The US dollar's strength at the end of last week’s trading pushed gold to the $1828 support level, its lowest level in three weeks, and the worst daily performance of gold since November 9, 2020. This loss came suddenly, despite the recent release of US jobs data, which confirms the extent of the suffering of the US economy from the effects of the pandemic. The recent selling off of gold came after it achieved strong gains in the first week of trading in 2021, as gold jumped to the resistance level at $1960, its highest in two months.

US economic data released last week was relatively impressive, which boosted investors' appetite towards global stock markets. Conversely, investment in safe-haven assets like gold appears to be on the decline.

The US jobs data for December returned to a disappointing figure on Friday, with the US economy losing a total of 140,000 jobs compared to the expected figure of 70,000. Nevertheless, average hourly wage growth beat the (annual) forecast of 4.4% with a change of 5.1%. The unemployment rate was also affected after stabilizing at 6.7%, compared to the expected rate of 6.8%. Prior to that, both the ISM Manufacturing PMI and Services PMI beat expectations. On the other hand, the ADP employment change for December missed expectations of 88K with a record -123K.

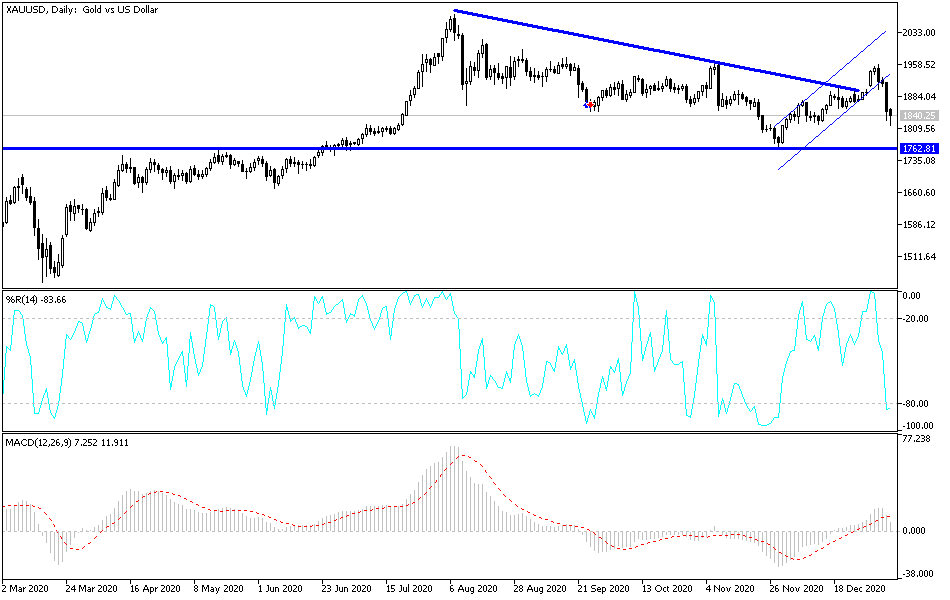

Technical analysis of gold:

In the near term, and according to the performance on the hourly chart, it appears that gold has decreased recently to break the formation of an ascending channel. This indicates a sudden change in market sentiment from bullish to bearish. Accordingly, the bulls will target the short-term retracement gains at around 50% and the 38.20% Fibonacci retracement levels at $1862 and $1,885, respectively. On the other hand, the bears will look to pounce on the 61.80% and 76.40% Fibonacci levels at $1836 and $1810, respectively.

In the long term, and according to the performance on the daily chart, it appears that the price of gold is trading within a descending channel formation. This indicates a significant long-term bearish bias in market sentiment. Accordingly, the bulls will target long-term retracements around the 23.60% Fibonacci level at $1.923, or higher at $2000. On the other hand, the bears will be looking for profits at Fibonacci levels of around 50% and 61.80% at $1768 and $1694, respectively.

In general, the recent decline in the price of gold may motivate gold investors to consider going short, and on the four-hour chart, the technical indicators moved to oversold levels after the recent strong decline.