today by the strength of the USD and the extent of investor risk appetite, as well as the interaction of the markets with the statements of European Central Bank Governor Lagarde and the reading of the German IFO Business Climate Index.