The American holiday of Martin Luther King, Jr. Day on Monday weakened liquidity, and thus overall performance, in the Forex market. That led to a decline in the price of gold at the beginning of this week's trading to the $1810 support level, the lowest in about a month-and-a-half. However, in the same trading session, gold quickly rose to $1841 and stabilized around it at the beginning of Tuesday's trading. The price of gold is still supported by global concerns about increasing restrictions to contain new strains of the coronavirus.

Risk aversion prevailed as weak US retail sales data as well as rising coronavirus cases around the world sparked concerns about a slow recovery from the pandemic. The total number of coronavirus cases worldwide exceeded 95 million, while the number of deaths exceeded the 2 million mark. China has reported more than 100 new cases of COVID-19 for the sixth consecutive day, while the number of hospitalized COVID-19 patients with severe symptoms in Japan has exceeded 970, a record since the outbreak appeared in the country.

Also, Portugal imposed a new nationwide lockdown, while the United Kingdom announced that it would close all travel lanes from today in order to limit the spread of new coronavirus cases. New infections from the doronavirus have decreased in Germany, but the country's Minister of Health said that more efforts must be made to control it permanently. Accordingly, German Chancellor Angela Merkel and the prime ministers of Germany's 16 states will discuss what should be done next Tuesday.

According to a report from the Wall Street Journal, US President-elect Joe Biden's choice of Treasury Secretary Janet Yellen is expected to rule out the pursuit of a weak dollar when she testifies at Capitol Hill on Tuesday. A hearing to confirm Yellen's appointment is scheduled for January 19 before the Senate Finance Committee, the day before President-elect Joe Biden is sworn in.

The Chinese economy gained further momentum at the end of 2020 as domestic activity continued to recover from the slowdown caused by COVID-19. Therefore, the Chinese economy was the first to be affected by the pandemic and the first to recover economically from it. Accordingly, the National Bureau of Statistics said yesterday that the gross domestic product of the second largest economy in the world jumped 6.5% year-on-year in the fourth quarter of 2020. It exceeded the expected rate of 6.1%, an increase of 4.9% from the third quarter. On a seasonally adjusted basis, GDP grew by 2.6%, but slower than the adjusted 3% increase in the previous three months and the 3.2% increase that economists had forecast.

In 2020 overall, GDP increased 2.3%, making China the only major economy to avoid deflation amid the COVID-19 pandemic. However, this was the weakest growth since the 1970s. Commenting on this, Iris Bang, an economist at ING, said it was too early to conclude that this is a full recovery. External demand has not fully recovered yet. This is a major obstacle to the full recovery of industrial production in China, especially for small manufacturers. For his part, Julian Evans-Pritchard and China Yu, economists at Capital Economics, said that monthly data indicate that growth has slowed slightly towards 2021, but it is still strong. Therefore, this strength is likely to continue through the first half of this year, before making room for a weaker second half.

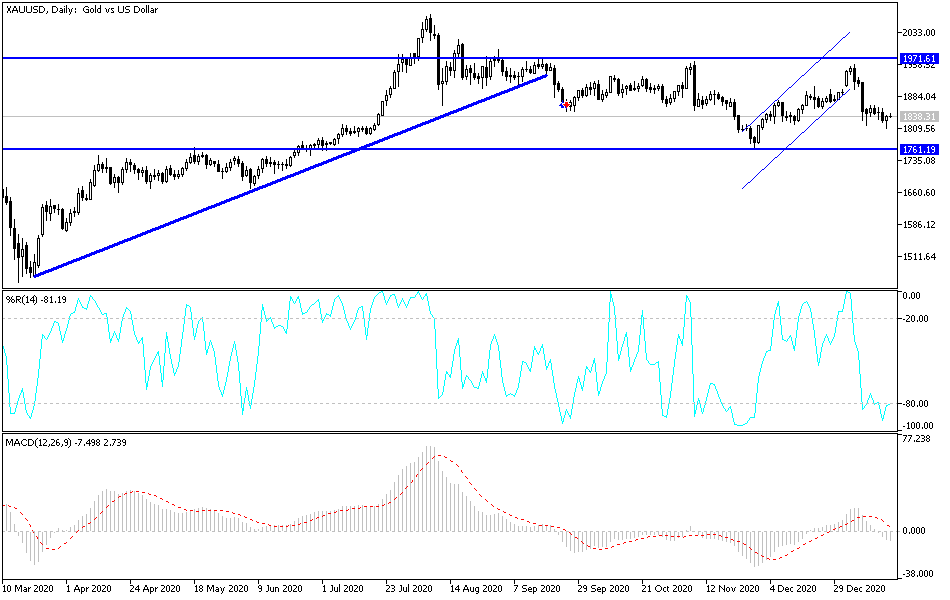

Technical analysis of gold:

According to the performance on the daily chart, there is a clear breach of the bullish channel, and approaching the level of psychological support at $1800 pushes the technical indicators to strong oversold areas. I think that the best levels of gold buying today will be between 1815, 1795 and 1770. On the upside, the bulls are still waiting for a return to the vicinity of psychological resistance at $1900 again to confirm a bullish reversal.

The price of gold will be affected today by the strength of the US dollar, investor risk appetite, global lockdowns and the new US administration's plans to revive the US and global economy in the face of the effects of the pandemic.